Featured

Why Foreign Investors Are Leaving Nigeria – Peter Obi

Published

1 year agoon

By

Eric

By Eric Elezuo

A former governor of Anambra State and Labour Party (LP) presidential candidate in the 2023 elections, Mr. Peter Obi, has given reasons foreign investors are shutting down their operations and leaving Nigeria.

He attributed the trend to a negative medium to long-term prospects strategy, unattractive investment profile and a continuous deteriorating business environment, among others.

Obi, who voiced his concerns in a series of tweets on his verified X account on Friday, tasked governments at all levels to take immediate steps towards reversing the trend and keeping strategic international investors in the country.

He said he is saddened to hear the news that multi-national consumer goods giant, Procter & Gamble (P&G), is leaving Nigeria.

The manufacturing conglomerate had announced a limited market portfolio restructuring which includes pulling out of Nigerian and Argentinian markets.

While reacting to the news, the former governor of Anambra State explained that Nigeria is scaring away multinational companies, at a time the purchasing power of most Nigerians nose-diving, the absence of the rule of law and lack of a conducive business environment, which ultimately makes it difficult to retain iconic companies let alone attract new ones.

“A few months ago, I lamented the exit of one of the top global pharmaceutical giants, GlaxoSmithKline (GSK) from Nigeria. GSK remains a top global pharmaceutical manufacturer and has had 51 years of operations in Nigeria,” Obi wrote.

“The reason for their exit was that there was no longer a perceived growth in Nigeria anchored on productivity.

“Today, Procter & Gamble (P&G), the world’s largest personnel care and household products company, makers of iconic brands like Pampers, Gillette, etc, is again leaving Nigeria, for the same reason GSK left.

“Following this also are French pharmaceutical company Sanofi-Aventis, and top Energy firm, Norwegian behemoth Equinor which has sold off its Nigerian business development associates.

“Fifteen years ago, P&G, as they are commonly called, viewed Nigeria as a strategic country of importance and invested millions of dollars in an ultra-modern chain supply structure in Agbara which, sadly, is now up for sale.

“The presence of these iconic companies in any economy is not only that they signify trust and confidence, as well as belief in the medium to long-term socio-economic prospects of such countries, but they massively create jobs, invest in Research and Development, as well as pieces of training which smaller players in the industry learn from and adapt.

“They help, to a great extent to develop local talents for both local and global jobs. The exit of these top global companies shows that our medium to long-term prospects strategy is in the negative.

“Our investment profile is not attractive and our business environment is deteriorating continually.

“The purchasing power of most Nigerians is nose-diving every day. In the face of the absence of the rule of law, and a conducive business environment, it will be difficult to retain such iconic companies and talk more about attracting new ones.”

“National greatness and development cannot be pursued in an atmosphere that is scaring away strategic international investors,” he added.

Recall that in August, pharmaceutical giant, GlaxoSmithKline packed up its businesses in the country with a promise to treat its staff fairly.

A statement to the effect, and signed by the Company Secretary, Frederick Ichekwai, stated in part, “In our published Q2 results we disclosed that the GSK UK Group has informed GlaxoSmithKline Consumer Nigeria PLC of its strategic intent to cease commercialization of its prescription medicines and vaccines in Nigeria through the GSK local operating companies and transition to a third-party direct distribution model for its pharmaceutical products.”

The company, whose primary activities include marketing and distribution of consumer healthcare and pharmaceutical products, said that its parent company, GSK Plc UK, had revealed its intent to cease commercialisation of its prescription medicines and vaccines through its Nigerian subsidiary.

A few days ago, the Chief Financial Officer of P&G, Mr. Andre Schulten, announced at the Morgan Stanley Global Consumer & Retail Conference that, “we have announced that we will turn Nigeria into an import-only market, effectively dissolving our footprint on the ground in Nigeria and reverting to an import-only model.”

Schulten, attributed the P&G’s decision exit Nigeria to the prevailing foreign exchange rate situation in the country, saying that Nigeria and Argentina were difficult to do business in because of macroeconomic environment.

