Boss Picks

I’m Apolitical, I Don’t Need Your Appointment, Abdulsamad Rabiu Tells APC

Published

8 months agoon

By

Eric

By Eric Elezuo

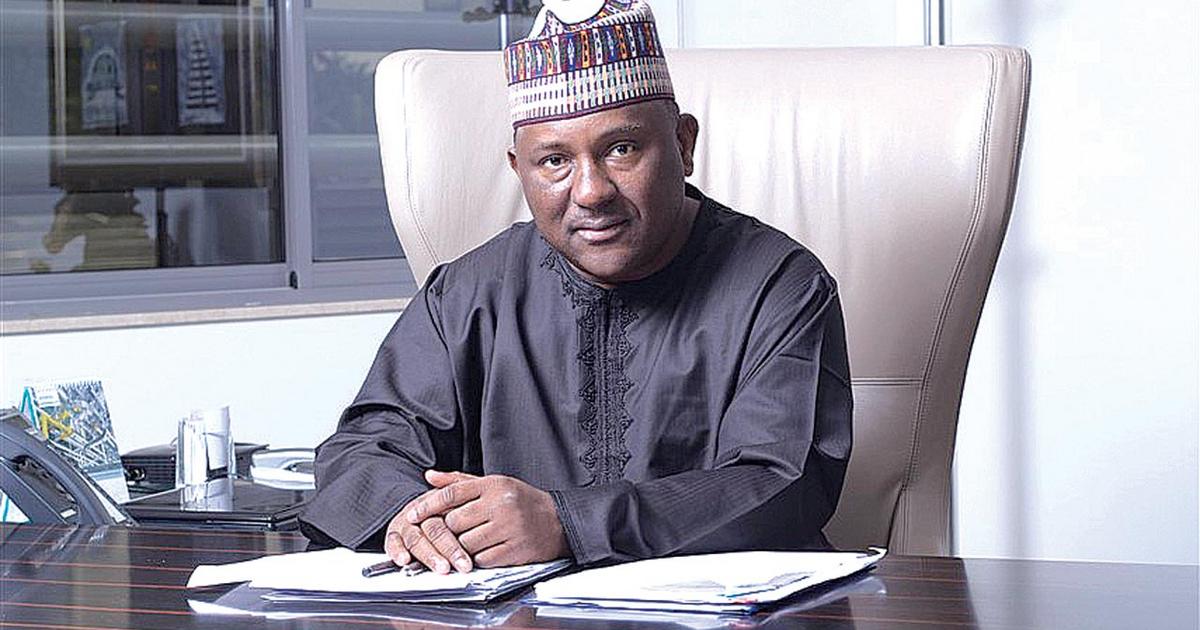

The Chairman, BUA Group, Abdul Samad Rabiu, has turned down the All Progressives Congress (APC) appointment as a member of the party’s finance standing committee.

The APC had on Friday released a list compromising names of its standing committees. The list name the billionaire industrialist as a member of its finance committee while the party’s national secretary, Ajibola Basiru chairs the establishment committee.

Among the personalities in the list is a former Interim National Chairman of the party, Bisi Akande, who heads the conflict and reconciliation committee. Others are Felix Morka, who chairs Publicity while Uguru Ofoke and Emma Eneukwu are to oversee finance and intergovernmental committees, respectively.

Rabiu featured in the finance committee alongside A. A Rano, the chairman of the Federal Inland Revenue Service (FIRS), Zach Adedeji, Minister of Finance and Coordinating Minister of the Economy, Wale Edun and Senate President Godswill Akpabio, among other lawmakers and prominent party members.

But in a swift response shortly after the list was made public, the BUA group released a counter statement, informing that Rabiu was not consulted by the ruling party or anyone before his name was added to the list, insisting that the industrialist has “consistently adopted an apolitical stance over the years”.

The statement read:

“We extend our sincere appreciation to the APC for considering our chairman for such a distinguished role. This acknowledgement reflects the recognition of his commitment, and that of BUA Group, to economic prosperity and the development of our dear nation, Nigeria.

“With respect to this, we wish to inform the publishers, our partners, stakeholders, and the general public that Mr. Rabiu has decided to graciously decline the nomination/appointment.

“This decision is made in light of the fact that he was not previously consulted regarding his inclusion in the list and his inability to commit time due to his demanding schedule.”

The inauguration of the committees, according to a statement on the ruling party’s social media page, is scheduled to hold on December 6, 2023 at its national secretariat in Abuja.

Rabiu is the Chairman/Chief Executive Officer, Bua Group, makers of quality cement, sugar among other wonderful household items.

Born on August 4, 1960, in Kano, to one of Nigeria’s foremost industrialists in the 1970s and 1980s, Khalifah Isyaku Rabiu, Abdul Samad Isyaku Rabiu CON is a perfect combination of many things in one.

It was in his native Kano that he kick started his academic pursuit, carousing through elementary education with ease as a gifted child, and obtained his First School Leaving Certificate. He was later admitted into the Federal Government College, Kano, where he had his secondary education, and gradually with honours.

With a combination of fate, brilliance and determination, Abdulsamad was catapulted to Capital University in Columbus, Ohio, where he studiously studied Economics, and acquired his tertiary education before returning to Nigeria, all before his 24th birthday, to oversee his family business. He was that much sort after, and highly brilliant, and considered capable of holding fort for his father, who was being detained by the administration of General Muhammadu Buhari over matters concerning import duties.

In 1988, just after learning the ropes of entrepreneurial excellence, Abdul Samad Rabiu established BUA International Limited, for the sole purpose of commodity trading. The company followed after the footsteps of his father, and imported rice, edible oil, flour, and iron and steel.

In 1990, having exhibited the character worthy of a world class entrepreneur, and the ability to execute classical projects, Rabiu’s BUA was invited by the government, which owned Delta Steel Company to supply its raw materials in exchange for finished products. This provided a much-needed leverage for the young company, and consequently expanded further into steel, producing billets, importing iron ore, and constructing multiple rolling mills in Nigeria.

Rabiu’s dexterity showed further a few years later, when the company acquired Nigerian Oil Mills Limited, the largest edible oil processing company in Nigeria, and there erupted the company’s and BUA’s influence and care over the people in the provision of affordable edible oil. His passion to see people excel in comfort has continued to make him churn out one great tiding after another, and endearing him in the hearts of the generality of the public.

A man with a vision for tomorrow, Rabiu, in 2005, started two flour-milling plants, in Lagos and in Kano, and by 2008, had broken an eight-year monopoly in the Nigerian sugar industry by commissioning the second-largest sugar refinery in sub-Saharan Africa. This was a feat only a bravest of hearts could wroth. As a result, in 2009 the company went on to acquire a controlling stake in a publicly-listed Cement Company in Northern Nigeria and began to construct a $900 million cement plant in Edo State, completing it in early 2015. Rabiu’s passion for expansion is unequalled.

BUA Group has since concentrated and excelled in manufacturing, infrastructure and agriculture and producing a revenue in excess of $2.5 billion. This is in addition to being the chairman of the Bank of Industry (BOI).

The Group, in 2019, announced plans to merge its privately owned Obu Cement with the publicly traded Cement Company of Northern Nigeria Plc (CCNN), to create Nigeria’s second largest cement producer thereby consolidating the grip on the cement market and breaking its monopolistic status.

It is worthy of note that Cement Company of Northern Nigeria PLC in which Rabiu owned more than 97% was producing two million metric tons of cement per annum (Mtpa) while Obu Cement has an annual production capacity of 6Mtpa. The move is in line with the company’s resolve to deepen the Nigerian capital markets and enhance the growth of the cement industry.

Rabiu’s expansion strides cannot be complete without a mention of his extraordinary philanthropic gestures.

In April 2020, he made a whopping donation towards the fight to contain the spread of the Coronavirus pandemic presently ravaging the country.

