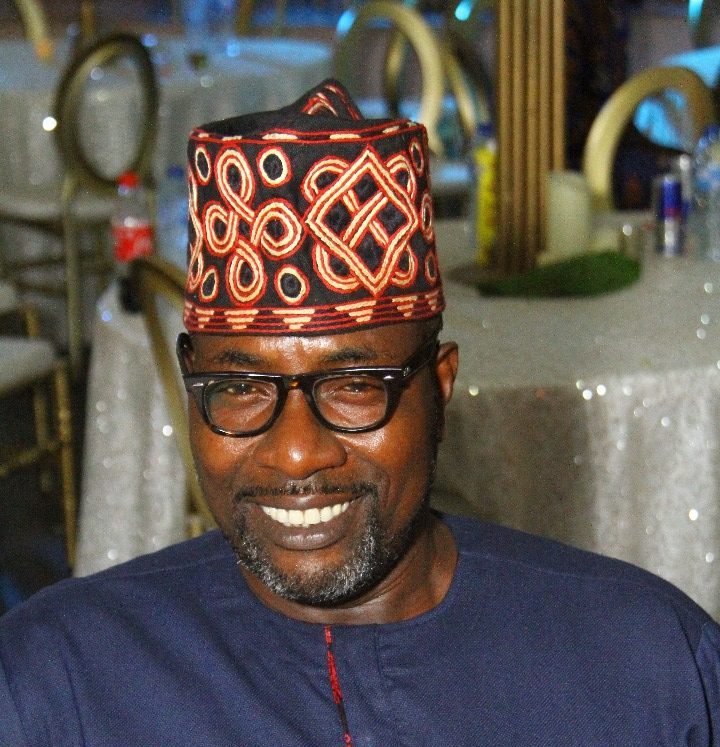

Boss Of The Week

We Are Lifting 42 Million Nigerians Out of Poverty – Basorun Adebola Orolugbagbe

Published

4 years agoon

By

Eric

By Eric Elezuo

The business of cooperatives has been taken to greater heights in Nigeria because of the top notch managerial abilities of Basorun Adebola Orolugbagbe, who sits atop the National Cooperative Financing Agency of Nigeria, the umbrella body of cooperative societies in the country. In this interview, the man reputed as always selflessly thinking about the betterment of others, speaks on the associations efforts at lifting 42 million Nigerians out of poverty among other sundry issues. Excerpts:

Could you please introduce yourself

My name is Basorun Adebola Orolugbagbe. I am the President of the National Cooperative Financing Agency of Nigeria. I am also the Founder and CEO of Coop Exchange Investment Trust and Credit Union Limited.

Before all these positions was you. Kindly tell us a little of your personality and background

I studied History and Political Science in the University of Ibadan, and graduated in flying colours in 1985. Thereafter, I proceeded to the United States of America where I studied Real Estate and Finance at Lumbleau Real Estate and Finance College inside University of California, Los Angeles (UCLA). I graduated and worked with several real estate companies including Mike Glickman Realty, Musselli Brokers, AMRIC Real Estate and finally Coldwell Banker, the largest real estate firm in the US. Afterwards, I returned to Nigerian, and established a real estate firm in Victoria, and with my background in information technology, which I obtained while I was in the US, I also established DTK Solutions in partnership with a UAE based IT company.

Well, a time came when I felt that there was a vacuum in the way we handle and practice our micro finance system in Nigeria, which everybody was seeing through the lens of the CBN, which I disagreed with, and I still do. And so, we looked for an alternative market system, and came up with the cooperative, and it enabled us to do everything we want to do under micro financing and financial inclusion. That led us to establishing Coop Exchange Investment Trust and Credit Union in 2011, and we marked our 10th anniversary earlier this year. Since then, I have risen to become the president of the National apex body for financial cooperatives in Nigeria, which is the national Cooperative Financing Agency of Nigeria, and that has been since 2012. And God willing, I should be finishing my term by 2023 and hand over to a new administration.

How did you manage to switch from Real Estate to Financing which appear to be two different industries

They are one industry. I studied Real Estate Finance, and we were involved in the finance aspect of real estate, not really property development. Of course, we got involved in property development. We noticed the vacuum for finance for those at the Bottom of the Pyramid. Finance for bottom of the pyramid involves finance for their personal uses, which include finance for their children’s school fees, payment of bills and for anything that catches their fancy. However, we also noticed that they could not get financing to purchase their homes; that’s where real estate comes in. So real estate is one thing, but to finance the purchase of the home is where the synergy comes in. I am still within that realm of finance.