He stated that, “the other reality that arises in some of these markets is that it gets increasingly difficult to operate and create U.S dollar value. So when you think about places like Nigeria and Argentina, it is difficult for us to operate because of the macroeconomic environment.

“So with that in mind, we are announcing a restructuring program with the intent to adjust operating model and adjust the portfolio to ensure that we maintain the portfolio discipline that has brought us to this point.

“The restructuring program will largely focus on Nigeria and Argentina. We’ve announced that we will turn Nigeria into an import-only market, effectively dissolving our footprint on the ground in Nigeria and reverting to an import-only model.”

He explained that Nigeria was a $50 million net sales business which would not make any significant marginal impact on the P&Gs overall portfolio worth $85 billion.

Mr. Peter Obi has been in the forefront of critiquing the policies of the President Bola Tinubu-led administration.

Related

You may like

Featured

Umahi Apologises to Tinubu, Lagosians, Denies Knowledge of Bridge Closure

Published

2 days agoon

April 4, 2025By

Eric

The Minister of Works, Senator Dave Umahi on Thursday, said the closure of Independence Bridge in Lagos for urgent rehabilitation of the collapsed retaining wall was made without his knowledge or authorization.

Umahi said this while apologising to Lagos residents and President Bola Tinubu for the disruption caused by the sudden closure of the bridge on Wednesday.

Umahi who spoke when he toured the bridge in Lagos said: ” Unfortunately, when the bridge was to be closed, I was not informed. It is very unfortunate because for a bridge to be closed, especially in Lagos, as has been the tradition, I should be informed as the minister.

“We should also have studied the implication of it even in an emergency situation. We would have deployed emergency evaluation of the implication of closing the bridge.”

Umahi warned that controllers of works and engineers would face disciplinary action if such an incident would happen again.

“I use the opportunity to warn all controllers and engineers all over the country. Never you close a road or close any bridge without running through the permanent secretary, who will seek for permission from the honourable minister of works,” he said.

The minister acknowledged the efforts of Lagos State Government in managing traffic flow during the closure.

He also took responsibility for the error, saying: “I take responsibility for it, even though I did not order it, but every action by any staff of the ministry of works, I take responsibility for it.”

Umahi said that the closure, which caused significant traffic congestion, was avoidable.

He said: “If we were to do this properly, there would have been a different kind of method deployed and it wouldn’t have necessitated the total closure.”

According to him, even if closure was necessary, it would have been done in a way that it would take three days: Friday, Saturday, Sunday, and necessary remedial work would have been put in place.

“What we are doing now is to restore the bridge temporarily within the next three days. By Sunday, this place will be totally open.”

He added that a permanent solution would be implemented after a two-week assessment.

“Then, after two weeks, we will look at the settlements, and then we will take out three days to put the permanent structure. That is what we are going to do,” he said.

The minister emphasised the competence of the contractor handling the project, Build Well.

“Build Well is a reputable company, and they have been restoring a lot of failures on our bridges in Lagos, some of them 53 years old.

“Some bridges’ spans have been lifted, especially Eko Bridge, Marina Bridge, and even the Lagos-Ibadan Bridge. They are also intervening in all of them,” he added.

The minister also said that the design of the bridge would be varied to address the emergency situation.

He said: ” The design will be varied according to the emergency situation we have on ground, and the contractor is going to cooperate with us.”

He pledged to personally oversee the restoration efforts, saying, “I am not going until the bridge is fully restored by Sunday, we will work day and night to restore it, and then we will evaluate it.”

The bridge was initially closed on April 1 for essential maintenance and rehabilitation works, with the government planning to complete the repairs by May.

NAN

Related

Featured

Communal Clashes: Adeleke Threatens Royal Fathers with Dethronement

Published

6 days agoon

March 31, 2025By

Eric

Osun State Governor, Senator Ademola Adeleke, has threatened stern state action against traditional rulers of Ifon, Erin Osun and Ilobu communities if they fail to sustain current peace, and de-escalate the crisis in their communities.

