First Bank of Nigeria Limited, Nigeria’s premier and leading financial inclusion services provider has announced the fourth edition of its annual FirstGem Conference, tagged FirstGem 4.0. The 2021 event is themed ‘The Art of Negotiation’ and convened to provide women with insights on the secrets of wealth management, investment and savings. It is scheduled to hold on Wednesday, 31 March 2021. Participants are required to register via the link http://bit.ly/firstbankwebinar

The product, FirstGem, is an account designed specifically to meet the needs of women, aged 18 years and above. The product is targeted at a broad spectrum of women, working professionals, entrepreneurs or market women to promote their business through an array of benefits, from free business advisory services on business funding, specialized training on Business Development initiatives (online and physical), regular information or insights on business opportunities or openings in various sectors and industries. FirstGem account owners have access to mouth-watering discounts at merchant outlets (spas, salons, grocery stores) that offer lifestyle products and services.

The Guest Speakers at the event are Mrs. Ibukun Awosika – Chairman, Board of Directors, First Bank of Nigeria Limited; Prof Pedro Videla – Prof. of Economics at IESE Business School and Prof Mehta Kandarp, Senior Lecturer, IESE Business School. They would respectively speak on the topics; the theme of the International Women’s Day “Choose to Challenge”, the current state of the Global Economy and how it Impacts Business Decisions and Negotiation as a Tool for Winning in Business & Career.

During the event, FirstBank SME customers would be given the opportunity to pitch their business idea and stand a chance to get N1,000,000 seed fund to kick-start their business. The business ideas would be judged by the following criteria; Originality, Feasibility, Good presentation skills and Sustainability.

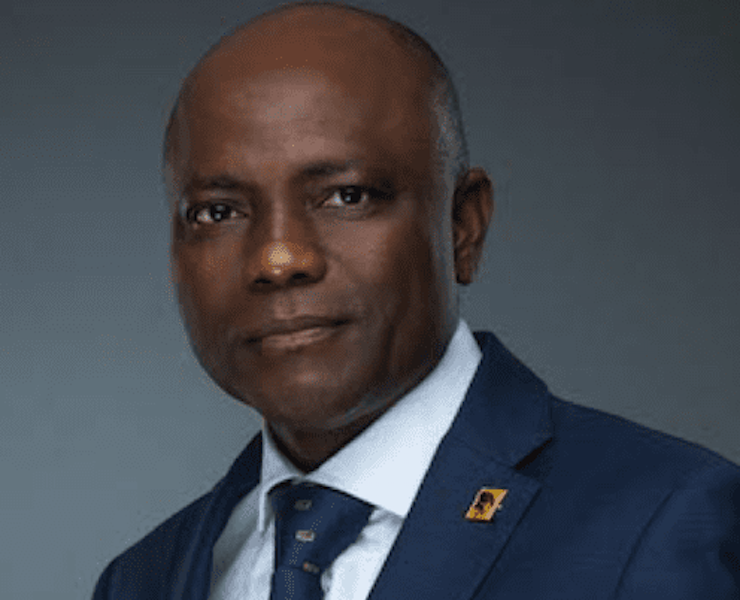

Speaking on the event, Mr. Francis Shobo, Deputy Managing Director, Firstbank said “The FirstGem 4.0 is the icing on the cake in the streams of initiatives and activities we have organised and participated in March as we join the world to celebrate women for the indelible roles they play in our society. Through these activities, we spearhead the call on the need to promote women inclusiveness in the country as the role they play towards the continued socio-economic growth and development of any given society cannot be overemphasized.”

Shedding light on the impact of the FirstGem account, he said “our FirstGem account is specifically designed to meet the financial needs of women as it offers unrivalled services that empower women to do more and achieve more. It seeks to drive financial development and the empowerment of women through gender engineered programmes. At FirstBank, we recognize that promoting female entrepreneurship and empowerment is crucial to a better society, “he concluded.

Since the product launch in October 2016, the Bank has implemented various activities targeted at promoting female empowerment, impact and influence in the economy. Through its online portal – designed to provide a virtual online community with over 61,293 members where like-minded women irrespective of where they are in Nigeria and abroad, gather to connect, grow and share knowledge on everything about lifestyle, motherhood, career development, entrepreneurship, health, work and family. We encourage all women to join the community by signing up via this link https://firstgem.com.ng/community to enjoy this experience.

FirstGem has successfully empowered women in states across the geo-political zones in Nigeria and the United Kingdom.

News6 years ago

News6 years ago

Featured6 years ago

Featured6 years ago

Boss Picks6 years ago

Boss Picks6 years ago

Headline6 years ago

Headline6 years ago

Headline6 years ago

Headline6 years ago

Headline5 years ago

Headline5 years ago

Headline6 years ago

Headline6 years ago

Headline6 years ago

Headline6 years ago