Boss Of The Week

We Are Lifting 42 Million Nigerians Out of Poverty – Basorun Adebola Orolugbagbe

Published

2 years agoon

By

Eric

By Eric Elezuo

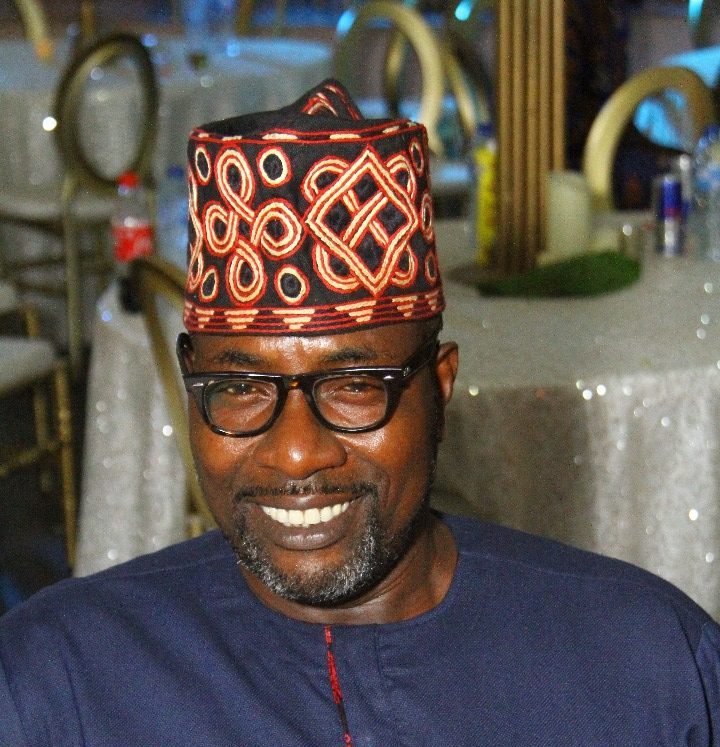

The business of cooperatives has been taken to greater heights in Nigeria because of the top notch managerial abilities of Basorun Adebola Orolugbagbe, who sits atop the National Cooperative Financing Agency of Nigeria, the umbrella body of cooperative societies in the country. In this interview, the man reputed as always selflessly thinking about the betterment of others, speaks on the associations efforts at lifting 42 million Nigerians out of poverty among other sundry issues. Excerpts:

Could you please introduce yourself

My name is Basorun Adebola Orolugbagbe. I am the President of the National Cooperative Financing Agency of Nigeria. I am also the Founder and CEO of Coop Exchange Investment Trust and Credit Union Limited.

Before all these positions was you. Kindly tell us a little of your personality and background

I studied History and Political Science in the University of Ibadan, and graduated in flying colours in 1985. Thereafter, I proceeded to the United States of America where I studied Real Estate and Finance at Lumbleau Real Estate and Finance College inside University of California, Los Angeles (UCLA). I graduated and worked with several real estate companies including Mike Glickman Realty, Musselli Brokers, AMRIC Real Estate and finally Coldwell Banker, the largest real estate firm in the US. Afterwards, I returned to Nigerian, and established a real estate firm in Victoria, and with my background in information technology, which I obtained while I was in the US, I also established DTK Solutions in partnership with a UAE based IT company.

Well, a time came when I felt that there was a vacuum in the way we handle and practice our micro finance system in Nigeria, which everybody was seeing through the lens of the CBN, which I disagreed with, and I still do. And so, we looked for an alternative market system, and came up with the cooperative, and it enabled us to do everything we want to do under micro financing and financial inclusion. That led us to establishing Coop Exchange Investment Trust and Credit Union in 2011, and we marked our 10th anniversary earlier this year. Since then, I have risen to become the president of the National apex body for financial cooperatives in Nigeria, which is the national Cooperative Financing Agency of Nigeria, and that has been since 2012. And God willing, I should be finishing my term by 2023 and hand over to a new administration.

How did you manage to switch from Real Estate to Financing which appear to be two different industries

They are one industry. I studied Real Estate Finance, and we were involved in the finance aspect of real estate, not really property development. Of course, we got involved in property development. We noticed the vacuum for finance for those at the Bottom of the Pyramid. Finance for bottom of the pyramid involves finance for their personal uses, which include finance for their children’s school fees, payment of bills and for anything that catches their fancy. However, we also noticed that they could not get financing to purchase their homes; that’s where real estate comes in. So real estate is one thing, but to finance the purchase of the home is where the synergy comes in. I am still within that realm of finance.