The Governor issued the warning against the backdrop of online reports that some faceless groups across the conflict areas are planning another round of attacks.

“In the midst of sallah celebrations, I got reports of some people planning another round of conflict around Ifon, Ilobu and Erin Osun towns. The security agencies have tightened surveillance to ensure no attacks take place.

“The security agencies are also speeding up the interrogation of key chieftains and actors in the conflict. I will remind top leaders of the towns that the peace undertaking they are signing are not for joke. They will be held accountable. There will be accountability before the law.

“The curfew we relaxed was on humanitarian grounds. As a compassionate government, we know many innocent people are suffering because of the evil agenda of a few elements across the conflict areas. Any attempt to exploit the adjustment of the curfew for renewed violence will be met with full re-imposition of the 24-hour curfew.

“Additionally, I will remove from office, any traditional ruler where violence recurs. This card is on the table. Royal fathers of each town must call their subjects to order. I will wield the big stick. Enough is enough”, the Governor was quoted as saying in the statement.

Related

Featured

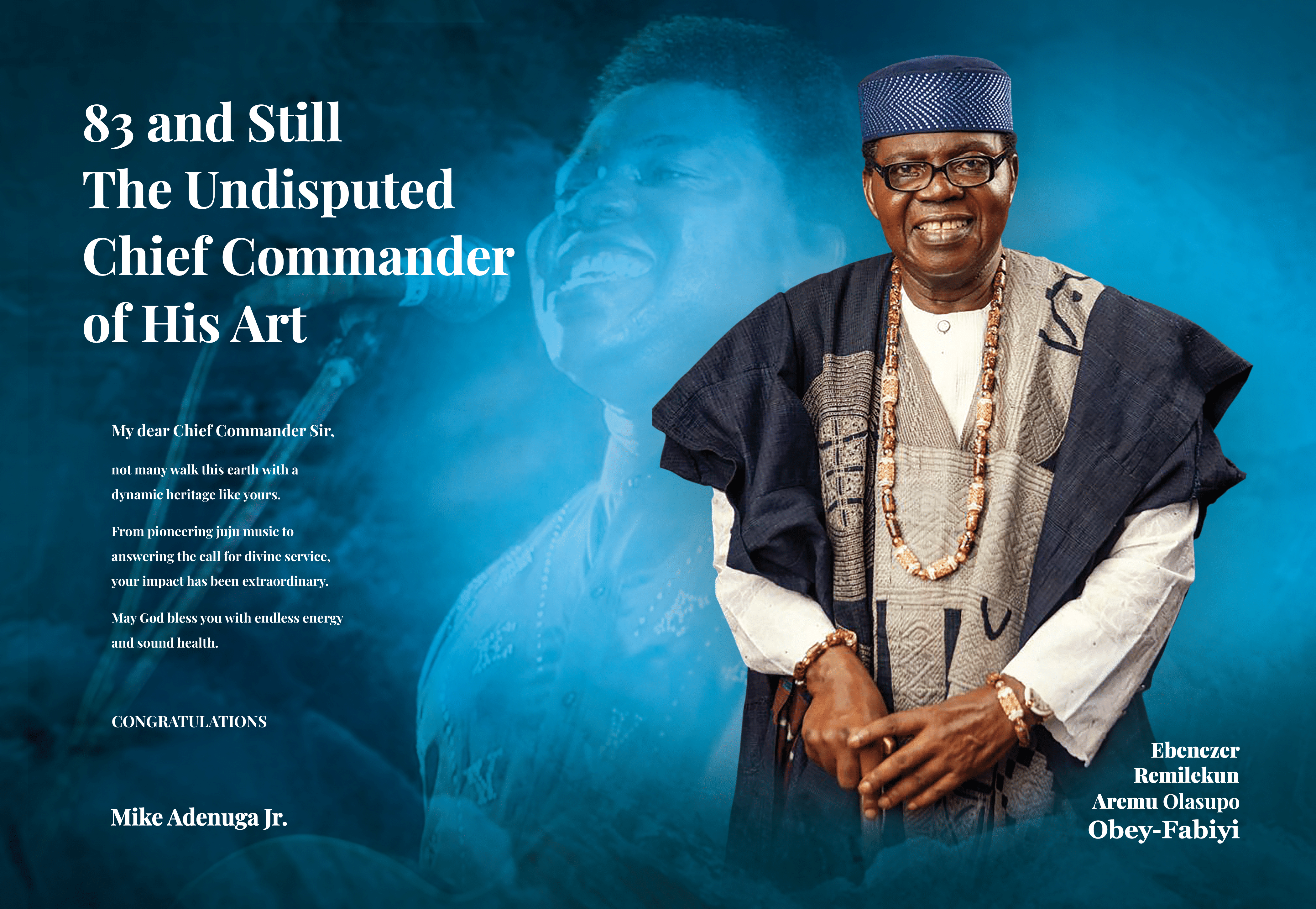

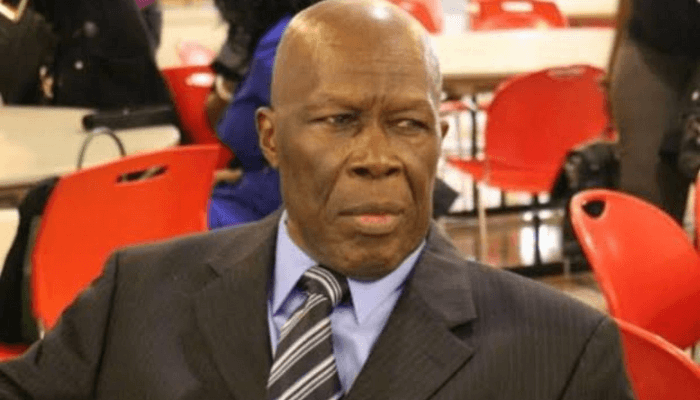

Celebrating a Hero of June 12, Humphrey Nwosu

Published

6 days agoon

March 31, 2025By

Eric

“Professor Humphrey Nwosu laid a landmark foundation for the present independent National Electoral Commission today and that Professor Humphrey Mwosu passed away on the 20th of October 2024, aged 83 years old.

