Heirs Energies Limited, Nigeria’s leading indigenous integrated energy company, has executed a USD 750 million financing with the African Export–Import Bank (Afreximbank).

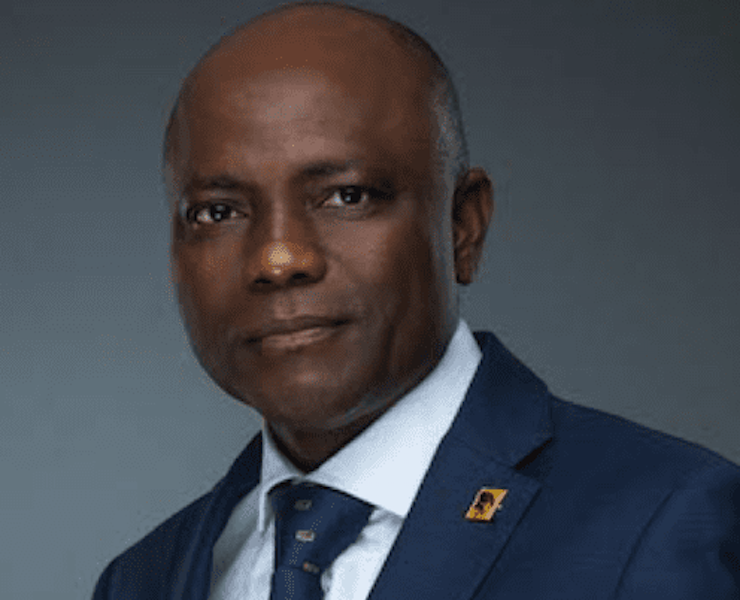

The transaction was concluded at a signing ceremony in Abuja on Saturday 20th December 2025, attended by Mr. Tony O. Elumelu, CFR, Chairman of Heirs Energies, and Dr. George Elombi, President and Chairman of Afreximbank.

The transaction represents one of the largest financings secured by an indigenous African energy company and demonstrates lender confidence in Heirs Energies’ operating performance, governance standards, proprietary brownfield excellence capability, and long-term growth trajectory.

Since assuming operatorship of OML 17, Heirs Energies has delivered a disciplined transformation programme, focused on restoring production, strengthening asset integrity, and improving operational efficiency. Through targeted brownfield interventions and infrastructure optimisation, the Company has successfully transitioned from acquisition-led financing to a capital structure aligned with the long-term development profile of its reserves.

Oil and gas production has doubled, from an acquisition production level of 25,000 barrels of oil per day (bopd) and 50 million standard cubic feet of gas per day (mmscf/d). Today, OML-17 produces over 50,000 bopd and 120 mmscf/d. All the gas production goes into the Nigerian domestic gas market and has been catalytic for power generation in Nigeria. Community relations have been transformed and the highest standards of health and safety implemented.

The Afreximbank facility will accelerate field development, optimise production, and allow Heirs Energies to pursue value-accretive growth opportunities, while maintaining disciplined capital management.

Speaking at the signing, Mr. Tony O. Elumelu, CFR, Chairman of Heirs Energies, said:

“This transaction is a powerful affirmation of what African enterprise can achieve when backed by disciplined execution and long-term African capital. It reflects the successful journey Heirs Energies has taken – from turnaround to growth – and reinforces our belief in African capital working for African businesses. This is Africa financing Africa’s future.”

Dr. George Elombi, President and Chairman of Afreximbank, stated:

“Afreximbank is proud to support Heirs Energies at this pivotal stage of its growth. This financing reflects our confidence in the Company’s leadership, governance, and asset base, and aligns with our mandate to support African champions that are driving sustainable economic transformation across the continent.”

The transaction further reinforces Afreximbank’s role in enabling indigenous operators with the scale and capability to deliver sustainable energy development, energy security, and long-term economic value across Africa.

With this milestone achieved, Heirs Energies is firmly positioned to advance into its next phase of growth, focused on operational excellence, responsible resource development, and enduring value creation for stakeholders.

Heirs Energies Limited is Africa’s leading indigenous-owned integrated energy company, committed to meeting Africa’s unique energy needs, while aligning with global sustainability goals. Having a strong focus on innovation, environmental responsibility, and community development, Heirs Energies leads in the evolving energy landscape and contribute to a more prosperous Africa.

The African Export-Import Bank is a Pan-African multilateral financial institution mandated to finance and promote intra- and extra-African trade. The Bank plays a critical role in supporting Africa’s industrialisation, trade expansion, and economic transformation.

Picture: Chairman, Heirs Energies, Mr. Tony O. Elumelu CFR and President and Chairman of the African Export-Import Bank (Afreximbank), Dr. George Elombi, during the signing ceremony to mark the execution of a USD 750 million Financing Transaction between Heirs Energies and the Afreximbank in Abuja on Saturday

News4 days ago

News4 days ago

Boss Of The Week6 days ago

Boss Of The Week6 days ago

Opinion6 days ago

Opinion6 days ago

Featured5 days ago

Featured5 days ago

Business6 days ago

Business6 days ago

News4 days ago

News4 days ago

Opinion5 days ago

Opinion5 days ago

Headline6 days ago

Headline6 days ago