The Association of Bureau De Change Operators of Nigeria (ABCON) has announced plans to create a unified structure for the retail end of the country’s foreign exchange market.

The association disclosed on Friday that the move would tackle volatility and boost regulatory compliance within that segment of the market.

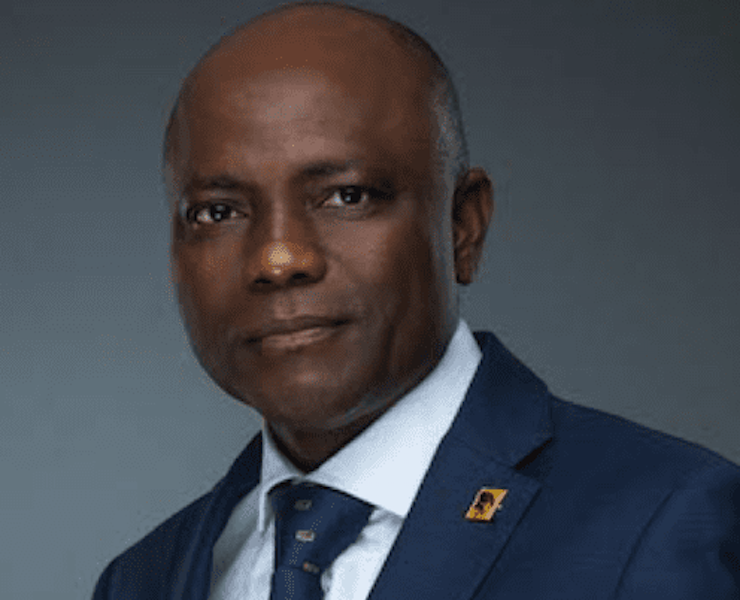

This move, according to the ABCON President Aminu Gwadabe, is aimed at tackling currency volatility and strengthening regulatory compliance within the sector.

Gwadabe outlined ABCON’s strategy, which involves unifying operators across various categories within the market. The association is establishing state chapters to achieve better market coordination, integration, and ultimately, a single, standardized market structure. This would, in theory, allow authorities to monitor all BDC operators throughout Nigeria more effectively.

He said: “Part of our vision for a united retail-end forex market includes activating geo-mapping and automated BDCs physical office verification exercise using the Remote Gravity Physical verification apps. This will enable forex buyers to easily locate BDCs offices for effective and seamless transactions.”

He reiterated the benefits of a vibrant retail end of the forex market to support the Central Bank of Nigeria’s goal of achieving true price discovery for the Naira, balancing international obligations and national objectives; ensuring ease of regulation, security agencies monitoring and supervision as well as entrenching market visibility for BDC players.

With the world going digital, BDC operators under the ABCON leadership are committed to staying ahead of the competition by deploying time-tested technology to deliver effective services to foreign exchange end-users.

“Finally, we also condemned in its entity, the seeming reappearance of illegal economic behaviours in forex conversion and peer-to-peer trading that pose another recent surprise in naira volatility and I therefore want to warn that while surprises are the new normal, resilience is also the new skills,” Gwadebe explained.

The benefits of a unified market are multifaceted, according to Gwadabe. It would not only address exchange rate fluctuations but also bolster regulatory compliance among BDCs.

This could have a positive impact on the Central Bank of Nigeria’s (CBN) efforts to achieve transparency in foreign exchange pricing. Additionally, a unified structure could enhance the overall image of BDCs and other stakeholders in the market, potentially leading to increased employment opportunities.

News6 years ago

News6 years ago

Featured6 years ago

Featured6 years ago

Boss Picks6 years ago

Boss Picks6 years ago

Headline6 years ago

Headline6 years ago

Headline6 years ago

Headline6 years ago

Headline5 years ago

Headline5 years ago

Headline6 years ago

Headline6 years ago

Headline6 years ago

Headline6 years ago