“Despite his contributions, Professor Humphrey Mwosu was seemingly neglected until his death, which highlights complaints of unfair treatment of notable public servants,” he added.

In support of the motion, Senator Osita Ngwu that “there was no way he would have announced the results with a gun to his head. That doesn’t change the fact that some of us see him as a hero.”

Among the several senators, who opposed the immortalisation motion, with excuses of Nwosu’s lacking courage to announce final results, were Senator Jimoh Ibrahim from Ondo State, who stated categorically that “nothing should be named after him”, Senator Cyril Fasuyi, who argued that history does not reward efforts, but only results, saying “As long as he did not announce the result, whether under duress or not, I am against naming INEC headquarters after him”, Senator Sunday Karimi, who criticised Nwosu for lacking the courage to speak out; Senator Afolabi Salisu, who said that immortalising him would undermine the memory of MKO Abiola, Senator Adams Oshiomhole and Senator Adeola Olamilekun, who claimed he lost his brother in the aftermath.

But Nigerians have argued in favour of the immortalisation of the former chief electoral officer, admonishing that he did his job very well. Most of them reasoned that if the likes of Babagana Kingibe, the running mate to Abiola, who ditched the struggle to join the government of General Sani Abacha, could be honoured with a GCON honours, the second highest in the land, how much more the proponent of the most viable option to voting, Option A4.

In his accessment, celebrated journalist and Chairman of Ovation Media Group, Chief Dele Momodu, said Nwosu performed his duty to the very best of his abilities, and very well. The well traveled journalist wondered on what pedestal the opposing senators stand to deny him honours.