Having earlier donated N1 billion to the private sector CACOVID and other states, he again announced the release of another N3.3 billion ‘grant to the working group made up of the Presidential Task Force, NCDC and other stakeholders in equipping two existing permanent facilities in Kano and Lagos states’.

In a letter dated April 24, 2020, he personally signed, and addressed to The Presidential Task Force on COVID-19, the billionaire businessman, congratulated the duo of the Task Force and the Nigeria Centre for Disease Control (NCDC) for doing a good job while observing that much as so much has been done, there was still need to do a lot more, as the disease continued to make inroads into many parts of the country, especially Lagos and Kano states.

“I view with deep concern, the increased rate of spread of the Coronavirus, especially in Kano and Lagos states despite concerted collective efforts to curb the spread and effects of the virus in Nigeria,” he said.

Rabiu is a treasure to humanity, and that explains why the ruling party found him suitable and worthy for membership of its finance committee. His truthfulness and strict adherence to focusing on the need of the society gave him the impetus to reject the appointment.

Related

You may like

Boss Picks

I’ll Continue Giving Back to the Public Till My Last Day – Sir Kesington Adebutu

Published

7 days agoon

July 20, 2024By

Eric

By Eric Elezuo

Many have described it as a wonder. Some others believe it is the best move towards curbing the menace of medical tourism that has sulked the nation dry of resources; it is the DIAMED CENTRE, a diagnostic and medical facility located in the heart of Lekki, and singlehandedly build and donated by giver extraordinaire, Sir Kesington Adebukunola Adebutu.

In this chat, Sir (Dr) Adebutu took the Ovation Crew, led by the Chairman, Chief Dele Momodu, on a mind-blowing expedition to revealing the intricacies surrounding the grand edifice, and his other benevolent endeavours, stating that he is not ready to quit the act of well doing.

Excerpts:

YOU ARE KNOWN FOR CHURNING OUT GREAT ACTS OF HUMANITY, BOTH FOR THE PUBLIC AND YOUR IMMEDIATE FATHER. HOW DO YOU DO IT SIR?

I continue telling people, I don’t stay negative. My calling is to do good to people, and to appreciate God’s mercy on my life and my family. I know I work hard, but some people work harder than me, but they are not getting a fraction from what I am getting from God. So the only way about mine is to show appreciation to God by giving out a little bit of the fraction of what he has given to me. I believe that a soul which is healthy and educated can never go backward, and that is what I have passion for; that explains my giving nature. So, as far as DIAMED is concerned, what I am doing is to tell God thank you.

WHEN DID YOU DECIDE TO GO THE FULL LENGTH TO BUILD THIS HOSPITAL?

Maybe you don’t know, my daughter is a doctor. She has worked for many years ago in the United Kingdom as a doctor. She actually conceived the idea of building a hospital after her retirement so I have to give her my maximum support.

Again, I will tell you a story surrounding the building. After they had perfected all the papers with the Lagos State government for over one year, not happened. On a Wednesday, I went to Governor Raji Fashola, he was the governor then. I went to him and said, we have perfected all our documents, we have make all our payments, but nothing from the government. Immediately, he made a call, and I heard him talk to another man, and he said it will be ready by Friday. And that was it. So all the support she needed within my power, I gave to her.

I HEARD THE BUILDING RUN INTO BILLIONS OF NAIRA

Yes, you are right, and I thank God for the equipment we have. They were purchased even before the completion of the building. And thank God we did, otherwise it would not have been possible at this time.

CAN YOU ITEMISE SOME OF THE PRINCIPLES THAT HAVE SUSTAINED YOU IN LIFE?

The truth is that I got to where I am today by principles, and I still have the principle

It is easy to get to the top, I know, but very difficult to remain at the top, and I thank God that He has been so kind to me.

WHAT PROPELS YOU TO DO GOOD BECAUSE IT APPEARS YOU ARE NOT TIRED OF DOING GOOD DEEDS

I started doing good while growing up, and until my last day, I will continue to give back to the public. Right now, we are building the Oduduwa House in Ile-Ife, which is almost completed; we are also doing a medical research centre at College of Medicine, University of Lagos, Idiaraba. As long as God spares my life, I will continue to do good deeds.

YOU WORK SO HARD, HOW DO YOU RELAX?

I love football, though I don’t have any particular club of interest, and go to football stadiums to watch football. From my flat in London, I can see the roof of Chelsea Stadium; the popular Stanford Bridge.

Related

Boss Picks

DIAMED CENTRE: Kesington Adebutu is a Father in a million – Daughter, Abiola Olorede

Published

7 days agoon

July 20, 2024By

Eric

By Eric Elezuo

A United States and United Kingdom trained prolific doctor, Dr. Abiola Olorede, the first daughter of accomplished businessman and renowned philanthropist, Sir Kesington Adebukunola Adebutu, is not a run-off-the-mill medical practitioner. She knows her onions, her worth and the mandate she is programmed to fulfill.

She is the Chief Medical Director of the just opened DIAMED CENTRE, a fully equipped diagnostic and medical facility saved with the responsibility of catering to the medical needs of the Nigerian public.

The hospital, which was built and handed over to her by her philanthropic father, is located at Kuboye Street, in the heart of Lekki Island, Lagos.

In this brief chat, the achiever, who lived most of her educational life in Dublin, Poland, expressed her gratitude to a father like no other, and how she and her team intends to make the best of the facility and equipment to totally affect humanity for the better.

Excerpts:

CAN YOU TELL US THE IDEA BEHIND THIS GREAT PROJECT?

Thank you very much, my name is Abiola Olorede, I am a medical doctor by profession. I schooled in Dublin, worked in the United Kingdom and in United States of America. When I came back home to Nigeria after my education including postgraduate studies, I realized that one of the major challenges is that a lot of the diagnostic tools that we need to use for evident-base treatment of our patient were lacking. Since then, I have always had a dream that when i am able to afford it, I will like to have a place that Nigerians can go to as comparable as those round the world because, just as I have always spoken about it, every Nigerian should have any treatment obtainable anywhere in the world in their home country.

CAN I DEDUCE THEREFORE, THAT YOU INTEND TO STOP MEDICAL TOURISM BY ESTABLISHING THIS ALL INCLUSIVE MEDICAL CENTRE?

Hmmm…Intend to stop is a very big word. I am hoping by the service we would offer here, a lot of Nigerians will see it as comparable to anywhere in the world and would want to use it instead of going out of the country. So, a lot of people that go out of the country can benefit from world class treatment in Nigeria.

SO OUT OF ALL YOUR DAD’S PHILANTHROPIC GESTURES, HOW DOES THIS ONE MAKE YOU FEEL?

If you noticed, the Kensington Adebutu Foundation, KAF, as it is fondly referred to, has major pillars and that’s education and health. It does a lot of other projects no doubt. I know that in any society, if the people are not educated, it’s a big loss to the country, if you don’t have the healthy workers too, it’s a big loss. So this brings out much of my pride in the service of Nigeria.

AS A PROUD DAUGHTER, WHAT MORE COULD YOU SAY ABOUT YOUR FATHER?

First of all, I would like to thank him. I tell everybody that he is father in a million. He supported his children over the years, financially, and with wisdom. I’m going up to 60, and my father still supports me pursue my dreams; it’s very rare. I want to thank him from the bottom of my heart. He’s always there, so thank you dad, you are a wonderful dad.

CAN YOU JUST ANALYZE THE KIND OF EQUIPMENT WE HAVE HERE?

We have a lot of facilities that are available, we have 3D monogram, it gives better images, and it’s less painful when you do that. We also have 64 high CT scan, digital X-rays, a lab, Haematology, Dialysis department, Dental suite, Opthalmology and Physiotherapy. We have a fully functional Pharmacy; so it’s like a one stop shop.

We have a Cardiac Suite where you can do ECO and other tests. We engage patients morning to night, make them comfortable as they get their test done. We don’t want you to feel you are in a hospital premises; you come from home and get all your test done.

