By Eric Elezuo

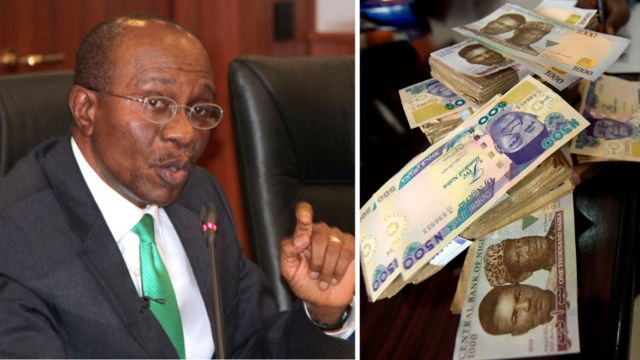

Like it did in 1984, the administration of President Muhammadu Buhari has proposed to redesign the higher denominations of the nation’s currency. The announcement was contained in a statement released by the Central Bank of Nigeria (CBN) Governor, Mr. Godwin Emefiele, during a press briefing in Abuja. The bank said it is undertaking the designing project to have control of the currency in circulation, manage inflation, as well as tackle counterfeiting. He noted that the targeted notes are N100, N200, N500, and N1000, while release into the Nigerian monetary space will start on December 15, 2022, and then by January 31, 2023, the existing notes will be completed phased out of circulation.

Emefiele hinted as part of the many reasons for the action, that the currency management has faced several daunting challenges that have continued to escalate in scale and sophistication with attendant and unintended consequences for the integrity of both the CBN and the country.

However, stakeholders, analysts and the general public have been left to wonder if the CBN and Emefiele were well advised as a cross section of Nigerians believe that the project could be a dangerous gamble, seeing that there are concerns the move may lead to confusion as rural population may find it difficult to change their currency notes within the given time among a whole lot of consequences, which the Minister of Finance, Zainab Ahmed has hinted.

In his address while making public the intention of the CBN, which permission, he said has been given by President Buhari, Emefiele said: “These challenges primarily include: Significant hoarding of banknotes by members of the public, with statistics showing that over 85 percent of currency in circulation are outside the vaults of commercial banks,” he said.

“To be more specific, as at the end of September 2022, available data at the CBN indicate that N2.73 Trillion out of the N3.23 trillion currency in circulation, was outside the vaults of Commercial Banks across the country; and supposedly held by the public.

“Evidently, currency in circulation has more than doubled since 2015; rising from N1.46 trillion in December 2015 to N3.23 trillion in September 2022. This is a worrisome trend that cannot be allowed to continue.”

Emefiele’s catalogue of excuses regarding why the existing naira notes must be phased out includes the fact that the increase in the hoarding of currency in circulation has affected inflation, which hit a 17-year high in September, in addition to the menace of worsening shortage of clean and fit banknotes with attendant negative perception of the CBN and increased risk to financial stability.

The CBN governor also listed that the redistribution of the new notes will discourage ransom payment as large volumes of money won’t be accessed because the amount of cash in circulation will be drastically reduced just as it will help deepen CBN’s drive to entrench cashless economy as it will be complemented by increased minting of the eNaira.

“Also, in view of the prevailing level of security situation in the country, the CBN is convinced that the incidents of terrorism and kidnapping would be minimized as access to the large volume of money outside the banking system used as source of funds for ransom payments will begin to dry up.

“This will further rein in the currency outside the banking system into the banking system thereby making monetary policy more efficacious,” Emefiele said.

As expected, the CBN governor’s initiative has received knocks and kudos from across the length and breadth of the country with stakeholders voicing their thoughts at how the redesigning of the naira will impact on the economy, and more importantly on the lives of the citizens.

First among the early praise singers of Emefiele’s initiative is the Economic and Financial Crimes Commission, (EFCC).

In his remarks, the chairman of the commission, Abdulrasheed Bawa, described the move as “well-considered and timely” as it will address the challenges of currency management which has negatively impacted the country’s monetary policy and security imperatives.

“The EFCC, the CBN and some other regulators in the financial sector have worked closely in the recent past to determine how best to stabilize the country’s monetary policy environment. It is heart-warming that the CBN has demonstrated courage in taking this bold decision which I believe will bring sanity to the currency management situation in Nigeria,” he said, in a statement released by its spokesperson, Wilson Uwujaren.

EFCC’s involvement , according to Bawa is to monitor the process to ensure that unscrupulous players and currency speculators and their cohorts among the BDCs do not undermine the exercise. He also charged banks to be alive to their reporting obligations and not assist unscrupulous customers in laundering suspected proceeds of crimes through their system.

The CBN has also requested that the process of introducing the new notes and phasing out the existing ones will ensure that

1. Banks must only accept cash from customers with bank accounts, adhering fully to the principle of KYC.

2. Cash must only be paid into customers accounts. Cash must not be paid into ledgers or suspense accounts

3. CBN will no longer print large quantities of Cash. New cashless policy to be announced in January

4. Banks that receive cash from non-account holders or customers will be penalised by CBN and EFCC

The process will also involve the CBN and EFCC monitoring and tracking all deposits just as it provides an opportunity to leverage on branch networks to drive funding of accounts and drive digital adoption and opening of new accounts.

But how feasible the lofty ideas the CBN has expressed in this initiative is remains a mirage and gamble as most bodies have risen in condemnation of the process.

The first of the misadventure of the naira redesigning is the denial of the Ministry of Finance, Budget and National Planning that they are not aware of the planned exercise. The Minister, Zainab Ahmed, who commented on the policy in response to questions raised by senators during the 2023 budget defence session she had with the Senate Committee on Finance, chaired by Senator Solomon Olamilekan, dissociated herself from the Naira redesign policy.

