By Eric Elezuo

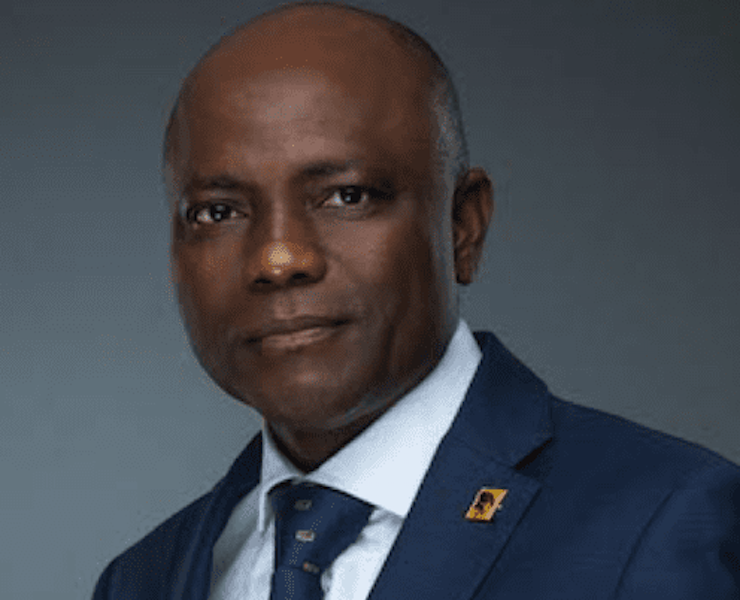

The Chief Executive Officer, First Bank of Nigeria Ltd and Subsidiaries, Dr. Adesola Adeduntan, has lauded the qualities of African women, saying a woman who knows how money works is in a vantage position to change the world for the better.

Dr Adeduntan made this assertion while delivering his speech at the First Gem Annual Conference 4.0 with the theme, “The Art of Negotiation”, held both on location and via the web.

This year’s event, which fell into the month of March appears symbolic as it represents two wonderful occasions including the celebration of the International Women Day, which provides opportunity to discuss and proffer solutions to gender parity issues and women empowerment challenges, and the 127th anniversary of the bank, FirstBank of Nigeria Limited. Of more importance is the fact that the 4.0 edition took place on the very day the company marked its birthday.

In his speech, Adeduntan paid glowing tributes to women, citing the fact that First Gem is tailor-made to suit the financial inclinations of women in business. He reiterated that “FirstBank, through the FirstGem initiative, is committed to supporting the contemporary woman’s financial services needs across the various stages of her life,” adding that “Our FirstGem value proposition provides real solutions to challenges faced by female entrepreneurs and working professionals.”

The FirstBank’s CEO eulogised the enterprising African woman, using an African proverb, which says, “If you educate a man you educate an individual, but if you educate a woman, you educate a family (nation)” stressing that “If you teach a woman how money works, provide her with the right products and funding support; she can transform the world.”

Further in his narrative, Adeduntan went down memory, bringing to the presence the moments that birth FirstGem as a preferred platform for the empowerment of women financially and numerous achievements recorded overtime.

He said: “In the last five years, our FirstGem initiative has served to foster the empowerment of women across the socio-economic strata with implementation across three pillars.

“The FirstGem platform for women (access to leadership programs/ workshops/trainings on women empowerment, business skills on wealth management and investment plans) Value proposition including capacity building, affordable finance, access to infrastructure, market visibility for women MSMEs

“A strong commitment as a financial institution to support women by leveraging the Bank’s resources in developing unique and mutually rewarding solutions.

“Today, our work is more important and impactful than ever! A review of the performance of the FirstGem initiative shows the effectiveness of our efforts to elevate and empower the Nigerian woman. In 2020, we gave out loans of NGN 58 billion to over 81,000 female entrepreneurs and professionals.

Empowering women via agent banking proposition is one of the outcomes of the FirstGem initiative. Across our agent banking network – the largest verified bank-led agent banking network in Nigeria – , we have about 24,500 female agents representing 28 percent of the agents in our network. It gives us much joy to see that more women are embracing this proposition and getting empowered.

“The FirstGem Initiative takes an inclusive approach to empowering women to make confident and sound decisions with respect to their business, family, and future. Whether you are the primary financial decision maker, a partner or financially independent, the time is now to power your own financial success by being part of the FirstGem Initiative – Open a FirstGem account and join the FirstGem community!

“Finally, as we close out on the activities that celebrate women folks, this March, I would like to restate that, at FirstBank, we remain committed to providing products and services that will allow our female customers and employees to thrive and attain their maximum potentials in business and career. Let us work together to make 2021 count for women, everywhere!

He advised women entrepreneurs to take advantage of the opportunities the FirstGem offers, noting that “we are leveraging the Agent banking proposition to close the gender gap and tap into the rich and overlooked base of the pyramid customer segment (that is predominantly women) with the realization that failure to fully harness women’s productive potential represents a missed opportunity to drive accelerated global economic growth.”

Recognising that the post- COVID-19 pandemic economic indices do not in any way favour women, Adeduntan informed that FirstBank has devised a veritable approach to support women’s wealth creation and financial independence.

“It has become imperative to match the scale and urgency of this challenge with financial products that address the lifecycle financial needs of women. The products should holistically address the needs of women by providing them with integrated access to savings as well as short and long-term credit, capacity building, and wealth management advisory. This suite of products will improve the earning capacity and reduce poverty levels amongst the women folk, in the medium to long term. Success will be dependent on everyone playing a part!” The FirstBank CEO said.

Firstgem is an exclusive FirstBank initiative to inspiresl and empower women to take charge of their financial future through the provision of access to resources and interactive workshops and advisory that help women to make informed financial decisions and build wealth management competences.

Other speakers at the event were the Chairman Board of Directors, First Bank of Nigeria Limited, Mrs. Ibukun Awosika, who spoke on the theme of the International Women’s Day, “Choose to Challenge”, Professor of Economics at IESE Business School, Prof Pedro Videla, who spoke on the current state of the Global Economy and how it Impacts Business Decisions, and Senior Lecturer, IESE Business School, Prof Mehta Kandarp, who lectured on Negotiation as a Tool for Winning in Business and Career.

News6 years ago

News6 years ago

Featured6 years ago

Featured6 years ago

Boss Picks6 years ago

Boss Picks6 years ago

Headline6 years ago

Headline6 years ago

Headline6 years ago

Headline6 years ago

Headline5 years ago

Headline5 years ago

Headline6 years ago

Headline6 years ago

Headline6 years ago

Headline6 years ago