WHAT DO YOU PROMISE NIGERIANS USING THIS FACILITY?

I promise Nigerians is that only experts, who will give the right diagnosis will be engaged here so we can give world class treatment and service. We want to use evidence and innovations to manage patients. Those are our promises to Nigerians and others as an organization and God will help us deliver all these promises.

AND HOW AFFORDABLE IS IT TO PATRONISE THIS PLACE?

We would try to make it cost effective in as much as medical care is not cheap. I tell people that being healthy is cheaper that being sick and that’s true, and that’s what we hope to accomplish. It is difficult to maintain some of this machines, some of them are very expensive so we must be able to recoop cost to get and replace equipment when due.

Thank you doctor Abiola, you have been very helpful and I wish you well in the management of this facility to the best interest of Nigerians. God bless you ma.

The pleasure is mine

Related

Boss Picks

Special Tribute to Wole Soyinka at 90 by Dele Momodu

Published

2 weeks agoon

July 15, 2024By

Eric

I am here to keep vigil and pay special tribute to the iconic man of letters in Literature, of no mean achievement. The first African to win a Nobel Prize for Literature. If you miss my session tonight, trust me, you have missed a lot. I will give opportunities for people to ask questions about Professor Wole Soyinka.

I’m here to celebrate one of the greatest world writers. It’s an insult to call him an African writer. He is one of the greatest world writers ever known to mankind. Some call him our own William Shakespeare, but I believe in his own way he has probably surpassed William Shakespeare. I call him the most prolific writer to come out of Africa. Tonight, I will demonstrate it. Tell your friends tell your families wherever they are to tune in to Dele Momodu Ovation on Instagram and Dele Momodu on Facebook and let me see if we can do Twitter space.

This is going to be very very very exciting. I know a lot of our young people nowadays might not be too interested in literature or in history or in music or in religious knowledge but this man deserves our celebration. I know a lot of the young people who don’t really know his trajectory have been bashing him and saying he’s anti Igbo. I will demonstrate to you tonight that there is nobody; no Nigerian who risked his life during the Nigerian Civil War more than Wole Soyinka. In fact, the trip he made to the East in search of his friend, brother, and fellow scholar, Christopher Okigbo eventually landed him in prison. He was in solitary confinement for so many years. A lot of people don’t know this man.

Yes, he’s entitled to his opinion. I’m a democrat I may not agree with him. A lot of people say he’s supporting President Tinubu. Yes, it is possible. There is nothing wrong with that. Every human being no matter who you are has the right to choose a friend that he will love unconditionally. I love Tinubu but I don’t agree with his politics. But that is me! There are others who love him and will tolerate his politics. I would rather stay outside and advise him and hopefully maybe Nigeria would not fail under his watch. If Soyinka says “this man and I we’ve been co-comrades and we suffered in bad times and in good times we’ve been together”, I don’t think it is too much for a man who has sacrificed so much for Nigeria. Wole Soyinka has sacrificed so much for Nigeria just like Dr Tai Solarin, Chief Gani Fawehimi, Mr Femi Falana, Michael Ozekhome, Lisa Agbakoba, Shehu Sani, Babafemi Ojudu, Kunle Ajibade, and Bayo Onanuga.

So, this is why I am here tonight to celebrate Wole Soyinka.

Let me say boastfully (you can say I am boasting) that I am probably one of those who have acquired most of Wole Soyinka’s books more than any other or average collector of his literary works, and I will demonstrate it tonight. You cannot imagine how many books I’ve assembled and these are not all; I have three libraries today. I have two in Lagos and I have one in Ibadan which is my biggest library but fortunately I’ve been able to assemble a lot of Wole Soyinka’s works and I will start from my very first encounter within at the then university of Ife; now Obafemi Awolowo University. So, please come with me on this journey on this roller coaster.

I have authors who have written copiously about Wole Soyinka, but this is not going to be about them tonight. One of them is our big Egbo doctor Yemi Ogunbiyi. Can you see this voluminous book is his biography and his memoirs; what he has done. He mentioned Soyinka in so many parts this book so but that is not we are not going to be talking about that. I said Soyinka is the most prolific African writer of all time and I’m sure some people, the usual doubting Thomas, will say no I am being hyperbolic, it is not true. It is very true. This is Ishara, one of his autobiographies, where he wrote about his late father. This is one of the books I have. I will first of all show you all the books that I have here before we start dealing with them one by one.

This is a book on the former premier of the old western region Chief (Aare Onakankafo) Samuel Ladoke Akintola. Soyinka of course featured in the book because Shoyinka was so radical in those days that he stormed the radio station in Ibadan at Gun point and removed the tape they were about to play and replaced it with his own tape.

This is another book on Soyinka Language. I agree that he is the most tedious writer in Africa is English would make even the English man bluffs. I don’t know of anybody used English language the way Wole Soyinka has used it like someone eating fresh yam with palm oil so this is Shoinka’s language as examined by Obioma Ofebo. I have it and I told you I’m a collector.

Now let’s go to the next book a selection of African poetry this this one of the oldest you can see this is one of my oldest books I will try and see if I wrote the date of collection I’ve been collecting books now for about 50 years. I’m looking at this unfortunately it doesn’t seem to have the date on it but I’m trying to see if I can see when it was published. It’s a selection of African poetry and I don’t think there is any selection in the world about African poetry that will not feature Wole Soyinka especially his Abiku. This one of the oldest books Abiku – in vain your bangles cast charm circles at my feet I’m an Abiku calling for the first time the repeated times must I win for gold sanctuary for palm oil and the sprinkled ash? Yams do not to earth Abiku’s leaves so when the snail is born in the shell welting deeply on the breast. So that’s from Abiku. Baiting Igbophobia the Sanyanugo’s thesis interventions. This is Wole Soyinka. The Igbo have been examined here there is the Sanyanugo’s thesis that is guest contributor Simon Kolawole the menace of the internet mob. This is a very recent book it was published this 2024. Anything I already have it anything Soyinkian, I must buy unless I have not seen it.

Soyinka was in prison, and he wrote his experience in prison and the title is ‘The Man Died’ – that’s one of the earliest books that introduced me to Wole Soyinka. I was so fascinated about his prison notes; how he had to be writing on tissue paper and hiding it from the prison warders when he was in solitary confinement. So, later in life I came across one of the greatest Egyptian writers who wrote a woman this time who also wrote about her prison experience and is almost similar to that of Wole Soyinka, and is titled ‘Woman At Point Zero’ – that’s Nawal El Sadawi. So, I have the book, and I wrote my master’s thesis partly about Nawal El Sadawi Nurudinfa from Somalia and Mariam Abbah from Senegal including

Ngugi wa thiong’o, the most famous Kenyan writer; the author of ‘Weep Not Child’. I’m sure you remember ‘Weep not Child’. We used to memorize as follows: weep not child, weep not my darling, with this kisses let me remove your tears, the reveling cloud shall not long be victorious, they shall no longer possess the sky. And Ngugi wa thiong’o also wrote a writer’s prison diary, and if you can lay your hands on it, it’s worth reading so you will see that writers not just in Nigeria, but elsewhere have really really suffered for their countries, for their principles and for their beliefs.

I mentioned Christopher Okigbo being Wole Soyinka’s friends and how Soyinka traveled and crossed the war lines to go look for his friend Christopher Okigbo; one of the greatest poets of that generation. This is in the book of poetry, The Labyrinths and under the African writer series in those days and use to be in Ibadan, and was very popular. I don’t know what has become of animal man books now but I suspect they usually sold it or change their name to something else. So this is Christopher Okigbo and that’s the man who rebelled against Nigeria, and these were people who paid dearly for their beliefs.