In the couple of years you have been in this business, you sure must have made some achievements. Can you itemise some of the achievements made so far

Oh, we have made quite a lot. We have done tremendously well. In the first place, through our national body, we have been able to established a streamlined and sustainable process of financing for our members across board in Nigeria, with due respect to the six zones of Nigeria; North West, North East, North Central, South East, South West and South South. The north west is our weakest link though. It is such that our members are able to go through a systemised process and access finance for any of their uses. That is one. Secondly, we have also been able to establish a N100 billion National Agriculture and Investment Cooperative Fund (NAIC FUND), which caters 70 percent of agriculture and 30 percent for other uses, and our members are accessing it presently. Then, how do we come about this? Usually, the CBN will come up to tell us that they have established funds for use in Nigeria, but in the end, what we have established and found out is that our members are unable to access funds when they establishes, so we have to come up with our own innovation, and people can easily access. We have had a lot of support from Lagos State government and they have opened the road for us to do that for our members to access funds for all the five stages of the agreed value chain.

Again, we have been able to establish what we call Cooperative Banking System. This means that our members are able to use our streamlined processes to manage their various their financial cooperatives such that members are able to access loans and credit through that systemised process. That is actually referred to as FOSA (Front Office Service Activities). That is ongoing. But the topmost part of it is our ability to establish the fifth exchange in Nigeria, which is the cooperative shares exchange (CSE). Presently, we have the Nigeria Exchange Group, which was formerly called Nigeria Stock Exchange. We also have the NASDOTC Exchange, we have FMDQ Exchange and lately Lagos Commodities and Features Exchange (LCFE). Those are the four existing exchanges in Nigeria. The Abuja Commodity Exchange was established during the General Sani Abacha era, but it never saw the light of the day. So our exchange, which is dedicated to cooperatives enables cooperative societies to come and list the shares of their societies and buy into the shares of others, and so check the capital market for the cooperatives. This is what is presently ongoing. We have completed all the processes. We have also received all regulatory approvals; from NLC, Lagos State and government approved agencies for us to be able to take off before the end of the year. So these are some of the innovative we have brought into cooperative financing and which is beginning to bear fruit.

You may wish to know that the cooperative financial access in Nigeria is in excess of N2.4trn of which we have in excess of 121 thousand registered cooperative societies. Our membership base is over 42 million across Nigeria. So, we are very large. We are the single largest business entity in Nigeria across board. Not even the Nigeria Labour Congress has our numbers. And we exist in every corner, from the Federal ministry of any establishment to the central bank to the oil industry – NLNG to Total to the remotest corner such as Zungeru. Just name it, we are there. We cover the entire strata of the Nigeria economy.

Is the accessibility of loans open to only members or just anyone in need of loans and credit

Yes, it is open to just members, however, who is a member? He is anyone in the society that has opted to join.

So what are the procedures for joining

One just have to pick a society that is of interest to him and join, and once you join, that brings you into the entire fold. So in essence. what it means is that any member of the society is a potential member, and for you to be a cognitive member, you must join the society. For example, if you want to do business with any bank, they will tell you to open an account. Opening an account means that you have a relationship with that financial institution, so it is the same time in cooperative. What you need to do is complete a membership registration process, and once done, you become a member.

Does it attract registration fee and other sundry fees like monthly dues

More oftentimes in cooperative societies, one has to pay registration and monthly fees, membership and development levies. One has to attend meetings and decide how much you wish to contribute on a monthly basis in terms of savings, which of course gives you access to either twice or thrice the amount of savings you have contributed whenever you want to borrow money. What it does really is that it encourages members to save money because of the rainy day. And most importantly, one is able to access credit whenever he needs money to do anything in the future.

Out of the 121 active cooperative societies in the country today, what special features will make me choose Coop instead of any other

Well, basically like any other thing; it is service and what you get in return, and then the assurances of your investments in the cooperative society. When we talk about investments, we mean your main savings, and you want to be sure that at the end of the day, whatever amount of money you saved in the society is save. And if you wish to apply for credit facility, you will be able to access the credit facility. So, that is what makes the difference. And we run ours in a professional manner than any other society. I make bold to say with all due respect to most of us that are in cooperative that regulation is still very weak within the cooperative sector. So for a society to keep to the tenets of financial regulation means that the society has actually chosen to remain on the side of probity. That is very important to us, and we have kept to that on since 2011 when we began operation. This is our 10th year, and we have been waxing strong.

Our focus is not even on us as the secondary society. The focus is on the national body where I preside over and runs affairs of things across the entire country. So, what we chose to do is to ensure that the processes of managing the activities of the cooperative societies has sustainable effect on the lives of the average persons across Nigeria. Remember we have 42 million members in Nigeria. So what it means in essence is that if I am affecting even 50 percent of the members, which is 21 million members; the total number of voters we have at every given election is less than 30 million, so you can equate us as a cooperative apex with that of a government in Nigeria. So, the truth of the matter is that we are a pseudo government, affecting the lives of our members positively.

Does it mean you can be a pressure group, and are you taking advantage of that

Correct! That is what we want to take advantage of now.

How soon

We have been working on it. We didn’t just start yesterday. We have been working on it as far back as 2013, and this is 2021. That is some good eight years that we have been on it. We believe that we should be able to have a say on who becomes the president of this country. And God willing, by 2023, we want to make sure that happens.

Economically, controlling 42 million Nigerians, can we say you have what it takes to lift 20 percent of Nigerians out of poverty

That is correct. We do as an institution, not in my person. But the institution of the cooperative – the movement – going by our capacity, yes, we do have what it takes to lift 20 percent of Nigerians out of poverty.