In the couple of years you have been in this business, you sure must have made some achievements. Can you itemise some of the achievements made so far

Oh, we have made quite a lot. We have done tremendously well. In the first place, through our national body, we have been able to established a streamlined and sustainable process of financing for our members across board in Nigeria, with due respect to the six zones of Nigeria; North West, North East, North Central, South East, South West and South South. The north west is our weakest link though. It is such that our members are able to go through a systemised process and access finance for any of their uses. That is one. Secondly, we have also been able to establish a N100 billion National Agriculture and Investment Cooperative Fund (NAIC FUND), which caters 70 percent of agriculture and 30 percent for other uses, and our members are accessing it presently. Then, how do we come about this? Usually, the CBN will come up to tell us that they have established funds for use in Nigeria, but in the end, what we have established and found out is that our members are unable to access funds when they establishes, so we have to come up with our own innovation, and people can easily access. We have had a lot of support from Lagos State government and they have opened the road for us to do that for our members to access funds for all the five stages of the agreed value chain.

Again, we have been able to establish what we call Cooperative Banking System. This means that our members are able to use our streamlined processes to manage their various their financial cooperatives such that members are able to access loans and credit through that systemised process. That is actually referred to as FOSA (Front Office Service Activities). That is ongoing. But the topmost part of it is our ability to establish the fifth exchange in Nigeria, which is the cooperative shares exchange (CSE). Presently, we have the Nigeria Exchange Group, which was formerly called Nigeria Stock Exchange. We also have the NASDOTC Exchange, we have FMDQ Exchange and lately Lagos Commodities and Features Exchange (LCFE). Those are the four existing exchanges in Nigeria. The Abuja Commodity Exchange was established during the General Sani Abacha era, but it never saw the light of the day. So our exchange, which is dedicated to cooperatives enables cooperative societies to come and list the shares of their societies and buy into the shares of others, and so check the capital market for the cooperatives. This is what is presently ongoing. We have completed all the processes. We have also received all regulatory approvals; from NLC, Lagos State and government approved agencies for us to be able to take off before the end of the year. So these are some of the innovative we have brought into cooperative financing and which is beginning to bear fruit.

You may wish to know that the cooperative financial access in Nigeria is in excess of N2.4trn of which we have in excess of 121 thousand registered cooperative societies. Our membership base is over 42 million across Nigeria. So, we are very large. We are the single largest business entity in Nigeria across board. Not even the Nigeria Labour Congress has our numbers. And we exist in every corner, from the Federal ministry of any establishment to the central bank to the oil industry – NLNG to Total to the remotest corner such as Zungeru. Just name it, we are there. We cover the entire strata of the Nigeria economy.

Is the accessibility of loans open to only members or just anyone in need of loans and credit

Yes, it is open to just members, however, who is a member? He is anyone in the society that has opted to join.

So what are the procedures for joining

One just have to pick a society that is of interest to him and join, and once you join, that brings you into the entire fold. So in essence. what it means is that any member of the society is a potential member, and for you to be a cognitive member, you must join the society. For example, if you want to do business with any bank, they will tell you to open an account. Opening an account means that you have a relationship with that financial institution, so it is the same time in cooperative. What you need to do is complete a membership registration process, and once done, you become a member.

Does it attract registration fee and other sundry fees like monthly dues

More oftentimes in cooperative societies, one has to pay registration and monthly fees, membership and development levies. One has to attend meetings and decide how much you wish to contribute on a monthly basis in terms of savings, which of course gives you access to either twice or thrice the amount of savings you have contributed whenever you want to borrow money. What it does really is that it encourages members to save money because of the rainy day. And most importantly, one is able to access credit whenever he needs money to do anything in the future.

Out of the 121 active cooperative societies in the country today, what special features will make me choose Coop instead of any other

Well, basically like any other thing; it is service and what you get in return, and then the assurances of your investments in the cooperative society. When we talk about investments, we mean your main savings, and you want to be sure that at the end of the day, whatever amount of money you saved in the society is save. And if you wish to apply for credit facility, you will be able to access the credit facility. So, that is what makes the difference. And we run ours in a professional manner than any other society. I make bold to say with all due respect to most of us that are in cooperative that regulation is still very weak within the cooperative sector. So for a society to keep to the tenets of financial regulation means that the society has actually chosen to remain on the side of probity. That is very important to us, and we have kept to that on since 2011 when we began operation. This is our 10th year, and we have been waxing strong.

Our focus is not even on us as the secondary society. The focus is on the national body where I preside over and runs affairs of things across the entire country. So, what we chose to do is to ensure that the processes of managing the activities of the cooperative societies has sustainable effect on the lives of the average persons across Nigeria. Remember we have 42 million members in Nigeria. So what it means in essence is that if I am affecting even 50 percent of the members, which is 21 million members; the total number of voters we have at every given election is less than 30 million, so you can equate us as a cooperative apex with that of a government in Nigeria. So, the truth of the matter is that we are a pseudo government, affecting the lives of our members positively.

