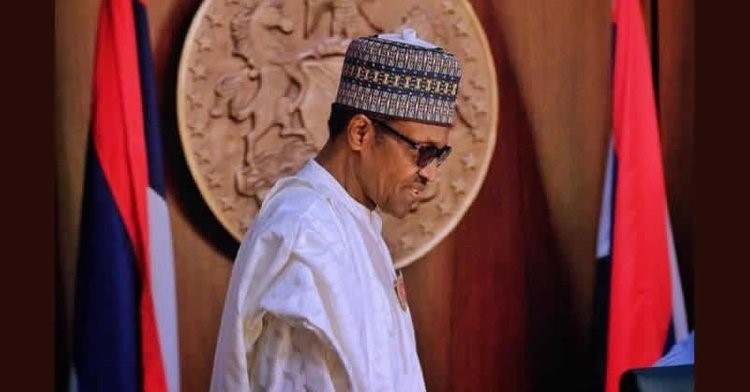

President Muhammadu Buhari has directed the Central Bank of Nigeria to blacklist any firm, its owner and top management caught smuggling or dumping any of the restricted 43 items into Nigeria.

The Presidential directive was disclosed by the CBN Governor, Mr. Godwin Emefiele on Friday in Abuja during a meeting with oil palm producers.

Emefiele also said the presidential directive mandated the apex bank to expand and provide support to firms and individuals that want to expand the production of ten different commodities in Nigeria.

The ten different products are rice, maize, cassava, tomatoes, cotton, oil palm, poultry, fish, livestock dairy and cocoa.

He disclosed that close to about N30 billion had already been disbursed to those currently involved in oil palm farming.

The apex bank governor said that for those coming newly into the oil business, credit facilities would be extended to them through their banks and that Out-Grower schemes would also be organised.

“We want to make everybody understand how serious we are and also to emphasise that what we are doing to stop the importation of oil palm into Nigeria is a presidential directive that must be adhered to.

“Doing this also means that while we are stopping the importation of palm oil, we must do all possible to ensure that palm oil production is aggressively increased in Nigeria.

“Like you all know, and I never cease talking about it that Nigeria in the 50’s and 60’s used to be the largest producer of oil palm in the world with a market share of 40 per cent.

“For one reason or the other, particularly because we found crude oil that even today by any analysis is cheaper than palm oil, we decided to abandon our God-given gift – palm oil.

“By doing that we lost jobs, our farmers lost jobs because we began to import palm oil from different parts of the world,” he said.

Emefiele said that the presidential directive also mandated CBN to expand and provide support to firms and individuals that wanted to expand the production of 10 different commodities in Nigeria.

The 10 products are rice, maize, cassava, tomatoes, cotton, oil palm, poultry, fish, livestock and cocoa.

Edo Governor, Mr Godwin Obaseki, who was at the meeting, said that 118,000 hectares of land had been identified for the oil palm programme in the state.

He said that 115,000 hectares would be used for the actual cultivation while three hectares would be used for infrastructure, including roads.

“Oil palm and other value crops like rubber, cocoa were the base on which the economy of this country was built at independence.

“If we are going to see real growth, we need to go back to those products where we have relatively competitive and comparative advantages.

“In the case of Edo, like I will say in the state, we have the advantage of being the home of oil palm in the country,” he said.

News6 years ago

News6 years ago

Featured6 years ago

Featured6 years ago

Boss Picks6 years ago

Boss Picks6 years ago

Headline6 years ago

Headline6 years ago

Headline6 years ago

Headline6 years ago

Headline5 years ago

Headline5 years ago

Headline6 years ago

Headline6 years ago

Headline6 years ago

Headline6 years ago