What is the response of members in terms of contribution and maximizing the opportunity to access loans, and how are the loans collected monitored to ensure prompt payback

Oh yes. You see, lending and credit, across board, has similar characteristics. When you want to lend, you must conduct due diligence on the borrower to know if he has the capability to repay. If he does, what is the source of the repayment? What is the credibility of the borrower, and then are we going to collateriase the loan? There are different ways to look at all these. They have similar characteristics across board whether it is GTB, Access or World Bank. There are lending characteristics, and we are not any different. Except that we have buyers for cooperative lending. This has its own peculiar characteristics that extend further than the normal lending characteristics e.g our lending is also based on trust. The trust content of it means that there must be two members within the cooperative that are standing as guarantors to the borrower. Meanwhile, those two guarantors must have their assets with which the cooperative will place a lien on. Then they will be able to access some credit. Which ever way, it is a win-win situation for both; lender and borrower.

Without mentioning names, can you give instances of those who have changed their lives positively through society borrowings

It is rather difficult not to mention names. However, it goes beyond the length and breadth of the cooperative lending movement. We talk about NLNG, Dangote Group and many others. This is what they do basically – For instance, we have NNPC cooperative wanting to set up a poultry farm in Kogi and needed to invest N1 billion. The One Billion was borrowed from a financial institution, but security for the lending was given by a cooperative movement. And they were able to service that, and the project is still existing in Kogi State even now for fish farming. There are so many; it cuts across the country. That is one of the key components of what we are happy to have achieved.

Don’t you have issues with the banks in the cause of your duties as regards taking their customers from them

Yes, there is. They fight us, but they cannot succeed. There are two key reasons why. Number one: the money that we lend to ourselves is sourced from within ourselves. Number two: all of the money are domiciled in these commercial banks because of the existing structure. So it is a win-win situation. It is very difficult for them to say we cannot lend to one another our own money. At the end of the day, we came to understand that we don’t have to see ourselves as competitors, but collaborators. And that is how we are surviving now.

Is there any law backing the establishment of cooperative societies

Yes, there are laws. The laws are on the Recurrent Legislative List of the Nigerian Constitution. They have what they call Nigerian Cooperative Societies Act 2004 Cap 98 Laws of the Federation of Nigeria. It was converted from the Decree 90 of 1993 and its Subsidiaries. And every state of the Federation plus the FCT has an adaptation of the Nigeria Cooperative Societies Act as the state cooperative laws which derives its powers from the Federal law. That is how we operate. It explains the reasons we are registered either by the office in the states or the office of the Federal Director of Cooperatives under the Federal Ministry of Agriculture and Rural Development, which is the chief regulator of cooperatives in Nigeria.

Basically, the activities of the Cooperative Societies are legit

Yes, fully legit. It is not like that in Nigeria alone, it is the same thing worldwide. Now, let me explain that the cooperative has six chaired level in the entire world. Four levels in Nigeria, and two worldwide. One – the primary societies, which we join as members. Two – secondary societies, which is made up of registered primary societies as members. We have state apexes and the national apex of which I am the national president. Those are the four levels in Nigeria. The fifth level is the African region, ACCOSCA, African Confederation of Cooperative Savings and Credit Associations, and then the World level, WOCCU, World Council of Credit Unions based in Wisconsin in the US. It is the same system across the world.

What advice do you have for those not members of the Cooperative societies yet

The advice is simple: join. Look for a cooperative society to join because a lot of things are happening in the societies now. This is the place where you can have access to the cheapest source of finance. I make bold to say that where your bank is charging you as high as two percent per month on your loan or credit, which gives about 24 percent per annum, cooperative will charge you not more half. You don’t have to deal with the issues of finance charge, procession charge, residence charge etc. You are better off with a cooperative society.

How did you come about your bashorun title

I am the Bashorun Adorun of Ayede Kingdom in Ekiti State. Ayede is one of the seven recognised old kingship institutions in the whole of Ekiti State. So, I am honoured to be a title holder for Ayede kingdom. I have been since 2009.

What is your marital status

I am married with very beautiful children and very lovely home

How do you relax

I read, and spend time with friends and family. I also love traveling. More importantly, I go through what is going on in the world of cooperatives with a view to discovering how to better the Nigerian cooperative societies, and that gives me a lot of joy.

Of all the countries you have travelled to, which of them left a more lasting memories in you

For me, it is South Africa. It is somehow in-between the European world and us, Africans. Whenever I am there, I feel like I am in a developed environment within the African context because I am fully African. I have been to a lot of places, but South Africa is it for me.

What is your favourite colour

I am very comfortable in white colour though one don’t get to wear white all the time. I love my traditional attires most especially. I wore foreign attire for the better part of my career, now at almost 60, I think I have to stick to traditional.