Does it mean you can be a pressure group, and are you taking advantage of that

Correct! That is what we want to take advantage of now.

How soon

We have been working on it. We didn’t just start yesterday. We have been working on it as far back as 2013, and this is 2021. That is some good eight years that we have been on it. We believe that we should be able to have a say on who becomes the president of this country. And God willing, by 2023, we want to make sure that happens.

Economically, controlling 42 million Nigerians, can we say you have what it takes to lift 20 percent of Nigerians out of poverty

That is correct. We do as an institution, not in my person. But the institution of the cooperative – the movement – going by our capacity, yes, we do have what it takes to lift 20 percent of Nigerians out of poverty.

What is the response of members in terms of contribution and maximizing the opportunity to access loans, and how are the loans collected monitored to ensure prompt payback

Oh yes. You see, lending and credit, across board, has similar characteristics. When you want to lend, you must conduct due diligence on the borrower to know if he has the capability to repay. If he does, what is the source of the repayment? What is the credibility of the borrower, and then are we going to collateriase the loan? There are different ways to look at all these. They have similar characteristics across board whether it is GTB, Access or World Bank. There are lending characteristics, and we are not any different. Except that we have buyers for cooperative lending. This has its own peculiar characteristics that extend further than the normal lending characteristics e.g our lending is also based on trust. The trust content of it means that there must be two members within the cooperative that are standing as guarantors to the borrower. Meanwhile, those two guarantors must have their assets with which the cooperative will place a lien on. Then they will be able to access some credit. Which ever way, it is a win-win situation for both; lender and borrower.

Without mentioning names, can you give instances of those who have changed their lives positively through society borrowings

It is rather difficult not to mention names. However, it goes beyond the length and breadth of the cooperative lending movement. We talk about NLNG, Dangote Group and many others. This is what they do basically – For instance, we have NNPC cooperative wanting to set up a poultry farm in Kogi and needed to invest N1 billion. The One Billion was borrowed from a financial institution, but security for the lending was given by a cooperative movement. And they were able to service that, and the project is still existing in Kogi State even now for fish farming. There are so many; it cuts across the country. That is one of the key components of what we are happy to have achieved.

Don’t you have issues with the banks in the cause of your duties as regards taking their customers from them

Yes, there is. They fight us, but they cannot succeed. There are two key reasons why. Number one: the money that we lend to ourselves is sourced from within ourselves. Number two: all of the money are domiciled in these commercial banks because of the existing structure. So it is a win-win situation. It is very difficult for them to say we cannot lend to one another our own money. At the end of the day, we came to understand that we don’t have to see ourselves as competitors, but collaborators. And that is how we are surviving now.

Is there any law backing the establishment of cooperative societies

Yes, there are laws. The laws are on the Recurrent Legislative List of the Nigerian Constitution. They have what they call Nigerian Cooperative Societies Act 2004 Cap 98 Laws of the Federation of Nigeria. It was converted from the Decree 90 of 1993 and its Subsidiaries. And every state of the Federation plus the FCT has an adaptation of the Nigeria Cooperative Societies Act as the state cooperative laws which derives its powers from the Federal law. That is how we operate. It explains the reasons we are registered either by the office in the states or the office of the Federal Director of Cooperatives under the Federal Ministry of Agriculture and Rural Development, which is the chief regulator of cooperatives in Nigeria.

Basically, the activities of the Cooperative Societies are legit

Yes, fully legit. It is not like that in Nigeria alone, it is the same thing worldwide. Now, let me explain that the cooperative has six chaired level in the entire world. Four levels in Nigeria, and two worldwide. One – the primary societies, which we join as members. Two – secondary societies, which is made up of registered primary societies as members. We have state apexes and the national apex of which I am the national president. Those are the four levels in Nigeria. The fifth level is the African region, ACCOSCA, African Confederation of Cooperative Savings and Credit Associations, and then the World level, WOCCU, World Council of Credit Unions based in Wisconsin in the US. It is the same system across the world.

What advice do you have for those not members of the Cooperative societies yet

The advice is simple: join. Look for a cooperative society to join because a lot of things are happening in the societies now. This is the place where you can have access to the cheapest source of finance. I make bold to say that where your bank is charging you as high as two percent per month on your loan or credit, which gives about 24 percent per annum, cooperative will charge you not more half. You don’t have to deal with the issues of finance charge, procession charge, residence charge etc. You are better off with a cooperative society.