I have this written in Yoruba, and translated by my former teacher, my former supervisor now of blessed memory Professor Akinwunmi Ishola, who also wrote Oleku and wrote Efunsetan Aniwura. This is a translation of Wole Soyinka’s Ake into Yoruba. This is so interesting so you may want to get a copy. If you are wondering where and how you can get copies of these things they are all majorly in Ibadan. There is a bookshop called Book Sellers in Jericho, Ibadan. I usually I go there and I spend anything between 200 and 400,000 naira depending on how much I can afford at any given time, so I go there and I pack all that I like and can afford.

The road map of a Nation; this talks about a narrative of the first African road safety corps and see Wole Soyinka, a lot of people don’t know about Soyinka’s contributions to the well being of Nigeria, this is an evidence, and this is one of them; a book that chronicles his experience as the chairman of the Road Safety Corps at that time.

Then, there is a book; a collection of the greatest people on planet earth, titled Wisdom and you can see these are people from all over the world not just Africa and Wole Soyinka; Achebe, Nelson Mandela are some of the Africans featured in this book titled Wisdom. They lifted quotes from them I’m always proud to see Africans who are doing great things.

This is one of my favorite; The Jero Plays – The Trial of Brother Jero, I’m sure anyone of you who ever studied literature would have come across the play; it is such a comedy very very funny, and in two parts. The second part is Jero’s Metamorphosis. This was published many many many many years ago. I have several copies of it. It was published by Spectrum Books in Ibadan. If you remember Spectrum books owned by Luke Beckhout. I think he was from the Netherlands, but settled in Ibadan – a very very great man.

There waa also Poems of Black Africa, edited by Wole Soyinka. I don’t know how he found time to do so many things we haven’t even reached half of the books I have here and this is just in this library alone. I have his works in my other libraries. This book unfortunately I didn’t write the date but it was published originally in 1975. I left secondary school in 1976. There is so much to read here, I’m happy that I still have it, I’ve bought some of newer editions of it, there are books, there are books I’ve bought several times, this is one of my favorite play by Wole Soyinka, A Play of Giants. I don’t know if any of you have seen it. You can see how much I love reading Soyinka. So, when someone say Dele you are a good writer I say a good writer ke? I am learning from the masters. I will talk about my earliest encounters with him and all that.

African Literature Today, Retrospect And Prospect was edited by Eldred Durosimi Jones. This is quite ancient and of course there is no way an athology would not feature Wole Soyinka. I bought this one can you believe it in 1984, I bought this and you can see some of the writers featured in this; they include Wole Soyinka, Inechita Opewu Omotosho Nwangi that’s Neja Marichira Ayikoyama, Chinua Achibe and Ngugi Wa thiong’o. You can see Soyinka, if there is one professor who truly merited being called a professor that man is Wole Soyinka ah before our very eyes is a collection of tribute when Soyinka won Nobel Prize. I think he won in October 1986 yes, think October 1986. A lot of people came together, one of his best friends late Femi Johnson wrote about him; Bola Ige wrote about him, Ifogale Amata wrote about him, Ale Richard Agufolare, Michael Etherton, Wale Ogunyemi, Tunji Oyelano, you remember the Benders, Yemi Ogunbiyi, Olumuyiwa Awe; yes those were co-founders of the Pirate Confraternity now known as the National Association of Sea Dogs; Olabimpe Aboyade, I’m sure that’s the Liberian, David Cook, Joel Adedeji, Brown Crow, Dapo Adeluba so they did their tribute to Wole Soyinka. They called it, Before Our Very Eyes.

Then, we have Wole Soyinka this was published by Cambridge Studies in African and Caribbean literature and it was authored by Biodun Jeyifo, who was my teacher. I can never forget Professor Biodun Jeyifo. Some people used to call him Jai Force. He also grew up in Ibadan just like Wole Soyinka and the rest of them at that time, and this is a book I was reading last night. It is very very powerful. Professor Jeyifo was at Cornell in the USA university; he was at Cornell and is one of the greatest African critics of African Literature. I was proud to have passed through him I remember he taught us a course called Name Dropping that anybody who is a student of literature must be able to name drop that’s why I’m able to name drop today because I studied literature greedily, voraciously and endlessly, and still buying works of literature; and what did he mean by Name Dropping? Name Dropping is that you should be able to mention the writers you have read. Before I started travelling all over the world, I first encountered those countries on the pages of literature. Kenya for example, I encountered Ngugi Wa thiong’o . I encountered in Cameroon, Mongo Beti and I have them in my library. I also encountered Fernando Yono, and Mbela Soridipoko. As a young man in Ghana, I encountered Kofi Awoonor. His book that I enjoyed the most was This Earth, My Brother unfortunately he was murdered by terrorist in Kenya a few years ago, but I’m proud that I was able to endow an African poetry competition at the University of Ghana in his name and later I was also supported by other people. Then Ayi Kwei Ama is actually my number one Ghanaian author. He wrote The Beautiful Ones Are Not Yet Born. He wrote Why Are We So Blest? I think he wrote A Thousand Seasons. Then of course, Achebe, when it comes to novels is the father of them all nobody nobody can compete with Chinua Achebe’s Things Fall Apart translated into countless languages in the world. A Man of The People, No Longer At Ease, Arrow Of God and many others.

This is Wole Soyinka’s Ake; the years of Childhood. He captures his childhood in this book, and I have different versions of it. I think this is one of the recent versions or editions. Interventions volume 3 the Unappeasable Price of Appeasement. I told you that Wole Soyinka’s language can be very tedious. This is one of his recent works interventions, and I must say kudos to Book Craft in Ibadan, they are responsible for most of them. If you go to book sellers at Jericho in Ibadan you will find almost 100% of Wole Soyinka’s works. I don’t know how they’ve managed to get the permission and the copyright to publish. It’s a great thing they have done the books are of the highest quality.

This is another one; Wole Soyinka’s Interventions Volume Six. The last one I show you was volume 3. This is volume six. I have it this is double I actually have two of this; Interventions One And Two. You can see they are double and they are packed together interventions. I have enough books to last me several lifetimes, but I will never get tired of buying and reading.

This is Politics of Soyinka written by Tunde Adeniran. I love the illustrations, I love the covers. They are world-class, and it’s also from Book Craft in Ibadan.

This is the earliest Ake. This is his autobiography. This is the earliest one I bought let me see if I wrote the date on it you believe it, this book must be older than many of those who are watching me right now. I bought it on 26 November 1986, and it was N16.50k. This is interesting. 1986 how many years would that be Oh my God. I’m sure almost 40 years. You can see how long I’ve been a great fan.

This book is so old that even the cover is lost. Do you know this book, for me, is my number one book. One of the books that introduced me to radicalism in Nigeria. The Man Died by Wole Soyinka but the back cover is still intact. I bought this book on 21st June 1978. Can you believe it? That was the year I entered the University of Ife. I entered around July 1978 and I already bought this book even before my matriculation. You can see my love for Wole Soyinka.

Now Wole Soyinka is so versatile he did not only write in English, he understood Yoruba very well and he translated the greatest Yoruba novel of all time by Obgojuode Ninu Igbo Irunmole, DO Fagunwa – Daniel Olonfemi Fagnwa; he translated it as The Forest of A Thousand Daemons – this is the book if you want to read and laugh please this is one book you must buy and read.

Wole Soyinka again collected plays; he wrote so many plays you won’t believe it in this collection by Oxford paper bags at that time; this book was two pounds ninety five pence. I bought it 17th December 1986. I was doing my masters then I was in the department of Literature in English so this place include The Lion And The Jewel, Kongi’s Harvest, The Trials of Brother Jero, Jero’s Metamorphosis, Madmen and Specialist – I have them. We, in our time, read a lot.

Again my former professor, my big brother professor Biodon, Essays in the Sociology of African Drama. The truthful is there is no way you can talk about African drama and Wole Soyinka will not feature prominently.