Related

You may like

Boss Of The Week

Prisca Ndu: Celebrating the Amazon of Enterprise at 50

Published

7 days agoon

April 27, 2024By

Eric

By Eric Elezuo

In just five decades, a woman that can easily be described as valour, has conquered the entrepreneurial stage, drawing accolades of great tidings, victory and transparent effect on humanity. She is known by many appellations, sobriquet and appendages including flower girl, corporate juggernaut, go-getter, among many others. She is Dr. Priscilla Ndu, known and addressed simply as Prisca by friends, associates, colleagues and family members.

Prisca has proved herself an amazon, a stressless survivor in a world full of challenges, where only the fittest are given the opportunity to thrive and hold their heads high. Her features are a combination of positive curiosity, focus, determination, an eye for details, painstaking and never-say-never attitude.

A former Executive Director at the Resolution and Restructuring Company Limited (a subsidiary of the Assets Management Corporation of Nigeria, AMCON), among many other high profile portfolios she had represented at the establishment, Prisca has exhibited distinct characters that have accelerated her excellence irrespective of challenges. She has given nothing to chance to ensure that even in the world assumed to belong to men, she has remained quite visible, and has demonstrated a level of steadfastness and commitment typical of the managerial and entrepreneurial investments she consciously injected into her career and self.

From the early days as a research analyst to becoming a Laboratory analyst at Global Environmental Consultants, Warri and Nigerian Eagle Floor Mills, Ibadan, she has remained diminutive and indefatigable. Today, she is a renowned technocrat and an icon, having traversed and the conquered the competitive waters of banking, advertising, aviation, logistics and more.

Born on April 28, 1974, to a medical and religious practitioner-father, Dr Marcus O. Ndu, who doubles as a humanitarian; and a caterer and businesswoman-mother, Mrs. Veronica Ndu, Prisca came as the fourth child of a family of seven, comprising five beautiful ladies and two handsome gentlemen. It is imperative to note that her brothers were born after her, and this in no small measure affected her tomboyish outlook to life while growing up.

It is also imperative not to undermine the fact she was brought up under strict tutelage, instruction and discipline of the Christianity doctrine, which is the hallmark of her family’s faith.

Highly privileged, Prisca relishes the euphoria of dual origin, having been born in Lagos and being a native of Arochukwu L.G.A, in Abia State, where both her father and mother come from.

“My father was a native of Arochukwu L.G.A of Abia State, same for my mum, who was also a native of Abia State (by her maternal lineage), while her father was a Brazilian National, from Sao Paolo, Brazil, both late now,” she informed.

A very gifted and brilliant child, Prisca completed secondary education at the tender age of 14, having spent only five years in Kindergarten, Nursery and Primary Schools, skipping primaries 2 and 4, in the bargain.

She said: “I had a flawless Junior Secondary School result of Seven A’s and was awarded the Elite scholarship from my community, a feat I repeated in my Senior School Certificate of Education, with Seven As, and an A1 in my favorite subject, Physics.” This is a clear attestation to her great academic prowess right from day one, and an indication of the great woman she was destined to be.

Dr Ndu, over the years, has acquired an intimidating resume, which is a product of her desire to continuously garner knowledge. This quest, without mincing words, took her through some of the best institutions of learning in the world, where her skills and world view were sharpened.

After her secondary education, Prisca attended the foremost University of Ibadan, where she studied Biochemistry at the Faculty of Medicine. She was to proceed afterwards to the Lagos Business School for an Executive MBA honours.

And like a typical tigress hungry for academic and professional honours, Prisca has attended several management programmes, in schools within and outside the shores of Nigeria. Some of such schools are IESE in Barcelona; INSEAD Business School in Abu Dhabi, United Arab Emirate; National University of Singapore Business School, Singapore; IMD, Switzerland, Antai College of Business and Management, Shanghai and Harvard Business School, Boston, USA. She maintains a healthy Alumni relationship with all these institutions of high academic and professional studies.

An egghead of monumental quality, she sits on and atop Boards of several companies including as Executive Chairman and Infrastructural Development, Stratevium Technology Services Limited, and as Vice Chairman, Energy Company Limited. Stratevium is an Information Technology and Education solutions provider, with focus on gamified learning for Junior and Senior Secondary pupils (GIDI Mobile EDU Program) and specific content development for both private and public sector organizations, like Central Bank of Nigeria (capacity development training for beneficiaries of the CBN’s creative industry fund), Pharmaceutical Industry capacity training for beneficiaries of the CBN Intervention Fund, Content and Capacity Development for Bank’s Credit customers (Keystone Bank and Access Bank) etc., and creating products for telecommunication companies like GLO, MTN; to guarantee customer loyalty and brand visibility.

Her presence in the banking world looms large, as she traversed the terrain and rose to become Head, Public Projects at the Bank PHB where she was charged with managing and ensuring adequate financial support for major contractors to the three tiers of government, providing them financial services and working closely with State Treasury Offices and Office of the Accountant General of the Federation.