The Minister went ahead to warn the CBN of consequences that may arise from the policy just as the Senate intoned that barely two days after the announcement of the policy by the CBN, the negative effect was already being experienced in the country’s forex. The Senate noted that just bare 48 hours later, the value of the Naira to a US dollar has risen from N740 to N788 due to rush in exchange of stashed Naira Notes for foreign currencies, particularly the dollar.

In their argument, the senators were of the opinion that the policy, a well-conceived one, but has timing deficiency, going by the realities on ground. They feared that the naira may fall to as low as N1,000 to a US dollar before January 31, 2023 fixed for full implementation of the policy.

Ahmed, who speaks for the Federal Government on monetary matters reiterated that she and her Ministry were not aware of the policy but only heard from the media.

“Distinguished Senators, we were not consulted at the Ministry of Finance by the CBN on the planned naira redesigning and cannot comment on it as regards merits or otherwise.

“However, as a Nigerian privileged to be at the top of Nigeria’s fiscal management, the policy as rolled out at this time portends serious consequences on value of naira to other foreign currencies.

“I will, however, appeal to this committee to invite the CBN governor for required explanations as regards merits of the planned policy and rightness or otherwise of its implementation now,” she said.

Reacting, Emefiele, carpeted the minister, saying that permission was sought and received from the President, and as a result need not consult any other person.

On their part, the Civil Society Legislative Advocacy Centre (CISLAC) said that the Central Bank of Nigeria’s plan to redesign the higher currency notes is not an economic priority for the country, considering the current challenges facing the economy.

The Executive Director of Centre, Auwal Musa, in a statement said that there are more pressing needs that the CBN ought to attend to, to set the economy on the path of revival, adding that concerned reactions from Nigerians was proof that the decision is a misplaced priority on the part of the CBN.

He said, “Firstly, the CBN’s decision to redesign and reissue new 200, 500 and 1000 notes is not an economic priority and barely a solution to addressing Nigeria’s poor monetary policy challenges and growing economic woes.

“Especially at a time when the country is grappling with huge fiscal deficits, a free fall of the naira, soaring inflation rates, multiple forex rates and rising borrowing costs. The reasons for this decision seem no different from those given for the forex demand management strategy which resulted in a non-satisfactory conclusion as the artificially low exchange rate failed to be as reflective of the market as possible to improve supply, but this time it only threatens damning economic consequences for Nigerians.

“The public perception that this decision holds no value proposition for the economy, reiterates the tendency of the CBN to be distracted from fulfilling priority statutory obligations.

“Various comments and responses from concerned Nigerians, show that a large number of Nigerians are worried about the misplacement of priorities of the Apex Bank to make such a decision that comes with possibly huge logistics costs and avoidable dislocations to small businesses, most of whom are in the informal sector.”

He added: “So far, the macro-economic and monetary policies of the CBN has brought untold hardship to the productive and service sectors of our nation’s economy with consequential negative effects on the lives of our citizens. The Apex Bank has floated multiple exchange rate regimes and has been accused of facilitating arbitrage between the parallel and official foreign exchange markets, providing huge financial patronage and extending forex-based favours to allies.

“Nigeria is grappling with the external pressures from the incapacity of the Central Bank of Nigeria to protect foreign exchange reserves from external outflows.

“The Apex Bank needs to do a lot to recover the confidence of the public by addressing its inability to ensure; Blockage of illicit financial flows and checkmating the use of financial systems to fund terrorism by strengthening oversight of commercial banks used as conduits for corruption,” adding that “Foreign investors rely on authoritative indexes like the Global Terrorism Index and even economic indexes that include an evaluation of security and stability, to inform their investment decisions;

“Intensifying collaborations with relevant anti-corruption agencies to check dubious charges by some commercial banks, who keep shortchanging poor Nigerians whose reducing disposable income is further worsened by growing inflation costs and unemployment;

“Reduction of competition with other agencies by going beyond its purview to drive interventions in sectors without the consent or cooperation of the relevant coordinating ministries. The CBN’s continued and unsolicited support for MSMEs can be more effective by ensuring synergy between the fiscal and the monetary authorities on intervention funds and adopting transparent mechanisms for beneficiaries to access;

“Availability of forex to those who legitimately need it like students studying out of the country and businesses. The artificially low exchange rate has failed to be as reflective of the market as possible and this has affected access to forex for payment of foreign tuition fees, and the importation of systems and raw materials which contribute greatly to the country’s worsening economic situation. There is a huge blow to our foreign direct investment as foreign investors are leaving due to their inability to access forex;

“Sanitization of the CBN recruitment processes, which are non-transparent as they seem to be reserved exclusively for the children, wards and affiliates of politically exposed persons.

“In this desperate period of economic woes for Nigeria, the CBN’s efforts will be better served in pushing robust monetary policies that are in tandem with global best practices, fighting inflation and building a strong financial system in an increasingly uncertain global economy.”

Recall that in 1984 when Buhari was the Head of State, he ordered the redesigning of the naira notes notably One, Five, 10 and 20 to trapped politicians, who were suspected to have hoarded currencies away from bank vaults. A case of deja vu!

Boss Picks5 days ago

Boss Picks5 days ago

Opinion5 days ago

Opinion5 days ago

Events6 days ago

Events6 days ago

Headline4 days ago

Headline4 days ago

Headline5 days ago

Headline5 days ago

Featured4 days ago

Featured4 days ago

Featured4 days ago

Featured4 days ago

National4 days ago

National4 days ago