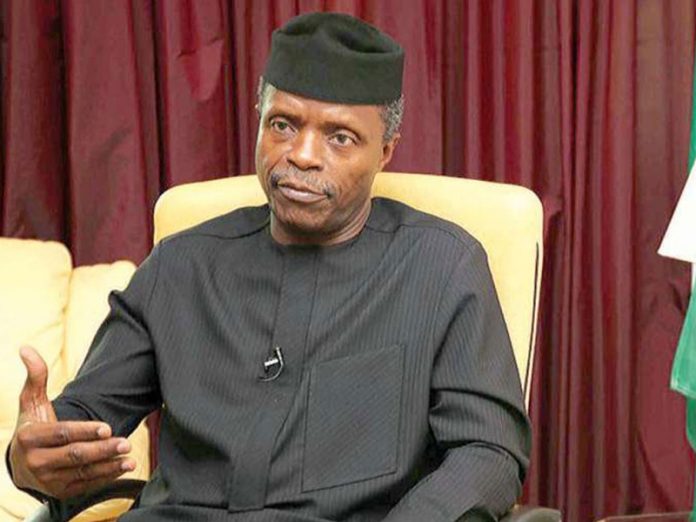

Vice President Yemi Osinbajo has urged Nigerians in the Diaspora not to rely entirely on social media reports on the security challenges facing the country.

Speaking at a townhall meeting in New York on Sunday evening, Osinbajo said the social media “tends to be hysterical about practically everything”.

The News Agency of Nigeria (NAN) reports that the vice president spoke in response to several questions and comments on the security situation back home.

Many members of the audience had taken turns to express concern about the reported spate of killings and kidnapping back home, and wanted to know what the government is doing to address the situation.

He said, “With respect to general kidnapping which we have seen in parts of the country, again, this is not entirely new.

“In fact, some of the kidnapping stories you read or listen to are simply not true anywhere, some are fuelled by politics.

“There are cases of kidnapping, no question at all about that, but some of the more dramatic stories that you hear are simply not true.

“Every report of kidnapping we receive, we try to verify, and at the end of the day you find out that people just tell all sorts of stories,” he said.

The vice president said the Federal Government was working with the states to check kidnapping where it was actually taking place, using technology to track the perpetrators.

He said the efforts were already yielding results with several arrests made by security agencies in affected areas.

Osinbajo said the government was capable of addressing the security challenges, assuring Nigerians that the news “will be a lot better very soon”.

Turning to banditry and farmers/herders clashes in the north west and central, the vice president described them as “resource conflicts”.

According to him, banditry especially in Zamfara and Katsina was more of a fight over the control of mining sites by armed groups.

He said the government was taking several measures, including shutting down the mines, to address the problem.

“In the north central, we have the livestock transformation plan to address the farmers/herders conflict.

“Ultimately, it is ranching that will solve the problem because you cannot have people wandering across the the country with their cattle.

“It is not helpful to them, this they know, because ranching is more convenient and profitable.

“So, we are building herd dams in the northern states so that people don’t necessarily come down south in search for water and green pastures for their herds.

“We are also trying to ensure we provide grazing areas before we come to cattle routes,” he added.

Osinbajo said in fairness to herders, the livestock sector had not enjoyed the kind of government’s funding and support accorded farmers over the years.

He stated that there was also need for government’s intervention in livestock, and solicited private sector support and investment in that area.

News6 years ago

News6 years ago

Featured6 years ago

Featured6 years ago

Boss Picks6 years ago

Boss Picks6 years ago

Headline6 years ago

Headline6 years ago

Headline6 years ago

Headline6 years ago

Headline5 years ago

Headline5 years ago

Headline6 years ago

Headline6 years ago

Headline6 years ago

Headline6 years ago