Nigeria’s domestic debt rose to N22.57tn as the Federal Government on Wednesday proposed a last-minute supplementary budget for the 2022 fiscal year.

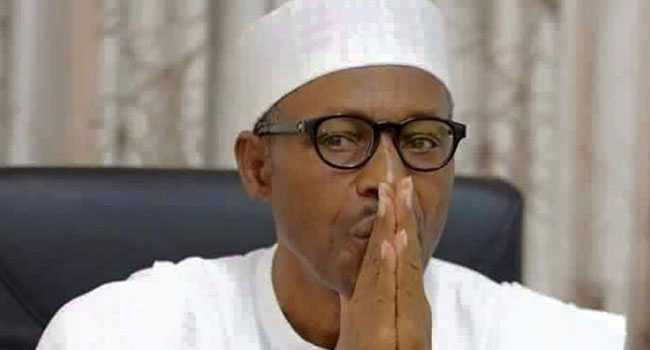

The President, Major General Muhammadu Buhari (retd.), is seeking the approval of the National Assembly for N819.54bn supplementary budget, which it planned to finance through domestic borrowing.

Buhari on Wednesday forwarded to the National Assembly for approval, N819.5bn supplementary budget for the 2022 fiscal year to fix various infrastructure destroyed by floods across the various states in the country a few months ago.

The supplementary budget as explained by the President in a letter read in plenary by the President of the Senate, Ahmad Lawan, is meant for the capital expenditure component of the 2022 budget with an attendant increase of deficit to N8.17tn.

The letter read, “The year 2022 has witnessed the worse flood incident in recent history which has caused massive destruction of farmlands at a point already closed to harvest season.

“This may compound the situation of food security and nutrition in the country. The flood has also devastated road infrastructure across the 36 states and the FCT (Federal Capital Territory) as well as bridges nationwide that are critical for the movement of goods and services.

“The water sector was equally affected by the flood and there is a need to complete some ongoing critical projects that have already achieved about 85 percentage completion. The nine critical projects proposed in the sector cut across water supply, dam projects, and irrigation projects nationwide.

“I have approved a supplementary budget of 2022 appropriation of N819.536bn, all of which are capital expenditures. The supplementary will be financed through additional domestic borrowings which will raise the budget deficit for 2022 to N8.17tn and deficit to GDP ratio to 4.43 per cent.”

Being a proposal coming 10 to the New Year, the President of the Senate hurriedly forwarded it to the Senate Committees on Appropriation, Finance, Works, Water Resources and Agriculture for expeditious consideration.

The Federal Government’s initial plan was to borrow N5.01tn (with domestic debt put at N2.51tn) to finance part of the N6.26tn budget deficit.

With the newly proposed N819.54bn domestic debt, the Federal Government’s domestic borrowing is expected to hit N3.33tn for 2022.

Data from the Debt Management Office showed that the Federal Government’s domestic debt stock was N19.24tn as of December 2021.

By September 2022, the domestic debt stock had risen to N21.55tn, which means that the Federal Government had borrowed N2.31tn so far.

With the additional N819.54bn borrowing, the Federal Government can still accommodate N1.02tn more domestic debt in line with its plan.

The Federal Government’s domestic debt rose from N8.4tn as of June 2015 to N21.55tn as of September 2022, according to The Punch.

This showed an increase of N13.15tn or 156.55 per cent under Buhari.

The Federal Government proposed to spend N4.5tn on interest charges for domestic debt by 2023, according to the proposed 2023 budget.

This is an increase of 243.51 per cent from the N1.31tn proposed allocation for interest charges on domestic debt in 2016.

In its latest Africa’s Pulse report, the World Bank said that public debt in Nigeria was concerning due to the rising debt service-to-revenue ratio.

According to the bank, the debt service to revenue ratio could stand at 102.3 per cent by the end of 2022.

While presenting the 2023 appropriation bill to a joint session of the National Assembly recently, the President, Major General Muhammadu Buhari (retd.), noted that despite the revenue challenges in the country, the country still consistently met its debt service obligation.

“Despite our revenue challenges, we have consistently met our debt service commitments. Staff salaries and statutory transfers have also been paid as and when due,” Buhari added.

However, speaking at the launch of the World Bank’s Nigeria Development Update titled, ‘The urgency for business unusual,’ held recently in Abuja, the Finance Minister, Zainab Ahmed, had admitted that Nigeria was struggling to service its debt.

She said, “Already, we are struggling with being able to service debt because even though revenue is increasing, the expenditure has been increasing at a much higher rate, so it is a very difficult situation.”

The Punch

Boss Picks4 days ago

Boss Picks4 days ago

Opinion6 days ago

Opinion6 days ago

Events5 days ago

Events5 days ago

Opinion4 days ago

Opinion4 days ago

Adding Value5 days ago

Adding Value5 days ago

Featured5 days ago

Featured5 days ago

News5 days ago

News5 days ago

Headline3 days ago

Headline3 days ago