Featured

Buhari Presents 2020 Budget of Sustaining Growth and Job Creation (See Full Speech)

Published

5 years agoon

By

Eric

Budget of Sustaining Growth and Job Creation

Delivered By:

His Excellency, Muhammadu Buhari

President, Federal Republic of Nigeria

At the Joint Session of the National Assembly, Abuja

Tuesday, October 8, 2019

PROTOCOLS

1. I will start by asking you to pardon my voice. As you can hear, I have a cold as a result of working hard to meet your deadline!

2. I am delighted to present the 2020 Federal Budget Proposals to this Joint Session of the National Assembly, being my first budget presentation to this 9th National Assembly.

3. Before presenting the Budget, let me thank all of you Distinguished and Honourable Members of the National Assembly, for your avowed commitment to cooperate with the Executive to accelerate the pace of our socio-economic development and enhance the welfare of our people.

4. I will also once again thank all Nigerians, who have demonstrated confidence in our ability to deliver on our socio-economic development agenda, by re-electing this Administration with a mandate to Continue the Change. We remain resolutely committed to the actualization of our vision of a bright and prosperous future for all Nigerians.

5. During this address, I will present highlights of our budget proposals for the next fiscal year. The Honourable Minister of Finance, Budget and National Planning will provide full details of these proposals, subsequently.

OVERVIEW OF ECONOMIC DEVELOPMENTS IN 2019

6. The economic environment remains very challenging, globally. The International Monetary Fund expects global economic recovery to slow down from 3.6 percent in 2018 to 3.5 percent in 2020. This reflects uncertainties arising from security and trade tensions with attendant implications on commodity price volatility.

7. Nearer to home, however, Sub-Saharan Africa is projected to continue to grow from 3.1 percent in 2018 to 3.6 percent in 2020. This is driven by investor confidence, oil production recovery in key exporting countries, sustained strong agricultural production as well as public investment in non-dependent economies.

8. Mr. Senate President; Right Honourable Speaker; I am pleased to report that the Nigerian economy thus far has recorded nine consecutive quarters of GDP growth. Annual growth increased from 0.82 percent in 2017 to 1.93 percent in 2018, and 2.02 percent in the first half of 2019. The continuous recovery reflects our economy’s resilience and gives credence to the effectiveness of our economic policies thus far.

9. We also succeeded in significantly reducing inflation from a peak of 18.72 percent in January 2017, to 11.02 percent by August 2019. This was achieved through effective fiscal and monetary policy coordination, exchange rate stability and sensible management of our foreign exchange.

10. We have sustained accretion to our external reserves, which have risen from US$23 billion in October 2016 to about US$42.5 billion by August 2019. The increase is largely due to favourable prices of crude oil in the international market, minimal disruption of crude oil production given the stable security situation in the Niger Delta region and our import substitution drive, especially in key commodities.

11. The foreign exchange market has also remained stable due to the effective implementation of the Central Bank’s interventions to restore liquidity, improve access and discourage currency speculation. Special windows were created that enabled small businesses, investors and importers in priority economic sectors to have timely access to foreign exchange.

12. Furthermore, as a sign of increased investor confidence in our economy, there were remarkable inflows of foreign capital in the second quarter of 2019. The total value of capital imported into Nigeria increased from US$12 billion in the first half year of 2018 to US$14 billion for the same period in 2019.

PERFORMANCE OF THE 2019 BUDGET

13. Distinguished and Honourable Members of the National Assembly, you will recall that the 2019 ‘Budget of Continuity’ was based on a benchmark oil price of US$60 per barrel, oil production of 2.3 mbpd, and an exchange rate of N305 to the United States Dollar. Based on these parameters, we projected a deficit of N1.918 trillion or 1.37 percent of Gross Domestic Product.

14. As at June 2019, Federal Government’s actual aggregate revenue (excluding Government-Owned Enterprises) was N2.04 trillion. This revenue performance is only 58 percent of the 2019 Budget’s target due to the underperformance of both oil and non-oil revenue sources. Specifically, oil revenues were below target by 49 percent as at June 2019. This reflects the lower-than-projected oil production, deductions for cost under-recovery on supply of premium motor spirit (PMS), as well as higher expenditures on pipeline security/maintenance and Frontier exploration.