Also lending his voice to the immortalisation of Prof Nwosu, the Aare Onakakanfo of Yoruba land, Iba Gani Adams, said all honours Abiola is enjoying today is credited to Nwosu’s honesty.

“It is very important that Prof. Humphrey Nwosu should be recognized, the genesis of having a free and fair or the foundation of having a free and fair June 12, 1993 elections was through having a sincere NEC chairman like Humphrey Nwosu.

“Humphrey Nwosu conducted free and fair election that gave Aare MKO Abiola the mandate that the Nigerian government then did not install him as president.

“And the respect and the glory that Aare MKO Abiola is having today is as a result of the honesty displayed by the then NEC chairman and the products that worked with him that made it happen,” he said.

HUMPHREY NWOSU AND JUNE 12 DEBACLE

The CNPP lamented the continued exclusion of Prof. Nwosu from the list of heroes celebrated on Democracy Day, despite his significant contribution to the nation’s democracy through the introduction of the Option A4 voting system.

“It is time to transcend petty biases and to embrace the spirit of inclusivity that Professor Nwosu’s legacy warrants,” the association of all registered political parties noted.

An online platform, Businessday.ng once captured Prof Nwosu’s contribution as follows:

In the middle of the night of June 10, 1993, an Abuja High Court presided over by Justice Bassey Ikpeme, in breach of the relevant decree, ordered the electoral body to put on hold the presidential election that was some 36 hours away from happening.

The plaintiff in the case was an unregistered body known as the Association for Better Nigeria (ABN) , which consisted of a group of politicians generally believed to have government backing. Nwosu took the risk of his life and found his way in the morning uninvited to a meeting of the MILITARY COUNCIL, ASO VILLA, to explain the grave consequences of Ikpeme’s indiscreet pronouncement. After intimidation and harassment of Prof and other deliberations at the uninvited meeting, it was agreed that NEC could discount Ikpeme’s order and continue with its arrangements and preparations for the elections.

At the end of voting, when it became clear from the majority of the results already collated from the states that the candidate of the then Social Democratic Party (SDP) Bashorun M.K.O. Abiola could not be stopped from winning the contest, the then Chief Judge of Abuja, Justice Dahiru Saleh ordered NEC to halt the process. Again, Nwosu stormed the Aso Villa, but this time, he found that the government had withdrawn their support.

The then Attorney General of the Federation (AGF) Clement Akpamgbo, who gave Nwosu legal backing earlier, did not only ditch him but also ensured that a bench warrant to arrest Nwosu issued by the Chief Judge of Abuja was duly served. From then, Nwosu became labelled as the problem, while his Electoral Commission was formally suspended forthwith. The only other option left to Nwosu was to seek judicial cover from the Court of Appeal, Kaduna Division, headed by Justice Achike. With no one else behind Nwosu except the Commission’s vibrant Director of Legal Services, Bukhari Bello, with Chief Tony Ojukwu SAN, OFR, one time Executive Secretary, National Human Rights Commission. NEC drew attention to an earlier judgment by a higher court in which Oguntade JCA as he then was, established two main points.

The first was that where a court makes an order in a case where it lacked jurisdiction, the order was null and void; and second, that it was unnecessary to go on appeal in such circumstance.

This suggested that Nwosu had no business obeying the erroneous decisions of the lower courts. Interestingly, NEC produced in Court the COMPLETE RESULTS OF THE ELECTION, which he had been stopped from announcing and which confirmed the victory of MKO Abiola. The real problem was that some ambitious military fellows aided by a set of compromised politicians wanted to prolong military rule. At this point, the government, sensing that it might lose the case, decided to annul the election a few hours before the judgment of the Court of Appeal.

Prof Nwosu is an apostle of democracy, and of June 12, 1993 more especially, and deserves to be honoured and celebrated.