She is until 2023 the Treasurer of Harvard Business School Association of Nigeria, HBSAN, but still to date the Treasurer and Board member of the Harvard University Alumni Association of Nigeria. In addition, she is the current President of the Lagos Business School Singapore Club, “Social Minister” of the Lagos Business School, Shanghai Club and also the past “Social Minister” of the Lagos Business School EMBA 11 Class.

Prisca is highly active; a metaphor for workaholism.

She is a Fellow of the Institute of Credit Administration, ICA, a Fellow of the Institute of Management Consultants and a certified Management Consultant professional, a lifetime Member of the Institute of Directors, IOD, and a member of the Chartered Institute of Bankers, Nigeria, CIBN.

She is not just in active service, she has garnered a lot of laurels to show for her eye to details attitude, painstaking attribute to delegated descriptions and much more.

Consequently, she has won the “Subarctic Survival Situation Exercise” conducted at the Harvard Business School, beating 135 participants drawn from 47 countries across the globe. She made history as the first African to win the honours, projecting the much advertised Nigerian can-do-spirit.

In recognition of her sacrifices for the betterment of humanity, the United Nations named her as one of the 100 Most Influential People of African Descent, Globally. The award was also in recognition of body’s celebration of people of African Descent below the age of 40 (by January 2015), doing exceptional things to develop Africa.

Much as the ebullient doctor is surrounded with human oriented achievements, she is looking far ahead into the future for mega discoveries to wow human race. She has confided in as many that has paid heed that her plans for the future is hinged on building a world conglomerate, with activities in at least five major sectors of the economy, employing at least 1,000 people across all its subsidiaries, and having intimidating presence in at least five G8 countries.

Not a woman who stumbles on chances, Prisca has a distinct plan to retire to academic world at 65 (exactly 15 years from now), to disseminate all she learnt over the years with a view to impart mankind; the Lagos Business School, where she had been invited severally to participate as an associate lecturer and guest speaker, appears a sure bet as her launching pad. These opportunities, according to her, has shaped who she is today, and sees herself playing a major role in Nigeria’s infrastructure space, as she still looks forward to roles in the public sector. She does not in any way takes them for granted.

A typical Jack of all trades, Prisca has her hand in almost every pie she comes across. These include Aviation, Oil and Gas Services, Advertising, Banking and Financial Services industries, both in the Private and Public sectors.

While at the Asset Management Company of Nigeria (AMCON), where she performed the role of Head Partnerships in AMCON, she singlehandedly put together the Asset Management Partners initiative in 2016, involving over 6,000 accounts, with balances below N100m, which was outsourced to these AMPs, engaged and trained to act in AMCON’s stead, in recovering bad loans and also turning the businesses around where possible.

This was extended in 2017 to cover accounts with balances between N100 million and N1 billion. Given that AMCON is not in perpetuity, it is the hope of the corporation that these AMPs will continue to offer the services AMCON currently does and support the banks in the area of debt restructuring and recovery. Today all of AMCON’s operations is structured around this initiative she put together, even though she is no longer in its employment, but her legacy lives on. She is known to have recorded her most achievements while on this beat.

When you talk about women or entrepreneurs that don’t take no for answer, Dr. Ndu is it. She is a very independent, foresighted, goal-oriented, focused and reputed to never fear any challenge. Above all, she is very adventurous and daring, and that contributed in her ability to discover and open new vistas as well as explore new horizons.

Her towering status over the entrepreneurship world notwithstanding, Prisca is a wonderful family woman, tending with zeal, humanity, gusto and panache to the emotional and physical needs of her home. As a lover of the academia, she has not spared any expense to give her adorable son, Charly, who forms an integral part of her pastime, the best of education. Charly, who wishes to be an Astronaut, has been pursuing a career in Aerospace Engineering, at the EmbryRiddle Aeronautical University, Daytona Beach, Florida, USA.

Addressed variously as Ph.D, DBA, DLM, FIoD, FICA, FIMC, CMC, CCFE, Dr. Ndu sees herself as a social impact advocate and a multi-sector entrepreneur, who has led turn-key economic and social development projects both at Federal and state levels in Nigeria.

Dr Ndu’s social corporate responsibility is as large as her personality. She is actively involved in charity work, empowering the youths and advancing the lot of the nation through the Rock Foundation, powered by the House on the Rock Church, Gemstone Management Development Centre, Lagos, Nigeria, Harvard Business School Association of Nigeria, where she is an active Board member.

A boardroom guru, she also sits on the Board of other companies, including Harvard Business School Alumni Association of Nigeria, as Financial Secretary and Treasurer, Skywise Group as Board Member and Mshel Homes Limited, Abuja, also as a member of its vibrant Board.

At the HBSAN, she is helping to champion the mentorship programme of the association, providing mentorship, guidance and career counseling to members of the Harvard University Alumni body in Nigeria.

“This is a role I also play with the Lagos Business School Alumni Association mentorship program, and a host of others. My passion for social service is seen in the various Board roles I occupy both paid and unpaid,” she concluded.