How did you come about your bashorun title

I am the Bashorun Adorun of Ayede Kingdom in Ekiti State. Ayede is one of the seven recognised old kingship institutions in the whole of Ekiti State. So, I am honoured to be a title holder for Ayede kingdom. I have been since 2009.

What is your marital status

I am married with very beautiful children and very lovely home

How do you relax

I read, and spend time with friends and family. I also love traveling. More importantly, I go through what is going on in the world of cooperatives with a view to discovering how to better the Nigerian cooperative societies, and that gives me a lot of joy.

Of all the countries you have travelled to, which of them left a more lasting memories in you

For me, it is South Africa. It is somehow in-between the European world and us, Africans. Whenever I am there, I feel like I am in a developed environment within the African context because I am fully African. I have been to a lot of places, but South Africa is it for me.

What is your favourite colour

I am very comfortable in white colour though one don’t get to wear white all the time. I love my traditional attires most especially. I wore foreign attire for the better part of my career, now at almost 60, I think I have to stick to traditional.

Related

You may like

Boss Of The Week

Prof Jide Owoeye: When a Distinguished Academic Turns 70

Published

3 days agoon

February 28, 2026By

Eric

By Eric Elezuo

It was a gathering of distinguished egg heads, prolific intellectuals and ardent academics at the Adeline Hall of the Lead City University, Ibadan, when notable and celebrated Chairman of Council and Pro-Chancellor of the Institution, Professor Jide Owoeye, marked his entry into the septugenarian circle.

The event, a multiple-in-1 classic, featured tribute session, a panel session, books presentation and reading as a well as a defined colloquium. Among topnotch individuals that graced the event were delectable heads of higher institutions of learning including the Vice Chancellor, Edo State University, Uzairue, Sheldrake O. Akindele; the Vice Chancellor, Chrisland University, Abeokuta, Oyedunni S. Arulogun; Vice Chancellor of Crescent University, Abeokuta, Ibrahim Gbajabiamila, and the Deputy Vice Chancellor, Ajayi Crowther University, Oyo, Muyiwa Popoola, who were members of the panel session that discussed critical mechanisms that enhance and safeguard the future of education in the country.

The panelists leveraged on the theme, Nigeria Higher Education and Private Sector Involvement: Navigating the Path, Confronting the Challenges, Exploring Opportunities for the Future. The lead discussant was the Vice Chancellor, Federal University, Katherine, Gombe State, Umaru Pate.

Speaker after speaker, the academic giants celebrated the unequaled legacies of Prof Owoeye’s 70 years of impressive existence, especially his scholarly contributions to the standardization of not only learning, but also academic environment in Nigeria with the establishment of Lead City University in 2005.

The ceremony was punctuated with various genres of entertainment including cultural dances, touch of saxophone, talking drum display, drama presentation by students of the institution, and a host of others.

Among the books presented at the ceremony were Asia in World Politics and Knowledge in the Emerging Global Order.

The highpoint of the gathering was the cutting of the birthday cake with various presentations of full size portraits and other gifts items from colleagues, students and staff.

Othe dignitaries who graced the occasion were Chairman, Ovation Media Group, Chief Dele Momodu, General Secretary, Pan African Writers Association (PAWA), Wale Okediran, Oyo State Commissioner of Lagos among others.

Speaking on his achievements, a long time friend from the University of Ife days, Chief Momodu, noted that Prof Owoeye has always been a man of letters, who has carved a niche for himself, adding that Nigeria and Africa are proud of him.

Distinguished in every ramifications, and an authority in International politics and relations, with bias to Asia, Owoeye has transverse all areas and degrees of the academic environment, terminating at the professorial level, and capping it all with the establishment of topnotch private university as the icing on the cake of his academic pursuit and inclination. He boasts of bachelor’s, masters and doctorate degrees in different fields of international studies.

For Owoeye, reaching the peak of his profession was when he became a professor of International Relations at OAU in the year 2000.

Born on March 1, 1956, Prof. Jide Owoeye is a teacher, and a very proud one at that, who would not miss any opportunity to introduce learning and exchange of knowledge. That practically explains why his 70th birthday celebration was tailored towards a colloquium and book presentation status.

Owoeye began his schooling at the OLMC Demonstration School, Ibadan, where he spent the period between 1962 and 1967 acquiring elementary or foundational knowledge of education.

Afterwards in 1968, he attended Olivet Baptist High School, Oyo, for his school certificate, and left in 1972 before attending Government College Ibadan, for his Higher School Certificate, from 1973 to 1974.

He was admitted into the University of Ife, now Obafemi Awolowo University, for his first degree.

