An ad hoc committee set up by the House of Representatives to investigate the scarcity of the new naira at commercial banks on Wednesday has frowned at the failure of the management staff of the Central Bank of Nigeria to appear before it on Thursday just as the House has insisted on January 31 deadline set for the exchange of the old notes with the new ones

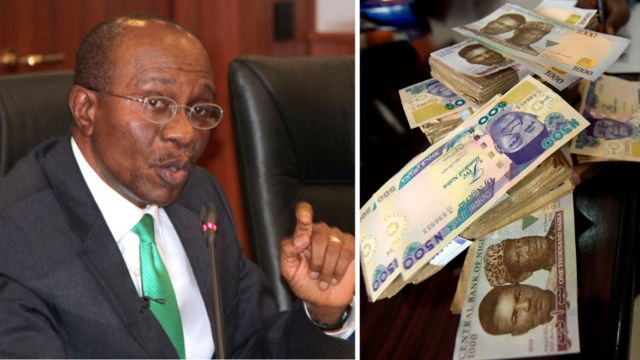

This came barely two months after the CBN Governor, Godwin Emefiele, failed to appear before the House over issues relating to the naira redesign.

The House had on Tuesday called on President Muhammadu Buhari over the brewing crisis occasioned by the January 31 deadline.

Apart from asking the CBN to extend the window for swapping the old notes with the newly redesigned one by six months, the House had invited the banks to a meeting on Wednesday over the scarcity of new naira notes.

The managing directors/chief executive officers of the banks, under the auspices of the Bankers’ Committee, were to meet with an ad hoc committee of the House to be chaired by the Majority Leader, Alhassan Ado-Doguwa.

On Wednesday, the CBN failed to appear before the committee.

However, Ado-Doguwa, at the inaugural investigative hearing of the committee, stated, “For the purposes of clarification, I want to say without any fear of contradiction, that the parliament is always an institution that represents the Nigerian people. For an invitation to any government employee, like it is the case here with the CBN, the governor of the CBN, his directors, deputy directors, all departmental heads, I believe, are employees of the Nigerian people; and when there is a kind of summons from the institution of the parliament like this, we expect every up-and-doing employee to only respect that invitation.”

“On this note, I would like to convey to this committee and members of the public and the press here with us that we have conceded to allow the CBN officials to come tomorrow by 1pm, so that we would engage them. And immediately after the engagement with them, we would engage the bank operators.”

Meanwhile, there was palpable discontent among bank customers in Lagos on Wednesday after some commercial banks shut down their Automated Teller Machines, ostensibly due to paucity or unavailability of new naira notes.

The development came in the wake of threats by the Central Bank of Nigeria that it would sanction any bank that dispensed old naira notes on its Automated Teller Machines.

When our correspondent visited four banks — Zenith Bank, United Bank for Africa, Access Bank and Stanbic IBTC along Iju road in the Ogba area of Lagos State, it was observed the bank ATMs were neither dispensing the new naira notes nor the old ones.

Meanwhile, a myriad of disgruntled customers were seen lamenting the frustration of not being able to withdraw cash from any of the ATMs in the area.

Our correspondent proceeded to visit Zenith Bank, Access and UBA along Ogunnusi road in the Ojodu axis of the state. The story was no different as a small crowd of frustrated customers was seen lamenting their inability to withdraw cash.

While some of the banks cited technical difficulties for their inability to dispense money via the machines, others said their ATMs had developed faults and could not temporarily dispense cash.

News6 years ago

News6 years ago

Featured6 years ago

Featured6 years ago

Boss Picks6 years ago

Boss Picks6 years ago

Headline6 years ago

Headline6 years ago

Headline6 years ago

Headline6 years ago

Headline5 years ago

Headline5 years ago

Headline6 years ago

Headline6 years ago

Headline6 years ago

Headline6 years ago