In her continuous quest to aquirre knowledge, she has recently attended the Guardians of the Nation International (GOTNI), top 50 African CEOs Leadership Roundtable, where she was elected as Vice Chairman of its Governing Council and the Vice Chairman of the Governing Council of the African CEOs Leadership Roundtable, organized by the Guardians of the Nation International, GOTNI Leadership Institute.

She is also an active member of the NESG Finance Committee. She is also a founding board member of the Black History and Lifestyle awards, where she supports the founder and visionary leader, Eziada, Chief, Mrs. Folashade Balogun. BHLA is an initiative set up to recognize Africans globally, doing great things in the continent and abroad, and the next event comes up in Los Angeles, USA, in June 2024.

Prisca is a symbol of that all round and complete woman, whose stock in trade is the best, the best and the best.

Indeed, at 50, Prisca has so much to celebrate, including without equivocation, the exceeding mercies of God.

Congratulations ma!

Related

Boss Of The Week

Done and Dusted: Adesola Adeduntan’s Eight Years of Stardom at FirstBank

Published

2 weeks agoon

April 20, 2024By

Eric

By Eric Elezuo

Like a bolt out of the blues, the news of the resignation of the Managing Director and Chief Executive Officer of First Bank of Nigeria Limited, Adesola Adeduntan, hit the media space on Saturday, April 20, 2024.

The shocking announcement took the financial world by storm, and creatwd diverse questions in the mouth of observers and stakeholders, especially as the Veterinary Medicine graduate-turned-financial guru still has about months before the expiration of his three terms tenure. He was due to retire in December 2024.

“I have however decided to proceed on retirement with effect from 20 April 2024 to pursue other interests,” he said in his resignation letter that has become a topical issue.

But of more importance is that Sola, as he is fondly called, who took over from Bisi Onasanya in January 2016, has held sway as FirstBank’s top shot for eight years and four months, and has verifiable achievements to show for his years of stewardship, which has catapulted him to stardom today.

For a start, only a few persons would believe that the indefatigable financial expert, Adesola Kazeem Adeduntan is just 54 years old. He will be 55 on May 7, 2024. This is as a result of the achievements that have trailed his young life. Adeduntan has bagged an international award as Distinguished Alumnus of the Year by his Alma mater, Cranfield School of Management, United Kingdom. And this was at the time FirstBank was named biggest mover of 2019 according to KPMG Report. It is not incorrect to say that Adeduntan’s tenure at FirstBank was dedicated to creative achievement.

As the first quarter of 2020 was winding down, he was a guest lecturer at the Edinburgh School of Business where he spoke authoritatively on financial institutions’ role as drivers of financial inclusion.

On September 11, 2020, Adeduntan, added additional feather to his cap when he was bestowed with the Forbes Best of Africa award by Forbes Africa in conjunction with Foreign Investment Network (FIN) for his contributions to the financial services sector in the country and the African continent. He wasn’t a stranger to awards.

An all rounder, he practically conquered every endeavour he found himself in, leading the FirstBank group to a height only imaginable as the bank recently marks 130 years of uninterrupted banking. It would not be forgotten in a hurry that a media intelligence report presented by P+ Measurement Services, placed Adeduntan atop the list of most prominent and reputable Nigerian banking CEOs in Q2 2020.

THE MAN, ADESOLA ADEDUNTAN

Born Adesola Kazeem Adeduntan on May 7, 1969, in Ibadan, Oyo State, the banker started his early education at Ibadan Municipal Government Primary School (IMG), Adeoyo between 1975 and 1981, for his primary education before proceeding to Urban Day Grammar School, Old Ife Road, Ibadan, where he had his secondary schooling. His excellent to duties created a space for him to become the Deputy Senior Prefect in his final year in 1986.

In the same year, he was admitted to the University of Ibadan in to study Veterinary Medicine, and qualified in 1992 as a Veterinary Surgeon, a profession he hardly practiced before switching over to financial management.

Consequently, in 1994 he joined Afribank (Nig) Plc., and was posted to the Ibadan Main Branch as a graduate trainee. He spent 18 months there learning the ropes, and working in various areas of banking operations including cash management, clearing, credit risk management, and foreign operations.

Between September 1995 and May 2002, Adeduntan worked with Arthur Andersen Nigeria, rising to become manager in the firm’s financial services industry business, leveraging on the 18 months mentorship he received at Afribank. In this role, he led and managed the statutory audit of a number of leading Nigerian banks.

In August 2000, he served as an instructor at the Andersen World-Wide Induction training for new hires in Eindhoven, the Netherlands. He also served as the lead instructor for the Local Office Basic Accounting Training and Induction course in 1999. It was while he was with Arthur Andersen that qualified as a chartered accountant in 2000.

With more feathers to his cap, Adeduntan moved to the financial services industry in KPMG as a senior manager in June 2002, and served diligently till October 2004 when he bowed out. At KPMG, he co-pioneered the firms’ financial risk management advisory services. He was also a KPMG-accredited Trainer and facilitated several internal training programmes.

When he left KPMG in 2004 to study, he pursued a Master’s degree in Business Administration at the Cranfield School of Management, where he was a British Chevening Scholar. He graduated in September 2005.