In his tribute at the burial of Prof Nwosu, President Tinubu, though acknowledged that the deceased upheld democratic principles, he was however, silent on any form of honour for the June 12 chief electoral officer. He noted:

“As we mourn the death of Prof Humphrey Nwosu, we are invited to celebrate him for his profound accomplishments and personal fulfilments as a public administrator, political scientist, and academics icon. We are urged to reflect on his democratic ideals and his sense of commitment to a democratic Nigeria. These are the hallmarks of his life and times that will be cherished beyond this generation,” Tinubu said, through his representative, the Minister of Works, Engr. Dave Umahi.

As the south east governors prepare to meet and present their proposition of honoring Nwosu before President Tinubu, Nigerians have said that whatever the situation, Nwosu remains and etched in the hearts and minds of the real heroes of democracy and June 12; the average Nigerians, as democratic force to reckon with, and a man without whose name the story and history of the freest and fairest election in Nigeria cannot be written.

According to Yusuf John Imam, who wrote from Abuja, in an article titled Senate’s failure to immortalize Humphrey Nwosu, disservice to democracy, “if the Senate cannot honour Nwosu, then every state in the Southeast should take it upon themselves to immortalize their son. Build monuments, name streets, and establish scholarships in his name. Push his narrative and celebrate his legacy. The Southeast must rise to the occasion and ensure that their son’s legacy is preserved for generations to come.”

The bottom-line remains that Professor Humphrey Nwosu is a hero of June 12, and deserve to be honoured, immortalised and celebrated.

Related

Oyo Crowns New Alaafin, Oba Abimbola Owoade

Police Invite Sanusi for Questioning over Sallah Day Violence

Adding Value: The Need to Define Yourself by Henry Ukazu

The Oracle: Nigeria’s Political Leadership Since 1960 and Rhythms of Corruption (Pt. 2)

Glo-sponsored African Voices Features Gospel Artistes, Nathaniel Bassey, Mercy Chinwo

Hakeem Baba-Ahmed Dumps Tinubu’s Appointment As Political Adviser

Court Stops Pro-Wike Rally in Bayelsa

Nigerian Engineer Wins $500m Contract to Build Monorail Network in Iraq

WORLD EXCLUSIVE: Will Senate President, Bukola Saraki, Join Presidential Race?

World Exclusive: How Cabal, Corruption Stalled Mambilla Hydropower Project …The Abba Kyari, Fashola and Malami Connection Plus FG May Lose $2bn

Rehabilitation Comment: Sanwo-Olu’s Support Group Replies Ambode (Video)

Fashanu, Dolapo Awosika and Prophet Controversy: The Complete Story

Pendulum: Can Atiku Abubakar Defeat Muhammadu Buhari in 2019?

Pendulum: An Evening with Two Presidential Aspirants in Abuja

Who are the early favorites to win the NFL rushing title?

Boxing continues to knock itself out with bewildering, incorrect decisions

Steph Curry finally got the contract he deserves from the Warriors

Phillies’ Aaron Altherr makes mind-boggling barehanded play

The tremendous importance of owning a perfect piece of clothing

Trending

-

News7 years ago

News7 years agoNigerian Engineer Wins $500m Contract to Build Monorail Network in Iraq

-

Featured7 years ago

Featured7 years agoWORLD EXCLUSIVE: Will Senate President, Bukola Saraki, Join Presidential Race?

-

Boss Picks7 years ago

Boss Picks7 years agoWorld Exclusive: How Cabal, Corruption Stalled Mambilla Hydropower Project …The Abba Kyari, Fashola and Malami Connection Plus FG May Lose $2bn

-

Headline7 years ago

Headline7 years agoRehabilitation Comment: Sanwo-Olu’s Support Group Replies Ambode (Video)

-

Headline6 years ago

Headline6 years agoFashanu, Dolapo Awosika and Prophet Controversy: The Complete Story

-

Headline6 years ago

Headline6 years agoPendulum: Can Atiku Abubakar Defeat Muhammadu Buhari in 2019?

-

Headline7 years ago

Headline7 years agoPendulum: An Evening with Two Presidential Aspirants in Abuja

-

Headline6 years ago

Headline6 years ago2019: Parties’ Presidential Candidates Emerge (View Full List)