15. Daily oil production averaged 1.86 mbpd as at June 2019, as against the estimated 2.3 mbpd that was assumed. This shortfall was partly offset as the market price of Bonny Light crude oil averaged US$67.20 per barrel which was higher than the benchmark price of US$60.

16. Additionally, revenue projections from restructuring of Joint Venture Oil and Gas assets and enactment of new fiscal terms for Production Sharing Contracts did not materialize, as the enabling legislation for these reforms is yet to be passed into law.

17. The performance of non-oil taxes and independent revenues such as internally generated revenues were N614.57 billion and N217.84 billion, respectively.

18. Receipts from Value Added Tax were below expectations due to lower levels of activities in certain economic sectors, in the aftermath of national elections. Corporate taxes were affected by the seasonality of collections, which tend to peak in the second half of the calendar year.

19. On the expenditure side, 2019 Budget implementation was also hindered by the combination of delay in its approval and the underperformance of revenue collections. As such, only recurrent expenditure items have been implemented substantially. Of the prorated expenditure of N4.46 trillion budgeted, N3.39 trillion had been spent by June 30, 2019.

20. In compliance with the provisions of the 2018 Appropriation Act, we implemented the 2018 capital budget till June 2019. Capital releases under the 2019 Budget commenced in the third quarter. As at 30th September 2019, a total of about N294.63 billion had been released for capital projects. I have directed the Ministry of Finance, Budget and National Planning to release an additional N600 billion of the 2019 capital budget by the end of the year.

21. Despite the delay in capital releases, a deficit of N1.35 trillion was recorded at end of June 2019. This represents 70 percent of the budgeted deficit for the full year.

22. Despite these anomalies, I am happy to report that we met our debt service obligations, we are current on staff salaries and overhead costs have also been largely covered.

2020 BUDGET PRIORITIES

23. Distinguished Senators, Honourable Members, let me now turn to the 2020 Appropriation, which is designed to be a budget of:

a. Fiscal consolidation, to strengthen our macroeconomic environment;

b. Investing in critical infrastructure, human capital development and enabling institutions, especially in key job creating sectors;

c. Incentivising private sector investment essential to complement the Government’s development plans, policies and programmes; and

d. Enhancing our social investment programs to further deepen their impact on those marginalised and most vulnerable Nigerians.

PARAMETERS & FISCAL ASSUMPTIONS UNDERPINNING THE APPROPRIATION BILL AND THE FINANCE BILL

24. Distinguished and Honourable Members of the National Assembly, the 2020-2022 Medium Term Expenditure Framework (MTEF) and Fiscal Strategy Paper (FSP) set out the parameters for the 2020 Budget. We have adopted a conservative oil price benchmark of US$57 per barrel, daily oil production estimate of 2.18 mbpd and an exchange rate of N305 per US Dollar for 2020.

25. We expect enhanced real GDP growth of 2.93% in 2020, driven largely by non-oil output, as economic diversification accelerates, and the enabling business environment improves. However, inflation is expected to remain slightly above single digits in 2020.

26. Accompanying the 2020 Budget Proposal is a Finance Bill for your kind consideration and passage into law. This Finance Bill has five strategic objectives, in terms of achieving incremental, but necessary, changes to our fiscal laws. These objectives are:

a. Promoting fiscal equity by mitigating instances of regressive taxation;

b. Reforming domestic tax laws to align with global best practices;

c. Introducing tax incentives for investments in infrastructure and capital markets;

d. Supporting Micro, Small and Medium-sized businesses in line with our Ease of Doing Business Reforms; and

e. Raising Revenues for Government.

27. The draft Finance Bill proposes an increase of the VAT rate from 5% to 7.5%. As such, the 2020 Appropriation Bill is based on this new VAT rate. The additional revenues will be used to fund health, education and infrastructure programmes. As the States and Local Governments are allocated 85% of all VAT revenues, we expect to see greater quality and efficiency in their spending in these areas as well.

28. The VAT Act already exempts pharmaceuticals, educational items, and basic commodities, which exemptions we are expanding under the Finance Bill, 2019. Specifically, Section 46 of the Finance Bill, 2019 expands the exempt items to include the following:

a. Brown and white bread;

b. Cereals including maize, rice, wheat, millet, barley and sorghum;

c. Fish of all kinds;

d. Flour and starch meals;

e. Fruits, nuts, pulses and vegetables of various kinds;

f. Roots such as yam, cocoyam, sweet and Irish potatoes;

g. Meat and poultry products including eggs;

h. Milk;

i. Salt and herbs of various kinds; and

j. Natural water and table water.