Armed with yet another great feather, Adeduntan moved to Citibank Nigeria Limited in 2005 where he became the Senior Vice-President (General Manager) and Chief Financial Officer. He was saddled with the responsibility of overseeing the bank’s financial and product control functions, quality assurance and operational risk management. He was on hand to assist the bank in its recapitalisation during the banking consolidation era.

In October 2007, he called it quits with Citibank, and a month later, pitched tent with the Africa Finance Corporation, as the pioneer Chief Financial Officer and Business Manager.

His achievement at the AFC includes leading the team that secured an A3/P2 investment grade international credit rating from Moody’s Investors Service in March 2014. This made the Africa Finance Corporation the second highest-rated lending financial institution in Africa.

In July 2014, he was appointed an Executive Director/Group Chief Financial Officer of FirstBank, where he was responsible for the bank’s financial control, internal control and enhancement, business performance management, treasury and procurement functions.

On Monday January 4, 2016, Adeduntan succeeded Bisi Onasanya, and assumed duty as Managing Director of FirstBank of Nigeria Limited, and its commercial banking subsidiaries including FBN UK, FBN Ghana, FBN DRC, FBN Guinea, FBN Gambia, FBN Mortgages, FBN Senegal, FBN Sierra Leone and First Pension Custodian Limited.

He coordinated his functions so professionally that on December 7, 2016, he was awarded the 2016 Banker of The Year award by the Leadership Newspaper “For refusing to ‘go with the flow’ even when the temptation was high and the reward substantial, and for reminding his colleagues that banking is nothing without integrity”.

A man of many beneficial and influential parts, Adeduntan has hitherto sat on the board of the Nigerian Economic Summit Group, and as a non-executive director on the boards of the Nigeria Interbank Settlement System (NIBSS), Africa Finance Corporation (AFC), FBN Bank U.K. Ltd., Universal Payments Plc, and FMDQ OTC Securities Exchange. He is also a Fellow of the Institute of Chartered Accountants of Nigeria.

In his eight years stewardship at the helm of affairs at FirstBank, Adeduntan has turned the tables and rewrote banking narratives, delving into all aspects of human endeavour to see to the development of SMEs, youth entrepreneuship among many others.

His speech at the kick off of FirstBank’s celebration of 125 years of unbroken business operations, has remained evergreen, and stood the test of time as the prototype to FirstBank’s success recipe.

Adeduntan hinted as follows: “From that very modest beginning in 1894, First Bank has traversed an incredible journey of delivering impeccable financial services to its customers and supporting the building of the modern-day Nigeria and indeed, West Africa, including our early pivotal role as the monetary and fiscal policy regulator for the entire West African region,” he said.

“As a long-standing institution, which even predates Nigeria as a unified entity, FirstBank is entrenched in the nation’s development; woven into the very fabric of society, with our involvement in every stage of national growth and development.

“At the amalgamation, independence and through the seasons ever after, we have been here marching hand-in-hand with you and our dear nation. We have enabled financial, technological, industrial and societal advancements, achieving very many firsts over time.”

Overall, Adeduntan has seen to the sponsorship of prolific enterprises to guide the youths on the right path. These include the African Fashion Week which took place at the Oriental Hotel and Youth Empowerment Seminar at the Harbour Point Event Centre. These shows among a whole lot of others in his eight years of prolific endeavors, have a lot of testimonials following.

Adesola is married to Mrs. Adenike Adeduntan and together they have three wonderful children.

Sir, we wish you a prolific retirement from FirstBank, and a more glorious openings for more of your intelligence and expertise to be tapped.

Related

Boss Of The Week

Aliko Dangote: A Distinguished Son of Africa Revels at 67

Published

3 weeks agoon

April 14, 2024By

Eric

By Eric Elezuo

Accolades from personalities across the nation, including from President Bola Tinubu, continued to surge towards the President, Dangote Group, Alhaji Aliko Dangote, as he hit another glorious age, celebrating 67 in grand style.

Tinubu, who was one of the early on the sustaining richest man in Africa, referenced the many industrial feats of the business colossus, describing him as one of Africa’s business lodestars.

The billionaire businessman has consistently proved that his entrepreneurial skills are not just geared towards uplifting him as a person, but to creating an enabling environment for the Nigeria youth and child to grow and develop in an environment he can proudly co-own. His vision, no doubt, is practically for the greater good of the world in general, and Nigeria in particular.

For so many blessed reasons and very many more, Dangote was recently named, and for the second consecutive year, the Africa’s foremost entrepreneur and humanist, and was honoured with a Lifetime Achievement Award.

The billionaire industrialist was accorded special recognition by the Organised Private Sector (OPS) employers in the country under the aegis of Nigeria Employers’ Consultative Association (NECA). That was just a tip of the iceberg in consideration to the avalanche of efforts he has put into business, and the lives touched so far.

Born in Kano in 1957, Dangote proudly shuttles between three wonderful tags as the richest man in Nigeria; the richest man in Africa and the richest Black man in the world. He has paid his dues, and mankind is the better for it.

