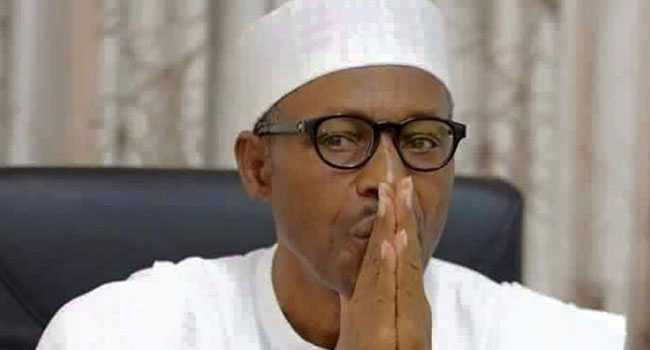

The Buhari’s administration has borrowed $2.02bn as loans from China from 2015, data obtained from the Debt Management Office on Monday showed, reports The Punch.

According to the statistics obtained from the DMO, Nigeria’s total debt from China as of June 30, 2015 stood at $1.38bn.

However, as of March 31, the country’s debt portfolio from China had risen to $3.40bn.

According to the DMO, loans from China are concessional loans with interest rates of 2.50 per cent per annum, a tenor of 20 years and grace period (moratorium) of seven years.

The debt office said that the terms of the loans were compliant with the provisions of Section 41 (1a) of the Fiscal Responsibility Act, 2007.

The loans from China are tied to project. The projects, (eleven in number as at March 31, 2020), include the Nigerian Railway Modernisation Project (Idu-Kaduna section), the Abuja Light Rail Project, Nigerian Four Airport Terminals Expansion Project (Abuja, Kano, Lagos and Port Harcourt), Nigerian Railway Modernisation Project (Lagos-Ibadan section) and the Rehabilitation and Upgrading of Abuja-Keffi-Makurdi Road Project.

The DMO said the low interest rates on the loans reduced the interest cost to government while the long tenor enabled the repayment of the principal sum of the loans over many years.

However, as of March 31, a total of $719.61m had been made as debt service payment to China since the third quarter of 2015.

Of the amount paid as debt service, 46.15 per cent ($332.03m) was paid to service the interest on the loans.

In the first quarter of 2021, $102.19m was used to service debt to China. This is about 11 per cent of the total $1.0bn used to service external debts within the period.

The DMO recently disclosed that Nigeria had more than $5.83bn foreign loans that had been approved but not yet disbursed as of December 31, 2020.

Out of this amount, $1.25bn is supposed to come from the Export-Import Bank of China. Apart from multilateral agencies, China has remained the nation’s largest creditor.

There had been fears among Nigerians that the country may forfeit some of the projects in case of loan defaults.

The fear grew when the Minister of Transportation, Rotimi Amaechi, in August 2020, confirmed that the country waived its sovereign immunity to obtain Chinese loans.

The minister, however, added that as long as debts were repaid, there would be no need for China to claim any infrastructure.

“We must learn to pay our debts and we are paying, and once you are paying, nobody will come and take any of your assets,” he had said.

Despite the assurance, fear persists that the Chinese loans contain some obnoxious clauses that could breach the nation’s sovereignty especially as the loan agreements are not available in the public domain.

Amaechi denied knowledge of any clause that hands over a national asset to China in case of any default in an AriseTV interview on Monday.

He disclosed that the administration of Major General Muhammed Buhari had paid $150m out of the $500m borrowed by the administration of President Goodluck Jonathan for the Abuja-Kaduna Rail project.

The minister also commented on other issues such as the suspension of Bala-Usman and the impacts of the country’s Deep Blue Project on every Nigerian.

When asked about the plans of the Federal Government to pay back the loans so as to avoid the Zambian experience where some national assets such as the Kenneth Kaunda International Airport, the Zambia National Broadcasting Corporation and the National Power and Utility Company were reportedly used to settle Zambia’s financial obligations to China, Amaechi said borrowers should meet their obligations.

He said, “When you take loans, you are expected to pay back. Today we are paying back. Under the regime of President Goodluck Jonathan, the loan for Abuja-Kaduna was taken. It was about $500m. Today, we have paid about $150m on that loan.

“Nigeria has never defaulted when it comes to repayment. I do not also expect that we should default on any other loan that we have taken.”

While commenting on the status of the suspension of Ms Hadiza Bala-Usman from the Nigerian Ports Authority, he said, “I am not aware that I suspended Hadiza. I am not the president, and I do not have such powers. That power rests with the president.

“I am not aware that Hadiza was actually suspended. I suspect she was asked to step aside, to enable investigation to be carried out on NPA, not on her. We are investigating NPA.

“At the conclusion of the investigation, all the reports will be sent to the president who will then make a decision on the way forward.”

The minister also said that he was not aware of when the panel would finish and that it was in the hands of the panel.

Responding to how the $195m Deep Blue Project will affect all Nigerians who are not seafarers, he said, “What we have done with the Deep Blue Project is that we will reduce the cost of producing oil in Nigeria.

“By the time we provide security on the waters, the economy would improve because there would be more money coming into the economy. That is the impact it will have.”

He added that the company that handled the project guaranteed to refund of the money spent on the project if there was no improvement in the economy six months after the project.

The Punch

Boss Picks4 days ago

Boss Picks4 days ago

Opinion6 days ago

Opinion6 days ago

Opinion4 days ago

Opinion4 days ago

Events5 days ago

Events5 days ago

Adding Value5 days ago

Adding Value5 days ago

Featured5 days ago

Featured5 days ago

Headline3 days ago

Headline3 days ago

News5 days ago

News5 days ago