29. Additionally, our proposals also raise the threshold for VAT registration to N25 million in turnover per annum, such that the revenue authorities can focus their compliance efforts on larger businesses thereby bringing relief for our Micro, Small and Medium-sized businesses.

30. It is absolutely essential to intensify our revenue generation efforts. That said, this Administration remains committed to ensuring that the inconvenience associated with any fiscal policy adjustments, is moderated, such that the poor and the vulnerable, who are most at risk, do not bear the brunt of these reforms.

FEDERAL GOVERNMENT REVENUE ESTIMATES

31. The sum of N8.155 trillion is estimated as the total Federal Government revenue in 2020 and comprises oil revenue N2.64 trillion, non-oil tax revenues of N1.81 trillion and other revenues of N3.7 trillion. This is 7 percent higher than the 2019 comparative estimate of N7.594 trillion inclusive of the Government Owned Enterprises.

32. The increasing share of non-oil revenues underscores our confidence in our revenue diversification strategies, going forward. Furthermore, in our efforts to enhance transparency and accountability, we shall continue our strict implementation of Treasury Single Account (TSA) to capture the domiciliary accounts in our foreign missions and those linked to Government Owned Enterprises.

PLANNED 2020 EXPENDITURE

33. An aggregate expenditure of N10.33 trillion is proposed for the Federal Government in 2020. The expenditure estimate includes statutory transfers of N556.7 billion, non-debt recurrent expenditure of N4.88 trillion and N2.14 trillion of capital expenditure (excluding the capital component of statutory transfers). Debt service is estimated at N2.45 trillion, and provision for Sinking Fund to retire maturing bonds issued to local contractors is N296 billion.

STATUTORY TRANSFERS

34. The sum of N556.7 billion is provided for Statutory Transfers in the 2020 Budget and includes:

a. N125 billion for the National Assembly;

b. N110 billion for the Judiciary;

c. N37.83 billion for the North East Development Commission (NEDC);

d. N44.5 billion for the Basic Health Care Provision Fund (BHCPF);

e. N111.79 billion for the Universal Basic Education Commission (UBEC); and

f. N80.88 billion for the Niger Delta Development Commission (NDDC), which is now supervised by the Ministry of Niger Delta Affairs.

35. We have increased the budgetary allocation to the National Human Rights Commission from N1.5 billion to N2.5 billion. This 67 percent increase in funding is done to enable the Commission to perform its functions more effectively.

RECURRENT EXPENDITURE

36. The non-debt recurrent expenditure includes N3.6 trillion for personnel and pension costs, an increase of N620.28 billion over 2019. This increase reflects the new minimum wage as well as our proposals to improve remuneration and welfare of our Police and Armed Forces. You will all agree that Good Governance, Inclusive Growth and Collective Prosperity can only be sustained in an environment of peace and security.

37. Our fiscal reforms shall introduce new performance management frameworks to regulate the cost to revenue ratios for Government Owned Enterprises, which shall come under significant scrutiny. We will reward exceptional revenue and cost management performance, while severe consequences will attend failures to achieve agreed revenue targets.

38. We shall also sustain our efforts in managing personnel costs. Accordingly, I have directed the stoppage of the salary of any Federal Government staff that is not captured on the Integrated Payroll and Personnel Information System (IPPIS) platform by the end of October 2019. All agencies must obtain the necessary approvals before embarking on any fresh recruitment and any contraventions of these directives shall attract severe sanctions.

39. Overhead costs are projected at N426.6 billion in 2020. Additional provisions were made only for the newly created Ministries. I am confident that the benefits of these new Ministries as it relates to efficient and effective service delivery to our citizens significantly outweighs their budgeted costs.

40. That said, the respective Heads of MDAs must ensure strict adherence to government regulations regarding expenditure control measures. The proliferation of Zonal, State and Liaison Offices by Federal Ministries, Departments and Agencies (‘MDAs’), with attendant avoidable increase in public expenditure, will no longer be tolerated.

CAPITAL EXPENDITURE

41. As I mentioned earlier, investing in critical infrastructure is a key component of our fiscal strategy under the 2020 Budget Proposals. Accordingly, an aggregate sum of N2.46 trillion (inclusive of N318.06 billion in statutory transfers) is proposed for capital projects in 2020.

.