Releasing impacts, Aliko Dangote Foundation (ADF), the private charitable foundation of Alhaji Aliko Dangote. Incorporated in 1994, as Dangote Foundation, is saddled with the mission to enhance opportunities for social change through strategic investments that improve health and wellbeing, promote quality education, and broaden economic empowerment opportunities. 20 years later, the Foundation has become the largest private Foundation in sub-Saharan Africa, with the largest endowment by a single African donor.

The primary focus of ADF is child nutrition, with wraparound interventions centered on health, education and empowerment, and disaster relief. The Foundation also supports stand-alone projects with the potential for significant social impact.

The Foundation works with state and national governments and many highly reputable international and domestic charities, non-governmental organizations and international agencies to advance its humanitarian agenda.

In one of its biggest collaboration to date, Aliko Dangote Foundation started working in partnership with the Bill and Melinda Gates Foundation and key northern State Governments in Nigeria from 2013 to eradicate polio and strengthen routine immunization in Nigeria.

Worthy of praise is the fact that nearly a decade, the Foundation has spent over N7 Billion in the course of feeding, clothing and the general welfare of the Internally Displaced Persons in the Northeast.

To make his host communities feel at ease, and the impact of his presence, Dangote has embarked on an initiative to provide further support to improving educational systems in Ibeju-Lekki and Epe locality. The educational support initiative is a tripartite programme consisting of scholarship, capacity building for teachers and school infrastructure projects.

In addition, Scholarships have been awarded to 52 secondary school students whilst some financial support was provided to their parents and/or guardians. Tertiary students will be included in the next batch of the scheme.

Furthermore, about 100 teachers, principals and school administrators were trained in teaching techniques for the 21st century. After which they were monitored in class on how they were using the skills acquired.

There is hardly any sector that has not felt the milk of human kindness running through Aliko Dangote; the military, media, politicians, governments across boards and more.

Dangote is surely an asset to this world!

As at today, there is no space for slowing down for Dangote as he continues to trudge on, creating firsts after first for himself and for humanity.

He is blessed with three wonderful daughters, who have followed the rewarding footprints of entrepreneurship.

Congratulates the African giant, and may you enjoy many more laurels as your footprints remain indelible in the sands of time, and continue to dominate the pages of history books.

Related

Is this the Nigeria of Our Dream? (Part 7)

Friday Sermon: Sickle Cell Anaemia: A Revisit

Sunil Taldar Named Airtel Africa CEO to Retire As Ogunsanya Retires

Midoil, Ikosi/Ejinrin Host Communities Set up Forum, Hold Inaugural Meeting

Masterminds of Abuja-Kaduna Train Attack, Greenfield University Kidnappings Nabbed

Adenuga: 71 Years of Unrivalled Philanthropy and Endless Empowerments

Osun Taskforce on Petrol Scarcity Raids Filling Stations, Forces Stations to Dispence Products

Nigerian Engineer Wins $500m Contract to Build Monorail Network in Iraq

WORLD EXCLUSIVE: Will Senate President, Bukola Saraki, Join Presidential Race?

World Exclusive: How Cabal, Corruption Stalled Mambilla Hydropower Project …The Abba Kyari, Fashola and Malami Connection Plus FG May Lose $2bn

Rehabilitation Comment: Sanwo-Olu’s Support Group Replies Ambode (Video)

Pendulum: Can Atiku Abubakar Defeat Muhammadu Buhari in 2019?

Fashanu, Dolapo Awosika and Prophet Controversy: The Complete Story

Pendulum: An Evening with Two Presidential Aspirants in Abuja

Who are the early favorites to win the NFL rushing title?

Boxing continues to knock itself out with bewildering, incorrect decisions

Steph Curry finally got the contract he deserves from the Warriors

Phillies’ Aaron Altherr makes mind-boggling barehanded play

The tremendous importance of owning a perfect piece of clothing

Trending

-

News6 years ago

News6 years agoNigerian Engineer Wins $500m Contract to Build Monorail Network in Iraq

-

Featured6 years ago

Featured6 years agoWORLD EXCLUSIVE: Will Senate President, Bukola Saraki, Join Presidential Race?

-

Boss Picks6 years ago

Boss Picks6 years agoWorld Exclusive: How Cabal, Corruption Stalled Mambilla Hydropower Project …The Abba Kyari, Fashola and Malami Connection Plus FG May Lose $2bn

-

Headline6 years ago

Headline6 years agoRehabilitation Comment: Sanwo-Olu’s Support Group Replies Ambode (Video)

-

Headline6 years ago

Headline6 years agoPendulum: Can Atiku Abubakar Defeat Muhammadu Buhari in 2019?

-

Headline5 years ago

Headline5 years agoFashanu, Dolapo Awosika and Prophet Controversy: The Complete Story

-

Headline6 years ago

Headline6 years agoPendulum: An Evening with Two Presidential Aspirants in Abuja

-

Headline6 years ago

Headline6 years ago2019: Parties’ Presidential Candidates Emerge (View Full List)