This just came out wow can you believe this look at my beauty handwriting this was part of my courses as a post graduate student at then University of Ife; now Obafemi Awolowo University. This is literature 406. I can’t remember who took it, but I believe it might be Professor Adebayo Williams. In those days, we didn’t have computer – it was handwritten. The topic was The Embodiment Of Political And Ideological Ideas In African Literature, and look at my writing, can you believe this? Can you see how neat my writing was, and of course you have to show your references where you got your fact from so this was a course work at that time and look at the paper we use and it’s still intact. It is still intact. This is interesting. I’m so excited to see this. I can’t believe and I’m reading the comments of the lecturer “beware cliché” I used a word blood chilling and he commented, then he was the alpha to omega. I don’t know what he gave me. Interesting. We thank God. We thank God. I will keep this very well. This very well so I don’t know of anybody who can compete with Wole Soyinka. Look can you see how voluminous this book is. This is Wole Soyinka’s Power and Freedom. Can you see how big this book is? Let me see how many pages. This man I don’t know well don’t let him say I don’t know how he writes. I was on a fight with him about two years ago, from Lagos to Istanbul in Turkey and while I will doze off whenever I woke up I will look he was sitting on the right of the plane I was on the left of the plane he was busy drinking his red wine and he was busy typing that’s Special Wole Soyinka’s for you so you can see this book, I got it from Ibadan recently. I didn’t write the date I have to start writing dates again. We haven’t finished; look at this one again of power and freedom. There is volume one, and there’s volume two, there is nobody who has done this in Africa but I must salute Book Craft again for a job well done so this is the volume two with about 420 pages or thereabouts.

Again, You Must Set Forth at Dawn. You know when a man had lived 90 years he has a lot to say by himself so this is another one and the book is 557 pages. Can you believe that.

I don’t know how anybody could have written all these essays but remember the man have survived 90 years. So that is Ibadan. This is one of his famous biographies again, The Penkelemesi Years. You know he started his journey at Government College before University of Ibadan before proceeding to the University of Lead. So, that’s what I have in house today.

I describe him as the most prolific. I hope you now agree with me if we all agree please let’s all give him an applause. He deserves our applause, you can give him thumbs up, you can wave, you can send him your love.

On July 13, this great man of the 20th and the 21st century will be turning 90 by the grace of Almighty God. I pray that when he turns 100, I will be here to show you more of his work because he is still productive, he is still lecturing, he still flies all over the world.

Days ago, he was honored in Morocco, he still lectures, goes to University of Abu Dhabi in the United Arab Emirates. He is traveling all over the world, and has not slowed down at all and I thank God for his life.

So, let us now go into the nitty gritty of my encounters with Wole Soyinka. One of my earliest recollection was at the then University of Ife. As you found out in that book, The Man Died. The day I bought that book was one of my happiest days on earth because as I said it introduced me to radical literature and everybody wanted to be like Wole Soyinka; later people wanted to be like Fela but I wanted to be a Soyinka. I wanted to write like him. I wanted to speak like him but of course there’s only one Wole Soyinka in this generation none other like him. I studied anything. I stand on him. I remember there was a time when the Kalakuta Republic was blown apart by the government of Nigeria, he sent a telegram message to Fela at the time, and that was the first time I heard his kind of English; sincere sympathies, yourself and all injured during the destruction of your own indignity at chilling cynicism of police invasion. I’m like what is this man writing in this telegram and so I started following him. Then I read The Man Died, and I saw how he suffered in prison and I saw you know how there was no love lost between himself and the then Head of State, General Yakubu Gowon. I read everything. His novels I found too difficult; there were two of them at the time The Interpreters and A Season Of Anomy The Interpreters I always stopped I think at page 71 when I get to the part where it says of isms I detch this day from homeophatic mandism to existentialism I say like we don’t come and scatter my brain you know and I will just put it. It took me so many attempts ah before I could pass beyond that page of isms. I touched this day from homeophatic narcissism to existentialism.

Then a Season of Anomy was truly a season of anomy cause it was a book of confusion and it confused me endlessly. But I enjoyed his place especially the Trials of Brother Jero, Jero’s Metamorphosis, Death and the Kings Horseman, Kog’is Harvest, a Dance of the Forest, Madmen and Specialist, you know, a player of the giants, Opera Moyosi, to beg is to buy, not his to lag, behind most successful men is our history of foolsome men, it’s not such a shame if you wish to make a name, learn how to butter up, how to be a sucker up, you know we will and then I love my country. I no go lie na inside down I go live and die I love my country. I no go lie na him and me go see till I die. Ethical revolution, you know he criticized so many governments and he paid dearly for it.