On graduation, he was employed as Insurance Officer at Akin George & Company, Lagos, as he decided to try his hands in circular career. His stint at the firm lasted between 1979 and 1980.

Thereafter, he made a daring turn into the word of teaching, becoming Lecturer II at the Department of Government, OSCAS, Ile-Ife, from 1980 to 1982. He briefly worked as Administrative Officer at the Obafemi Awolowo University, Ile-Ife, afterwards in 1983 before landing the position of Senior Lecturer at the Department of International Relations, Obafemi Awolowo University.

Then, there was no turning back from the academic world. He was made a Visiting Senior Research Fellow at the Nigerian Institute of International Affairs, Lagos, from 1992 to 1993, and then, Associate Lecturer, Foreign Policy Academy, at the Ministry of Foreign Affairs, International Centre for Asian Studies.

In a 2019 interview he granted The Punch, Owoeye noted as follows as to what propelled his desire to establish his own university: “I have been in the university system for almost 37 years and 24 of those years were spent in the public university system. I was a professor at the Obafemi Awolowo University, Ile Ife, Osun State, and I noticed then that if one has passion for education, one should have seen some of the lapses (in the system), and some of those lapses one discovered can only be corrected if one is the head of the institution. I believe if you aspire to have a better university system, it is either you head the institution or you look for avenues to help create one where you can impact upon. That was what brought about the passion to work towards establishing a private university where the quest for excellence can actually be attained.”

Owoeye’s rich trajectory in the world of education is common knowledge, leading to his hold several high-profile positions in Obafemi Awolowo University.

Owoeye is married to his lovely wife, Emuleomo, whom he wedded in 1982, and they are blessed with three children; a son and two daughters.

Meanwhile, a special birthday soiree has been scheduled for March 1, his day of turning 70 proper, at Adeline Hall of the university. It promises to be the mother of all celebrations.

Having spent a lot of energy paying attention to education, Owoeye would love to be remembered as somebody who contributed to quality education (at the tertiary and non-tertiary levels) in this country.

Happy 70th birthday sir!

Photos: Tunde Bolarinwa

Related

Boss Of The Week

Kojo Bonsu: Creating Ghana’s New Investment Face in China

Published

2 weeks agoon

February 15, 2026By

Eric

Schooled in varioius areas of human endeavour and administration, Mr Kojo Bonsu is an asset, not only to the Republic of Ghana, but the world in general. He has by every standard paid his dues to the development of his country, serving as the current Ambassador to the Peoples Republic of China, and having served in many other diverse areas including sports administration and entrepreneurship.

Presently, the face of the Republic in China has taken it upon himself to recreate the investment platform of Ghana in China, mandating the media to begin as a matter of urgency, to make Ghana the subject of focus in their reporting.

In other words, the Ambassador has appealed to the Chinese media to use their medium to promote Ghana. A call that resonate the general mantra of the government of President John Dramani Mahama

According to Bonsu, Ghana boasts of several business opportunities, therefore if the Chinese media take keen interest in Ghanaian issues, it would help attract investors from China to Ghana.

He insisted that the door of the Ghana Embassy in China is wide open to Chinese journalists, especially those who want to positively project Ghana.

Bonsu made the remarks while hosting a press soiree in Beijing, on behalf of the Ghana Embassy, which was graced by a number of prominent media institutions in China.

The programme was mainly used to promote Ghana’s upcoming 69th independence anniversary celebrations and also highlight investent opportunities in the country.

Kojo Bonsu, who is a former Kumasi Mayor, said Ghana is the safest, friendly and best country for any investor to do business, urging Chinese businessmen to heed his advice.

“The Chinese media institutions should henceforth partner with the Ghana Embassy in promoting trade and investment opportunities in both of our sister countries for growth.

According to him, Ghana is a democratic nation, which has conducive atmosphere for businesses to flourish, stressing his desire to work and improve Ghana-China relations.

“Ghana is committed to strengthening ties with China. My country is a stable democracy, has business-friendly environment and rich cultural heritage,” Kojo Bonsu stated.

A native of Offinso, a town in the Ashanti Region of Ghana, Michael Kojo (Mensa) Bonsu, thoroughbred professional, both in politics and administration, was born to a respected Offinso Queen Mother and a military officer, among eight other siblings.

He had his Ordinary Level education at the Tamale Secondary School, between 1974 and 1979, where he developed the knack, desire and dream of becoming a football administrator.

Thereafter, he was admitted into the Drayton School in London, but could not immediately assume studies because of the several businesses he was handling at the time. However, between 1985 and 1990, when Bonsu joined giant sports kit manufacturers, Adidas, he enrolled into their football Business Unit at Herzogenaurach, Germany, and in the process obtained a Diploma in Sports Business and Marketing. Presently, he holds a Master’s Degree in International Relations.