42. Although the 2020 capital budget is N721.33 billion (or 23 percent) lower than the 2019 budget provision of N3.18 trillion, it is still higher than the actual and projected capital expenditure outturns for both the 2018 and 2019 fiscal years, respectively. However, at 24 percent of aggregate projected expenditure, the 2020 provision falls significantly short of the 30 percent target in the Economic Recovery and Growth Plan (ERGP) 2017-2020.

43. The main emphasis will be the completion of as many ongoing projects as possible, rather than commencing new ones. MDAs have not been allowed to admit new projects into their capital budget for 2020, unless adequate provision has been made for the completion of ALL ongoing projects.

44. Accordingly, we have rolled over capital projects that are not likely to be fully funded by the end of 2019 into the 2020 Budget. We are aware that the National Assembly shares our view that these projects should be prioritised and given adequate funding in the 2020 Appropriation Act.

45. Therefore, I will once again commend the 9th National Assembly’s firm commitment to stop the unnecessary cycle of delayed annual budgets. I am confident that with our renewed partnership, the deliberations on the 2020 Budget shall be completed before the end of 2019 so that the Appropriation Act will come into effect by the 1st of January.

46. Some of the key capital spending allocations in the 2020 Budget include:

a. Works and Housing: N262 billion;

b. Power: N127 billion;

c. Transportation: N123 billion;

d. Universal Basic Education Commission: N112 billion;

e. Defence: N100 billion;

f. Zonal Intervention Projects: N100 billion;

g. Agriculture and Rural Development: N83 billion;

h. Water Resources: N82 billion;

i. Niger Delta Development Commission: N81 billion;

j. Education: N48 billion;

k. Health: N46 billion;

l. Industry, Trade and Investment: N40 billion;

m. North East Development Commission: N38 billion;

n. Interior: N35 billion;

o. Social Investment Programmes: N30 billion;

p. Federal Capital Territory: N28 billion; and

q. Niger Delta Affairs Ministry: N24 billion.

47. Although Government’s actual spending has reduced, our plans to leverage private sector funding through our tax credit schemes will ensure our capital programmes are sustained.

48. For example, we launched the Road Infrastructure Tax Credit Scheme, pursuant to which I have approved the construction and rehabilitation of 19 Nigerian roads and bridges of 794.4km across 11 States. Indeed, the Scheme has attracted private investment of over N205 billion and the first set of tax credits are being processed by the Federal Ministry of Finance, Budget and National Planning.

49. As I mentioned during my Independence Day Speech, under the Presidential Power Initiative, we will modernise the National Grid in 3 phases; starting from 5 Gigawatts to 7 Gigawatts, then to 11 Gigawatts by 2023, and finally 25 Gigawatts afterwards in collaboration with the German Government and Siemens.

BUDGET DEFICIT

50. Budget deficit is projected to be N2.18 trillion in 2020. This includes drawdowns on project-tied loans and the related capital expenditure.

51. This represents 1.52 percent of estimated GDP, well below the 3 percent threshold set by the Fiscal Responsibility Act of 2007, and in line with the ERGP target of 1.96 percent.

52. The deficit will be financed by new foreign and domestic borrowings, Privatization Proceeds, signature bonuses and drawdowns on the loans secured for specific development projects.

DEBT SERVICE

53. Nigeria remains committed to meeting its debt service obligations. Accordingly, we provided the sum of N2.45 trillion for debt service. Of this amount, 71 percent is to service domestic debt which accounts for about 68 percent of the total debt. The sum of N296 billion is provided for the Sinking Fund to retire maturing bonds issued to local contractors.

54. I am confident that our aggressive and re-energised revenue drive will maintain debt-revenue ratio at acceptable and manageable levels. We will also continue to be innovative in our borrowings by using instruments such as Sukuk, Green Bonds and Diaspora Bonds.

SOCIAL INVESTMENT PROGRAMME

55. Our government remains committed to ensuring the equitable sharing of economic prosperity. Our focus on inclusive growth and shared prosperity underscores our keen interest in catering for the poor and most vulnerable. Accordingly, we are revamping and improving the implementation of the National Social Investment Programme through the newly created Ministry of Humanitarian Affairs, Disaster Management and Social Development.

56. The National Social Investment Programme is already creating jobs and economic opportunity for local farmers and cooks, providing funding to artisans, traders, youths, and supporting small businesses with business education and mentoring.