Then I don’t know what to call him whether he’s an animist definitely not a Christian. One of my highest encounters with him would have been between 1978 and 1979, he invited his friends and fellow writers from Uganda and Malawi. The man from Uganda who was my teacher, he came on exchange program to the university of Ife. He taught me how to drink while sudden literature the man was so radical may God bless his soul. The other was professor David Rubadiri who came from Malawi. I was very close to all of them because I was quite fascinated about their lifestyle and I moved with them went to their houses and you know they were very free and they made us enjoy literature. So, one day we were invited by Ebu Jakande; my very dear friend and sister she’s now of blessed memory. Ebu Jakonde invited us to watch bishop she was an issue despite the fact that the father was Alhaji Lateef Jakode. She invited us to ah the sports center it was on the field filled to capacity and she had invited Wole Soyinka and I and other friends of ours to the crusade by Bishop Benson Idahosa and you know the bishop will ask those who I mean something like an altar call what we call alter call today we say those who have accepted Jesus Christ should come forward and people this mammoth crowd will go towards the stage then he say go back to your seat and they will all come back to me and Wole Soyinka shook his head and said this is mass hypnotism. I was laughing and everything and when I was going home. I was leaving with my brother Professor Deli Ajayi on Road Nine of the staff quarters at the time so he gave me a ride and you know when we got there he knew my brother and I told him he was home so he came briefly upstairs and we’re talking African politics talking about Ideami, Dada, the then head of state of Uganda. So, I got radicalized, I started reading about Pana Africanism, I read the works of the Osajifo in Ghana, Dr Kwame Nkuma, I read about the Nwalimu, Julius Nyri, Doctor Julius Nyri in Tanzania I read about Walter Rodney, the Guyanese writer, I read Anukabra, I read France Fanon, I read voraciously and the influence came from knowing the show he cast. Ife paraded the best of the best at the time, Koli Omotosho who also died recently, we had uncle Yemi Ogunbi is still going strong. We had prophet or what they have been bothered the authority on Ifa professor Akinwunmi Ishola; the playwright and novelist in Yoruba who was my direct supervisor. We had Karen Baba; a British professor of Yoruba who came and specialized in Oriki, Orile. The influence of Wole Soyinka at that time was all pervasive because everybody and Wole Soyinka had like a jeep an open jeep which was you know when he’s driving and you see his hairy head you know everybody wanted to touch him. For us, he was Christ like; he was the Christ of literature what people call the God of literature. His favorite deity is Ogun the God of iron and all of us. I had a shrine in my in my room when I was at the university office and I was using that shrine to everybody. People thought I had juju but it was a way of creating ah a mistake around myself I remember later became you know a rain catcher, I will subcontract the rain catching to Babalawos all this juju people in town and because I was studying Yoruba so people believed me and the influence came from people like Soyinka who used to speak about Ogun and all those esoteric Gods of the Yoruba. We had them we had them in Ife and then Soyinka hardly stayed long on campus because he was wanted all over the world he was always going from country to country and I don’t know if there is any country he hasn’t visited in his life. He’s really lived life to the fullest. He’s lived several lifetimes even if you give him 200 years, and I don’t think some people can catch up ah with him. So that that that is eh how I started this journey with Wole Soyinka. Yes we all know him as a hunter he loves to carry his gun. I’m told even on his birthday he’s likely to be in a bush somewhere looking for Aparo to kill. The partridge he will go in search and he’s a very good sharp shooter he knows how to get and after killing Aparo, they will make a bonfire and roast the poor innocent Aparo. Then, they wash down with one of his favorite wines once he visited my house in London during the Alaafi of Oyo Saga. When the Alaafi was arrested in London Press. I contacted him that we needed his help to get baba out of trouble and he was so humble enough to come to my house at that time. I was staying somewhere in Amsterdam East just next to the Royal Free Hospital in London and he came and so I asked one of his sons what his favorite drink was and he said Jacob’s Creek so I went in search of the wine and made sure I had enough of Jacob’s creek by the time Prof arrived my place. I had so many other encounters when he was with the Road Safety, there was a time some people wrote nasty things about him and so a few of us were sent to him to meet with him and to ask questions in Ibadan but he was in Abeokuta so we went to see him I think somewhere called Lalubu. I think that’s where his office was; opposite a bank in Abeokuta. So we went to Lalubu to see him and he actually wrote a note to the bank that they should open his account to us if people didn’t believe that he did not steal money such transparency is very rare. I don’t think anybody will do that today he wrote to the bank and said the bank should open up his account to us he waived the confidentiality of a banker to a customer and so my respect for him quadrupled. His life is very very simple, very easy, you won’t see him drive a Rolls Royce or buy a Lamborghini but he flies. He likes to travel extensively he’s wanted all over the world everybody wants to have him as a guest speaker; a guest lecturer; a special guest of honor. Yes, we’ve also had our very tense moment, when he fought me. For example, when we were going to start the Weekend Concord newspaper in 1989 my editor Mr Mike Awoyinfa sent me to go and find a story that can be the maiden cover for that newspaper who were ah the pioneer team so Mr Mike Awoyinfa was the editor Mr Dinba Igwe of Blessed Memory was the deputy editor. I later became the news editor and the number three in Nair key ah but so I went away and I came back with an interview with Mrs Laide Soyinka that interview was so explosive my love life with Soyinka and if you know Wole Soyinka he doesn’t like people prying it to his privacy and he got so so angry. Then to cap it up, I also did an interview with his son Ilemake who was a student then at the university of Ife and that infuriated him the more. And I remember on one occasion he send me a handwritten note at Concord that I should come and see him at the Gbagada office of the Federal Road Safety call and I went there and he lambasted me so much that day am I owing your family anything or why are you always writing about me you know and eh I said no now I’m just looking for a good story and it seems your story is always a best seller and he said I’m warning you the next time you do it, I’m going to flog. We called him Bros Kungi you know the dictator you know the man is a very tough man but I could see he likes me and you know whatever I did to irritate him he will just give me a warning we had another fight me and his son we quarreled over some issues and I lambasted his son and also brought in Wole Soyinka name which got him very angry. So the next time I saw him was at the Muritala Mohammed International Airport in Lagos and I went to greet him and he did like this you stupid boy, you stupid boy, stop doing what she do to me you know so sometimes. I just either deliberately or inadvertently you know irritate him but whenever we met everything would have melted. I like people who can speak their mind, if you offend a man instead of keeping malice and things no Wole Soyinka will tell you as it is and that’s it, and once want to say I’m sorry sir then you are free to go. So as he celebrates 90 years one of my prayers for him is that the medical world would find a way of cloning such brains. I can’t imagine the world losing such a brain. So I’m hoping that medicine or technology now in this era of artificial intelligence maybe they will be able to clone his brains and preserve it for humanity I think we’ve done almost one hour. So tonight is entirely dedicated to Professor Wole Soyinka. I think tomorrow I will try to read from some of his works that we have here I was hoping I could go to my library in Ibadan today but unfortunately I couldn’t make it. I don’t know if I can make it tomorrow or any other time I wanted to bring in a lot of his works so that ah for the next couple of days you and I can go through ah those works together but I’m happy that you all joined me.

I was never a member of the pirates confraternity. I had nothing against them. I had a lot of my friends who were members but I was a one-man mafia. I had my own mafia in my room with. I was talking to you about the rain catching. Yes, one man who should be watching me right now is Senator Bruce because he keeps saying that I’m still owing him money he brought shalama to perform in Ife you remember the American artist Shalama he brought Kai and I think the one was Whispers and on the day of the Whisper on the day of Shalama there was no problem on the day of sky there was no problem but the day of whispers ah so I went to the Babalawo in town to tell them that rain must not fall and they collected my money and a bottle of Shinap’s drink you know and they gave me a juju that I should go to the back of the venue which was the university amphitheater which could sit maybe about two, three thousand. And as I was bending down to bury the juju I just felt a breeze before I could say Jack Robinson rain started falling. I put my bada on my head and started running away and the students went to rampage they were so angry and so Ben Bruce and his people lost a lot of money but me had already collected my rain money and which I’ve not refunded. So I’m apologizing to him publicly that he shouldn’t collect that money because I think time has passed anyway it’s been a few decades since then you know but that that’s the way omo boy suffered school now. You have to eh if you don’t have rich parents you have to find something doing you know to keep body and soul together. I was able to survive the university you know by some people don’t know my story, they think I just woke up and then one day everything started happening for me you know I’m a struggler and I’m still struggling. Now all I have is contentment and that is why I’ve never been in any government I’ve been in opposition. I look at someone like Soyinka apart from his sacrifice at road safety call he’s never been in government he’s never been in government and he’s probably one of the most successful Africans of all time. I must correct something, I’ve read somewhere where people say Soyinka is the only ah Nobel Prize winner for literature. It is not true that Nagu Nagui Mafus the Egyptian author Nagu Mafu I’m sure I have his book somewhere in my library he is yeah he won the Nobel Prize around I think 8 nine Wole Soyinka won in 1986, I think Nagui Mafus won in 89, but I remember I wrote an article about him in Weekend Concord which was published by my editor Mr Mike Awoyinfa my boss, for life. I love him if he’s watching I love you sir. I love you. I will tell and find the book by Naguri Mafus because Africans must learn to read. For me there is no food sweeter than reading literature and in our time we read anything whether you are William Shakespeare, you are Chosa, you are Thomas Payne, you are Kenneth Kawunda, you are Alex Laguma, I was seeing a lot of those books last night you know Elechi Amadi you know TM Aluko, we we read, we read books. You know, say who are these other guys ah yeah I enjoyed Nurudeen Farah. The day I met Nurudin Farah I thought my God it was like suddenly working into an angel no because they were larger than life and we all wanted to be like them these days everybody wants to be like rich men you know but the rich men didn’t get there overnight. Michael Adenuga. I read about him all the time I read about Dangote. I read about Otedola and this one people have known for decades and I know that life is not easy still working harder than some of us we must keep working even when you say oh you don’t have a job you can think of something I just told you now how I was a rain catcher although I wouldn’t catch all the rain in the world but at least I made an effort. You must make an effort to do what you need to do and eh eventually God will bless your hustle. And when God blesses your hustle you must still not fall asleep God like Chief MKO Abiola used to tell us you know poverty is a very stubborn goat so the cane you use to chase it away keep it handy because poverty will always come back and when it come back you beat it again and chase it away. And the only way you can chase away poverty is when you work you keep working don’t give up.

I don’t know if there are questions. I can take a few questions and then we can call it a night so we can go and sleep Jackie Asamwa. Oh yeah so I’m waiting if you have any questions please fire on the topic tonight is Wole Soyinka at 90 is not easy for anybody to get to 90 and still be in good health in good shape you know mentally fit, mentally alert, physically able, it’s not easy. I tap into his grace I really tap into it.

Oh, I’m happy you are inspired. Thank you. I’m happy.

I should recommend books for you maybe you have to watch this again. I’m going to save it and put it on my Facebook and Instagram pages so you can watch it again. I’ve mentioned so many books tonight. I love philosophical works. I read a lot of Bethran Russell. He was my favorite and Thomas Payne, they were my favorite; let me see if I can grab or two of their works.