After completing his training in sports Business and marketing, Bonsu worked with Adidas and became their first representative in West Africa and served as an Assistant Marketing Officer. He rose to become the kit maker’s manager in Ghana and the whole of West Africa. Within which period he brokered deals between the company and the Ghana football Association specifically the Ghana football national team.

Bonsu’s dexterity in all the things he has laid his hands, including the oil sector, on earned him a citation of honour in 2015 by Managing Director of GOIL, Mr Patrick A.K. Akorli as follows; “You were the key advocate on the board when the monumental decision to rebrand GOIL was taken – the results of which have seen GOIL being propelled to the number one position (retail) among oil marketing companies in Ghana”.

He served as the Managing Director of GOIL from July 2011 to February 2012.

In addition to his legacy of achievements, Bonsu is a director of Tamale-based club Real Tamale United. He was also an executive member of Asante Kotoko.

In 2003, he launched a bid to be the Ghana Football Association’s President. He went against former president of the GFA Kwesi Nyantakyi, politician and executive member of Accra Hearts of Oak, Vincent Odotei Sowah, a former FA vice-chairman, Joseph Ade Coker and former executive council chairman, Y.A Ibrahim. He subsequently lost to Kwesi Nyantakyi in the elections in December 2005.

An ardent supporter of Asante Kotoko and Premier side Tottenham Hotspur, in 2001, he founded and published Agoo Magazine, an African lifestyle magazine.

In January 2010, Bonsu was appointed board chairman of the National Sports Authority then a council under the Ministry of Youth and Sports. He is known and respected for spearheading the re-branding of the sports council until it subsequently became a sports authority.

In 2013, President Mahama nominated him for the position of Metropolitan Chief Executive for the Kumasi Metropolitan Assembly. He resigned in July 2016, following an issue with the Kumasi Traditional Council.

Among many other landmarks, Bonsu would be remembered building the first ever recreational facility, the Kumasi Rattray Park, and organizing the second largest event as part of the celebration of Ghana at 50, dubbed “Ghana As One Gala Night” at Ghana’s Black Star Square with International artists including The Whispers, Shalamar, Pat Thomas, AB Cresntil, Gyedu Blay Amboley, Paapa Yankson and Ola Williams.

It is also on record that in 2014, he secured a loan facility from the Deutsche Bank UAE through parliamentary approval to build the largest modern market in West Africa, the Kejetia Market, called the “Kejetia Dubai,” completed in 2017. He also built the Asawase market, Tafo market, and Atonsu-Agogo market. He renovated the Kumasi Prempeh Assembly Hall. Bonsu’s strides speak volumes.

Bonsu tried his hands at the presidency of Ghana in 2024, but could not win the ticket of his party as Mahama was the preferred choice.

Bonsu continues to exhibit great strides as a distinguished administrator, businessman and political juggernaut.

Related

Boss Of The Week

Renowned Academic, Lawyer, Prof Afe Babalola, Bags PAWA’s Top Award

Published

3 weeks agoon

February 7, 2026By

Eric

By Eric Elezuo

The University community of the prestigious Afe Babalola University, Ado Ekiti (ABUAD), buzzed with renewed vigour during the end of last week, when the renowned founder, who doubled as a distinguished Academic and Legal luminary, Prof Afe Babalola, was honoured with the Pan African Writers Association’s (PAWA) top award.

Early on D-day, the 5th of February, 2026, members of the university community, media practitioners, friends and well wishers gathered at the premises of the academic landmark for the all-important conferment of the Nobel Patron of the Arts Award to the distinguished Nigerian Legal Practitioner, Educationist and Writer, Aare Afe Babalola.

The event, which took off with a tour of the gigantic and expansive setting, saw guests representing PAWA, Authors Association of Nigeria, management and staff of the university, expressing heartfelt wow at the luxury that greeted every section and department of the institution, including the medical facility and the farm. Everyone unanimously agreed that the school merits its Time Higher Education (THE) Impact ranking as at 2025 as the 84th in the world, 3rd in Africa and 1st in Nigeria.

Babalola, at 96, and who has not shown any sign of slowing down in his pursuit of rendering academic assistance and nurturing the real leaders of tomorrow through purposeful education, followed in the footsteps of other great Africans, who had been recipients of the prestigious PAWA award. Some of them are former President of Ghana Jerry John Rawlings, former President of Nigeria, Dr. Goodluck Jonathan, immediate Past President of Ghana, Nana Akufo-Addo, and former President of Somaliland, Musa Bihi Abdi.

