In line with its usual custom of rewarding loyalty especially during the yuletide season, Africa’s Global Bank – United Bank for Africa (UBA) Plc- has rewarded its loyal customers in the just concluded UBA Super Savers Draws giving out over N36million in cash prizes.

The winners were announced following a highly transparent draw which held at the Tony Elumelu Amphitheatre, UBA House on Thursday, and was witnessed by members of the press as well as representatives of the Federal Consumer Protection Council (FCPC) and the National Lottery Regulatory Commission (NLRC).

A UBA Bumper account customer, Fabian Matthew Okon, copped the biggest prize of the day as he won the N10m jackpot, while Abiodun Joseph Aduramigba, emerged winner of the N5m star price for the day. Kahalla Mohammed was the lucky winner of the N1.8m rent for a year cash prize.

Ten lucky savings/current account holders: Emmanuel Onyeka Ozoude; Nneka Ali Ologwu; Juliana Obioma Idoko; ThankGod Gagbe; Babayo Dahiru; Ahmad Hamza; Wisdom Otaghogho; Ecdelson Chukwuamaka Amusa; Genom Isaac Jibrin and Atimanu Eunice Bala, emerged lucky winners of N1m each; while Monica Onuzurike, a bumper account holder carted N500k shopping voucher.

In another category; 15 Kidddies and Teens account holders: Giovanni Chidera Ikwuagwu; Brinemigha Prince, Prezide; Oguzie Ugonna Mitchell-Chris; Chimamanda Chikamso Samuel Louis-Okafor; Oyebola Jayden Okikiola; Ugomsinachi Emmanuel Obiegbunam; Bonaventure Odira Udoyibo; Jayden Obehi Lucky; Chimdiebube Joan Ugoma; Isaac Ibrahim; Emmanuel Dominion Innocent; Daniel Tamarakuro Oyadonghan; Ayibanugha Lawson; Muhammad Mohammed Murtala and Abdullah Ndanusa Abdulkadir were each rewarded with N200,000 each.

On the other hand, Onyinyechukwu Perpetua Okechukwu; Chinenye Christiana Ukaobasi; David Ayomide Olarewaju; Malik Olamide Mustapha; Mujaheed Abdulwahab; Grace Amarachi Nduka; Izoduwa Theophilus Umweni; Ibironke Mercy Temitayo; Fatima Bello and Sandra Luevese Akaahan were the 10 UBA Next Gen account holders who each won N180,000 pocket money.

The 35 winners of N100,000 each were: Lantyo Clement Aondohemba; Chibuike Godwin Oluchukwu; Sunday Miracle Ukah; Sonia Igho; Chukwuebuka Victor Wilfred; Friday Emmanuel Okon; Ajao Ramota Abiola; Comfort Ifeoluwa Jonathan; Abisoye Oluwakemi Agbeja; Kurah Rejoice; Rukkayya Ibrahim; Confidence Loveday; Gift Nke Yusuf; Salamat Onize Hadi; Hadiza Lawal; Stonia Oghenekevwe Ohwofa; Anthonia Adesua Ukazu; Alimo Ajoke Usman and Hassana Zubairu.

Others were Musa Abdulhamid; Paul Peter; Sarah Olabanke Olawunmi; Do-Ere Ekpe; Nduka Paul; Ijeoma Loveday Ndumechi; Idris Muhammed; Chinonye Christabella Olumba; Ossai, Josephine Oluchukwu; Gift Rhoda Adode; Felix, Felicia; Nwakaego Sunday; Okwudiri Victor Nwankwo; Peter Enyo-Ojo Alfa; Blessing Damilola Alao and Gbolahan John Ayanlowo

When contacted over the phone, the N10m jackpot winner, Fabian Matthew Okon, expressed gratitude to the bank for the prize, adding that he was very grateful. “Thank you UBA, I am very happy” he said.

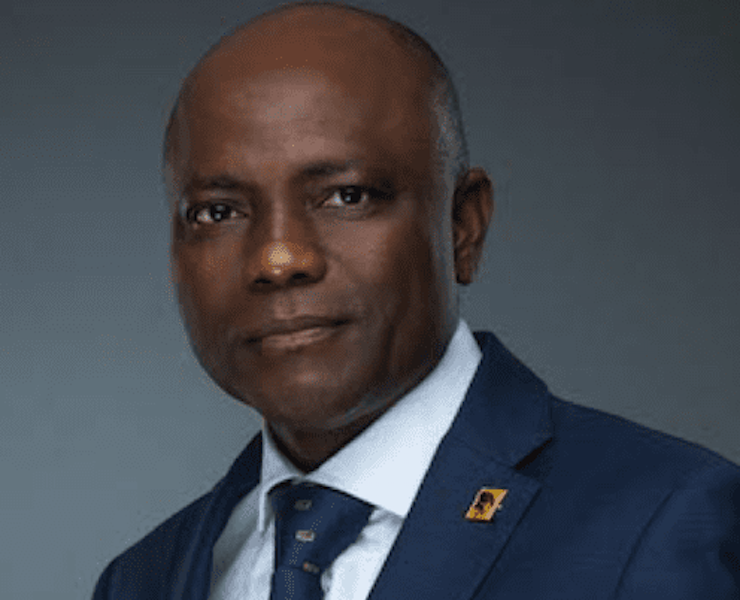

UBA’s Head, Retail Banking, Prince Ayewoh, who congratulated all the 74 winners after the draw, encouraged other people to keep on saving so they could be winners in the next edition.

He said; “At UBA, our customers are at the heart of everything we do, which is why in the midst of the current financial terrain, high cost of living and reduced income, we chose to reward 74 people today and we will keep rewarding you every month. The Super Savers Draw is not just a moment to reward our savers; it’s a celebration of the strong bond that we share with you.

He disclosed that the bank will be embarking on new ventures and initiatives aimed at enhancing customer experience in 2024, as he asked them to anticipate a range of innovative products, improved services, and exclusive offerings crafted specially to address your evolving needs, especially for the senior citizens.

United Bank for Africa Plc is a leading Pan-African financial institution, offering banking services to more than twenty-five (25) million customers, across 1,000 business offices and customer touch points in 20 African countries. With presence in New York, London, Paris, and Dubai, UBA is connecting people and businesses across Africa through retail, commercial and corporate banking, innovative cross-border payments and remittances, trade finance and ancillary banking services.

News6 years ago

News6 years ago

Featured6 years ago

Featured6 years ago

Boss Picks6 years ago

Boss Picks6 years ago

Headline6 years ago

Headline6 years ago

Headline6 years ago

Headline6 years ago

Headline5 years ago

Headline5 years ago

Headline6 years ago

Headline6 years ago

Headline6 years ago

Headline6 years ago