I spoke about Nagui Mafus the Egyptian author that I said also won the Nobel Prize and found one of his books now this is Nagui Mafus the Egyptian. I can’t believe the book I bought this in 1991 this was before I went into exile wow 1991 this is the book by Nagri Mathros and this is the book; one of this is my favorite philosopher Bethran Russell. My favorite book of his is titled Why I am not a Christian; it’s a book that you can find you should read then. Also, Thomas Payne’s The Age Of Reason Or The Rights Of Man. Those are books that you can read. They may test your faith, but it is worth reading. I can see Kamala, I have so many books here, incredible. I have a lot of books on Donald Trump. I read a lot of biographies. I have a lot of books here on Chinua Achebe. I have Things Fall Apart here. I have books by TM Aluko. I have Chief Olusegun Osoba who is launching another book this Saturday by the grace of God. I’m looking forward to getting my copy. I see books by the great poet, professor Niyi Osundare I have his works. I have books on Ibadan, by Professor Toyi Falola, one of the greatest historians ever to come out of Africa.

So they are all here. Of course I have volumes and volumes of books by Baba Olusegun Obasanjo. Every time I look through my library I find a new in another book by Wole Soyinka. It’s unbelievable that will tell you how prolific he is. I’ve just seen one now, which is very voluminous too, wow. Chronicles Of The Happiest People On Earth; a novel by Wole Soyinka. This must be one of the his most sweetened novels can you see I haven’t even read it can you see? This is incredible, how many pages? How does he find time to read this? I like to write I wonder how many hours he sleeps? It’s good I’m seeing this book can you believe this the works by Wole Soyinka the recent ones of power and freedom 2021, collected poem, 2020 one prose and fiction, Season of Anomy 1973, the Interpreters 1965, then his memoirs, You Must Set Forth at Dawn 2006 Ibadan the Penkelemes Years; a memoir 1946 to 1965; he released that in 1990 four Ishara, a Voyage Around Ese 1988, Ake, the Years of Childhood 1981 Ishara was 1988 Ake was, 1981 that’s 7 years earlier. The Man Died prison notes of Wole Soyinka was 1971 essays and non fiction beyond aesthetics 2019, climate of fear 2004, Salutation To The Gut 2002, the seven signed post of existence knowledge honor justice and other virtues to thousand, year 2000. The burden of memory, the muse of forgiveness, 1999. The open soul of a continent, a personal narrative of the Nigerian crisis, 1997. The cradle of being and nothingness, 1993. Miss literature and the African world, 1990. Art dialogue and outrage, I have that too. Essays on Literature and Culture, 1988. Miss Literature and the African world 1976, a Shuttle in the Creek 1972, a democracy intervention series a democracy day primer 2019, queen custody it so custody that needs unfinished business 2018, the republic shrink back 2017, a personal Odessey 2 2017, a personal Odessey in the Republic of Liar 2015, power hydropons and other toxic mutation 2013, the unappeasable, price of appeasement 2011, justice; funeral rights 2010, we the people 2010, caught a people in denial 2010, in a lighter vein 2010, of power 2010, we make our world that 2010.

I don’t know what happened to him where he got his inspiration from ad he produced so many works will make our world 2010 Ghanaian bridging the regeneration gap 2010, therefore anything to do with slavery 2010, therefore cartoons and other images of race 2010, corruption it’s dimension 2010, Festac agonites 2010, Kun Barakuns and Barak a king a syndrome 2010, civilization dead or alive 2010, lessons from the Iruke a plea for the aesthetic encampus life 2010, poetry a humanist hold for Chibok Leah 2019, early poems 1998, Mandela’s F and other poems 1988, Okun Abibiman 1976 poems of black Africa 1975, poems from Prison 1967-69, Idanre another point 1977, Alapata Apata he play for Yoruba Phonia class for Senophils 2011, the back eye of Euripedis. I read that at the university in communion right 2004, King Babu he played the manner Rufus Alfred Jari 2002, the beautification of area boy, a Lagosian 1995, from there with love 1992, requiem for a futurologist 1998, five a player of giants 1984, Opera Woyosi 1981. I was still a defendant, death and the king’s horseman 1975, Jero’s Metamorphosis 1973, Camwood on the list 1973, the back eye of a communal right 1973, madmen and specialist 1971, Before the Blackout 1971, Kongi’s Harvest 1970, The Trials of Brother Jero 1969, The Row 1965, A Dance of the Forest 1962, The Lion and the Jewel 1962, The Invention 1957 films and documentaries blues for a prodigal 1985, verse 1970, Joshua in Nigerian portrait 1963. But he didn’t write about his music and his stage play which have been performed globally.

Playwright, poet, author, teacher and political activist, WOLE SOYINKA became the first African to receive a Nobel Prize for Literature in 1986.

Born Akiwande Oluwole Babatunde Soyinka on July 13, 1934 in Abeokuta Western Nigeria, his father Samuel Ayole Soyinka was a prominent Anglican minister and headmaster while his mother Grace Enola Soyinka whom he nicknamed Wild Christian was a shopkeeper and local activist.

As a child, Wole Soyinka was precautious and inquisitive. He lived in an Anglican mission compound learning the Christian teachings of his parents as well as the Yoruba spiritualism and tribal customs of his grandfather.

After completing preparatory university studies in 1964 as government college in Ibadan, Shuika moved to England and continued his education at the University of Leeds where he served as the editor of the schools magazine The Eagle. He graduated with a bachelor’s degree in English Literature in 1958. In 1972, the university awarded him an honorary doctorate. In the late 1950s, Soyinka wrote his first important play, A Dance Of The Forest which staturized the Nigerian political elite. From 1958 to 909, Soyinka was a dramatologist at the Royal Court Theatre in London. In 1960, he was awarded a rocky fellowship and returned to Nigeria to study African drama.

At the same time he taught drama and literature at various universities in Ibadan Lagos and Ife. In 1960, he founded the theater group the 1960 masks and in 1964 company in which he produced his own place and performed as an actor.

During the civil war in Nigeria, Wole Soyinka appealed in an article for ceasefire and was arrested in 1967 accused of siding with the Biafra rebel this is what I was telling my Igbo friends that please whatever you don’t know about, you can go and read his history very well, read everything during the Biafra war. He was held as a political prisoner for 22 months. A few years after, his release he published a book chronicling the experience titled The Man Died which I have here the prison notes of Wole Soyinka through his works of fiction poetry place and mostly non fiction.

Soyinka has documented the struggles of his homeland, Nigeria, the African continent and the world at large. He has periodically been a visiting professor at the universities in Europe, North America and the far east.

To this day, Wole Soyinka continues to write and remains an uncompromising critic of corruption and oppression where he finds them.

We thank God always. So that’s the story of one man Professor Wole Soyinka. I’m sure if I look there again, I will see a lot of other works but I know I have a lot of his books in my library in Ibadan. I will probably have some in Ikeja GRA as well in Lagos.

So I’m reaching you live from the home office, Lagos. So, if you have any question please go ahead let’s fire it and let’s answer it.

I heard there was a hurricane in Houston, Texas, is that true? I hope you are very safe, you are okay, your family, everyone is fine.

Does anyone want to join me? Please indicate if you want to. Yes. Inkles vehicles, I’ve missed you, I’ve missed Houston, Texas, I can’t wait to come back. I don’t know maybe when I go to Canada in September. I may choose to come briefly to see you in Houston Texas it is well when next am I coming to Chicago. I think I was in Chicago last year. I don’t know you know eh you have about 50 or more states to cover in the US so it’s always difficult last month I was in Washington DC so I just left Washington but most times I passed to New York Atlanta Houston Dallas I haven’t been in Los Angeles in a long time think my time in Los Angeles was when I went for the funeral of my hero; one of my greatest heroes was Michael Jackson. I attended his funeral at the Staples Center, Los Angeles.