Others are President Mahmoud Abbas of Palestine, President Ismail Omar Guelleh of Djibouti and President Abdelmadjid Tebboune of Algeria. The award, according to the leader of the delegation and General Secretary of PAWA, Dr. Wale Okediran, is reserved for top world leaders, who have contributed immensely to the development of the arts.

Lending credence to the contributions of Prof Babalola in the academic and legal world, leading to the establishment of the world class University, the crowd of attendees representing the 54-African nations strong PAWA, ANA among others, were already in the huge conference room, venue of the elaborate ceremony, before the recipient made his grand entry into the hall.

Acknowledging reverence and accolades, Babalola, who was dressed in pure white suit, with red shirt and tie to match, and complimented with his signature (white) hat, made his way to his seat, guided by the Vice Chancellor of the University, Prof Smaranda Olarinde, who momentarily anchored the event.

Other professionals, who graced the occasion with their presence were members of PAWA, ably led by Dr Okediran, members of the Association of Nigerian Authors (ANA) led by the National President, Dr Usman Ladipo Akanbi.

In her welcome address, the Vice Chancellor, Prof Olarinde, extended a hand of fellowship to the delegates, and thanked PAWA for deeming it fit to honor Prof Babalola who has distinguished himself in several areas of life especially as the Founder of a magnificent University with world class facilities.

In his opening remarks, Dr. Okediran lauded the landmarks contributions of Prof Babalola, noting that none other deserve the award at a time like this like the ABUAD founder.

The PAWA Secretary, who has served six years, with just two more years to go, noted that PAWA is not just a run-off-the-mill group, but renowned in all 54 Africa counties, with headquarters in Accra, Ghana, where the secretariat resides. He further stressed that awards emanating from the group is acknowledged worldwide.

Dr Okediran further emphasized that PAWA’s decision to honor Chief Babalola was based on his track record of scholarship, service and devotion to education and mentorship.

Among the many intimidating qualities of the recipient, is his influence in the literary world, having authored many educational and literary books, established a distinguished law firm, “Emmanuel Chambers” dating back to 1965, and also groomed an impressive array of senior members of the bar and the bench.

After his meritorious service as the Pro Chancellor of the University of Lagos, he established the ABUAD, a non profit University in 2009.

With the formalities concluded, Okediran went ahead to decorated the recipient with the golden medal of award, and complimented it with a presentation of certificate of merit as the Grand Patron of the Arts mid loud applause from the audience and a convivial atmosphere.

One of the fireside activities of the occasion was the presentation of his book, Medicine and Literature without Borders to the Vice Chancellor and the Founder. It is worthy of note that Dr Okediran is a qualified medical doctor, who diversified into literal writing. He also runs a writing retreat resort, Ebedi International Writers Residency, Iseyin, Oyo State.

Responding in a speech laced in achievement, Babalola thanked PAWA for the honour done to him, flaunting prowess in the world of awards and honours. He reiterated that he is also a recipient of nine honorary doctorates including one from his alma mater, the University of London, noting that the honor will spur him to do more for Nigeria and Africa as a whole.

The Noble Patron of The Arts Award is a prestigious recognition from the Pan African Writers Association reserved for distinguished personalities, who have excelled in their areas of endeavors.

THE MAN, AARE AFE BABALOLA SAN

Below is the life and times of the accomplished legal icon, educational mentor and philanthropist, as lifted from his personal website, afebabalola.com

Aare Afe Babalola SAN is one of the most distinguished legal luminaries of his generation, renowned both in Africa and globally for his profound contributions to the legal profession and the advancement of education. With over five decades of uninterrupted legal practice, Aare Babalola’s career is a testament to exceptional dedication, strategic advocacy, and visionary leadership.

A highly accomplished advocate, he has led some of the most celebrated cases in Nigerian legal history, representing high-profile clients, including government institutions, multinational corporations, and individuals. His advocacy spans domestic and international courts, including contributions as a consultant to the Federal Government of Nigeria, World Bank, and various conglomerates. His extensive experience includes his role in arbitration, both locally and internationally, where he remains a respected authority. Aare Babalola has appeared in numerous landmark cases, shaping Nigerian jurisprudence and establishing himself as one of the nation’s most formidable legal minds.

His influence goes beyond the courtroom. As the Founder of Afe Babalola & Co. (Emmanuel Chambers), one of Nigeria’s leading law firms, Aare Babalola has trained over 300 lawyers, including 14 Senior Advocates of Nigeria (SANs), judges, and attorneys-general, making his chambers one of the most significant contributors to the legal profession in Nigeria. His exceptional litigation skills and legal acumen earned him the prestigious title of Senior Advocate of Nigeria (SAN) in 1987, cementing his place at the pinnacle of legal practice in the country.

A renowned scholar and author, Aare Babalola has authored several authoritative legal texts, including Injunctions and Enforcement of Orders and Law and Practice of Evidence in Nigeria. His contributions to legal education extend to teaching at the Nigerian Institute of Advanced Legal Studies and delivering lectures at prestigious universities such as the University of Lagos and the University of Ibadan. His popular column, YOU AND THE LAW, published in the Nigerian Tribune, reflects his commitment to educating the public on legal matters.

Beyond his legal practice, Aare Babalola has made extraordinary strides in education. His experience as Pro-Chancellor and Chairman of the Governing Council of the University of Lagos (2001-2007) exposed him to the declining standards of education in Nigeria, spurring him to establish Afe Babalola University, Ado-Ekiti (ABUAD).

ABUAD has quickly become a beacon of academic excellence, setting new standards in Nigeria’s educational system. His efforts in education have been recognized globally, with numerous honorary degrees from universities, including the University of London, University of Lagos, and Ekiti State University.

Aare Babalola’s leadership in academia and law has earned him numerous accolades, including the Officer of the Federal Republic (OFR), Commander of the Order of the Niger (CON), and international recognition such as the Queen Victoria Commemorative Award at the Socrates Awards in Oxford, UK. He was named Africa Man of the Year on Food Security and awarded an Honorary Doctor of Management by the Federal University of Technology, Akure. His groundbreaking achievements continue to inspire generations of lawyers and leaders across Africa and beyond.

In addition to his legal and educational contributions, Aare Babalola remains a committed philanthropist and advocate for reform in various sectors. His vast experience, unmatched expertise, and unwavering commitment to excellence make him not only a legal icon but also a trailblazer in the fight for quality education and justice.

Key Achievements:

- Senior Advocate of Nigeria (SAN), 1987.

- Officer of the Federal Republic (OFR).

- Commander of the Order of the Niger (CON).

- Pro-Chancellor and Chairman of the Governing Council, University of Lagos (2001-2007).

- Founder and Chancellor, Afe Babalola University, Ado-Ekiti (ABUAD).

- Queen Victoria Commemorative Award winner, Oxford UK.

- Fellow, Nigerian Institute of Advanced Legal Studies.

- Honorary Doctor of Laws from the University of London, Ekiti State University, University of Lagos, and more

From all of us at the Ovation Media Group, we wish the revered professional many more years of accomplishments and honours.

Related

Tinubu Nominates Oyedele As Minister of State for Finance, Moves Anite-Uzoka to Budget Ministry

Defection: Atiku’s Son, Adamu, Resigns As Adamawa Commissioner

Senate Rescinds Resolution Seeking Sack of Magaji As CAC Registrar-General

Israel Declares Hezbollah Leader Marked Target

DSS Nabs Man over Assassination Attempt on Peter Obi

NELFund Extends Deadline for Student Loan Applications Nationwide

Saudi Arabia Shuts Down One of World’s Largest Oil Refinery after Iran’s Drone Strike

Prof Jide Owoeye: When a Distinguished Academic Turns 70

Many Killled, Houses Torched As Terrorists Unleash Deadly Attacks on Adamawa Communities

Iran’s Supreme Leader Khamenei Cut Off from Contact, Fate Unknown

The Oracle: Entertainment is the Next Hope for Nigeria After Oil (Pt. 2)

Opposition Parties Reject 2026 Electoral Act, Demand Fresh Amendment

Fubara Appoints New SSG, Chief of Staff

Friday Sermon: Reflections on Ramadan 2: The Taraweeh Conundrum

Trending

-

Boss Of The Week3 days ago

Boss Of The Week3 days agoProf Jide Owoeye: When a Distinguished Academic Turns 70

-

Featured5 days ago

Featured5 days agoMany Killled, Houses Torched As Terrorists Unleash Deadly Attacks on Adamawa Communities

-

Middle East3 days ago

Middle East3 days agoIran’s Supreme Leader Khamenei Cut Off from Contact, Fate Unknown

-

The Oracle4 days ago

The Oracle4 days agoThe Oracle: Entertainment is the Next Hope for Nigeria After Oil (Pt. 2)

-

Headline5 days ago

Headline5 days agoOpposition Parties Reject 2026 Electoral Act, Demand Fresh Amendment

-

News5 days ago

News5 days agoFubara Appoints New SSG, Chief of Staff

-

Islam5 days ago

Islam5 days agoFriday Sermon: Reflections on Ramadan 2: The Taraweeh Conundrum

-

Opinion3 days ago

Opinion3 days agoBeyond the Vision: The Alchemy of Turning Ideas into Execution