So, if you have question, if you don’t have question, let’s go and sleep. Let’s go and sleep. Anyone who wants to join me should please indicate you sent questions, I can’t see them, where are they? Can’t see your questions yes oh so we can go to our usual dinner dinner joint. They have good food. In Houston, Texas. We can actually do our dinner at Saint Regis. I know they normally give us dodo yeah imagine a five star hotel they serve dodo it’s so nice. I don’t know where they get their odo from and it’s so so nice. I love dodo.

Do I think Atiku will contest in twenty twenty seven?

Why not? I’m a democrat I don’t and I’m not in a position to disqualify anybody; everybody has a right to contest and Nigerians have the right to vote or not to vote, but for you to say oh somebody should step down his own ambition when you know you have capacity you know so and if you don’t want it then don’t vote for him – it will be unfair to ask someone not to exercise his right.

So that’s the only question I have seen there I haven’t seen any other question. My take on the new ministry, another waste of resources. I think I don’t know if the president is being advised or is the one just taking his big decisions. I don’t understand I don’t understand so why create more ministries when you should even merge; you have ministry of agriculture; you have everything already; you should just merge some of the ministries who associate cause now you are going to have a new minister you are going to have permanent secretary you are going to have civil servants you are going to have special assistant something definitely is wrong with this government I’m sorry but when you advise they say you are criticizing them so.

Okay, I’m seeing a question now on

Facebook. Sir of all the books written by professor Soyinka some were for knowledge, and some were to read to pass exams what is the impact of that of the road safety and shouldn’t it be to review re-edit and republish since we have more complex roads and users technologies and other.

Well, he wrote about his own time and his experience so he might not be too conversant with the current experience so it’s okay it played his part let others also write Osita Chidoka can write you know our friends you know Kayode Olagunju you know these are brilliant guy they they can write about their own experience and we shall read them okay 2000 is says good evening sir my question is with all your tight schedule how do you have time to read all this it’s all about balancing and your love my passion is about reading and I love literature a lot literature philosophy religion sociology I just love them too much so most times you are reading different books simultaneously you read one chapter here you put it down you pick another book you read another I have books like that that I’m reading and now books are coming everyday I have a book from my Godfather doctor Bode Rajumoke which he just launched ah less than two yeah less than two two weeks ago so these are books these are books there are so many books to read I just acquire and acquire and acquire and eh for me it also keeps me away from boredom it keeps me away from trouble and it exposes your heart to knowledge knowledge is power everyone should try and read biographies read I have a lot of books here on Chief Awolo by Chief Awolo I mean he’s a man who had always intrigued me and eh so I want to know how they did it I may say I won’t be president what if tomorrow I’m president and I’m not prepared and I don’t even know the history of Nigeria that’s what happens to a lot of our leaders

They are busy fighting to win election but they are not fighting for knowledge they are not fighting to read about Nigeria they don’t even know the problems of Nigeria so when they get there they are doing trial and error and they don’t get it they don’t get it ah these days people refuse to and it’s so easy to read these days because you can buy you don’t need to even buy books you can go online you know go to Kindle go to all kinds of platforms and you will have access to knowledge eh you want to read or you want to watch interviews go on YouTube you know so that’s the way it is who you are Oluwawa

I can’t see anything again.

Is well it is well. it is well oh Mm. So I guess I have to go now. We’ve tried, we’ve done over 90 minutes. If you have no more questions, please let’s go and sleep.

Yeah everybody has a right to contest and not to contest but you cannot ask anybody not to exercise his democratic rights that’s what I’m saying so he hasn’t told me he wants to contest but I don’t see why he cannot you know once you have good health your brains are intact he is a very experienced very exposed administrator he doesn’t support thuggery, and he’s not controlling any state in Nigeria; he’s managing his businesses That for me, is good.

Okay.

So how did Atiku make his wealth oh he started business as a young man that is not to say that he’s a saint, you are not a saint I’m not a saint but like I said he doesn’t control any state, and he left government since 2007. He invested heavily in Nigeria and elsewhere so which is better than being a full time politician who doesn’t do any business who doesn’t do anything, he’s cool he’s one of the best in Nigeria today that somebody who has a business agreement you have to give it to him and respect him that is the way… ahead of a lot of our politicians. You will not go to his house and meet thugs outside waiting for anybody, never. So these are things I admire in people but we are all free to choose whoever we want I haven’t told you to support anybody you may measure Ojola.

I don’t think I can see anything new again, so let me go.

He made his money through corruption if you say so; if a man left government in 2007 and he’s still employing so many thousands of Nigerians today, you should give him kudos. The others who left with him what have they done with their own money you guys just come on social media, and all you do is abuse people. It is well.

Is it compulsory he becomes president why not, if God says he will be president, he will be president. I believe in destiny, so there is nothing wrong with that. Nothing is wrong with that.

Let’s play some music by Shina Peters before I go.

We thank God. So, it’s two hours now since we started this journey and celebration of Professor Wole Soyinka then ending up with Sir Shina Peters playing for Governor Ademola Adeleke. I think it’s been a good night for all on this program. I look forward to see you again sometime tomorrow. Inshallah.

God bless you all.

Good night.

Related

Foreign Mercenaries Involved in Proposed Protest, Says IGP Egbetokun

Adeleke Has Neither Borrowed Nor Draw Security Votes in Running Osun, Says Spokesperson

Beware of ‘Full Blown Dictatorship, Dele Momodu Cautions Tinubu in New Letter

Glo 1 Celebrates Eight Years of Connectivity, Boosts Capacity

Friday Sermon: Monuments of Waste: Abandoned Projects and Ignoble Epitaphs of Corruption

Rotary International District 9112 Launches Coastal Restoration Initiative, Plants 1000 Coconut Trees in Lagos

Italian Oil Giant Eni Gets FG’s Approval to Sell Agip Oil to Oando

Nigerian Engineer Wins $500m Contract to Build Monorail Network in Iraq

WORLD EXCLUSIVE: Will Senate President, Bukola Saraki, Join Presidential Race?

World Exclusive: How Cabal, Corruption Stalled Mambilla Hydropower Project …The Abba Kyari, Fashola and Malami Connection Plus FG May Lose $2bn

Rehabilitation Comment: Sanwo-Olu’s Support Group Replies Ambode (Video)

Fashanu, Dolapo Awosika and Prophet Controversy: The Complete Story

Pendulum: Can Atiku Abubakar Defeat Muhammadu Buhari in 2019?

Pendulum: An Evening with Two Presidential Aspirants in Abuja

Who are the early favorites to win the NFL rushing title?

Boxing continues to knock itself out with bewildering, incorrect decisions

Steph Curry finally got the contract he deserves from the Warriors

Phillies’ Aaron Altherr makes mind-boggling barehanded play

The tremendous importance of owning a perfect piece of clothing

Trending

-

News6 years ago

News6 years agoNigerian Engineer Wins $500m Contract to Build Monorail Network in Iraq

-

Featured6 years ago

Featured6 years agoWORLD EXCLUSIVE: Will Senate President, Bukola Saraki, Join Presidential Race?

-

Boss Picks6 years ago

Boss Picks6 years agoWorld Exclusive: How Cabal, Corruption Stalled Mambilla Hydropower Project …The Abba Kyari, Fashola and Malami Connection Plus FG May Lose $2bn

-

Headline6 years ago

Headline6 years agoRehabilitation Comment: Sanwo-Olu’s Support Group Replies Ambode (Video)

-

Headline6 years ago

Headline6 years agoFashanu, Dolapo Awosika and Prophet Controversy: The Complete Story

-

Headline6 years ago

Headline6 years agoPendulum: Can Atiku Abubakar Defeat Muhammadu Buhari in 2019?

-

Headline6 years ago

Headline6 years agoPendulum: An Evening with Two Presidential Aspirants in Abuja

-

Headline6 years ago

Headline6 years ago2019: Parties’ Presidential Candidates Emerge (View Full List)