57. The provision of N65 billion for the Presidential Amnesty Programme has been retained in the 2020 Budget. Furthermore, to fast track the rebuilding efforts in the North East region, a provision of N37.83 billion has been made for the North East Development Commission.

OTHER STRATEGIC PRIORITIES IN 2020

58. The 2020 Budget is expected to accelerate the pace of our economic recovery, promote economic diversification, enhance competitiveness and ensure social inclusion. We are optimistic of attaining higher and more inclusive GDP growth in order to achieve our objective of massive job creation and lifting many of our citizens out of poverty.

59. The efficiency of port operations will also be enhanced by implementing a single customs window, speeding up vessel and cargo handling and issuing more licenses to build modern terminals in existing ports, especially outside Lagos.

60. Furthermore, completing the reforms to the governance and fiscal terms of the Petroleum Industry will provide certainty and attract further investments into the sector. A consequence of this will be increase in jobs and in government’s take. I therefore seek your support in passing into law two Petroleum Industry Executive Bills I will be forwarding to you shortly.

61. In addition, we need to quickly review the fiscal terms for deep offshore oil fields to reflect the current realities and for more revenue to accrue to the government. The Deep Offshore and Inland Basin Production Sharing Contract (Amendment) Bill 2018, was submitted to the 8th National Assembly in June 2018 but was unfortunately not passed into law.

62. I will be re-forwarding the Bill to this Assembly very shortly and therefore urge you to pass it. We estimate that this effort can generate at least 500 million US dollars additional revenue for the Federal Government in 2020, and over one billion dollars from 2021.

63. Whilst the Budget is our principal fiscal tool to achieve these socio-economic development targets, we remain committed to prudently planning for our future economic prosperity. In this regard, I have directed the reconstituted Ministry of Finance, Budget and National Planning to commence preparations towards the development of successor medium – and long-term economic development plans, particularly as the Nigeria Vision 20-2020 and the ERGP expire next year.

CONCLUSION

64. Mr. Senate President, Mr. Speaker, Distinguished and Honourable Members of the National Assembly, this speech would be incomplete without, once again, commending the patriotic resolve of the 9th National Assembly to collaborate with the Executive in the effort to deliver inclusive growth and enhance the welfare our people. I assure you of the strong commitment of the Executive to deepen the relationship with the National Assembly.

65. As you review the 2020-2022 Medium Term Expenditure Framework (MTEF) and Fiscal Strategy Paper (FSP), as well as the 2020 Budget estimates, we believe that the legislative process will be quick, so as to restore the country to the January-December financial year.

66. It is with great pleasure therefore, that I lay before this Distinguished Joint Session of the National Assembly, the 2020 Budget Proposals of the Federal Government of Nigeria.

67. I thank you most sincerely for your attention.

68. May God bless the Federal Republic of Nigeria.

Related

You may like

Featured

Rivers: Wike’s Men Reject Reployment, Resign from Fubara’s Govt

Published

5 hours agoon

April 25, 2024By

Eric

Two Rivers State commissioners have resigned their appointments shortly after they were redeployed in a cabinet reshuffle by Governor Siminalayi Fubara. They are the Attorney General and commissioners for Justice, and Finance; Zacchaeus Adangor and Isaac Kamalu respectively.

The duo were affected by a minor cabinet reshuffle made by the governor on April 23.

Kamalu and Adangor are loyalists of Nyesom Wike, the immediate former governor of Rivers and incumbent minister of the federal capital territory (FCT).

Last year, the commissioners resigned from their positions following the political feud between Wike and Fubara.

They were later reinstated after Wike and Fubara signed a peace accord facilitated by President Bola Tinubu.

While Adangor was moved to the ministry of special duties (governor’s office), Kamalu was moved to the ministry of employment generation and economic empowerment.

Kamalu’s resignation came hours after Zacchaeus Adangor, tendered his resignation.

In a letter addressed to Tammy Danagogo, secretary to the state government (SSG), Kamalu said the governor’s “inability to maintain peace” in the state was the reason he quit the cabinet.

The former commissioner said he could not give his best in an atmosphere of rancour.

“The mandates of the respective Ministries were to the best of our abilities (as Ministries) duly carried out and at all times material relevant reforms were embarked upon for improved performance and effective and sustainable service delivery.

“Among several others, we successfully carried out the following; “Initiating and (supporting existing) policy frameworks for enhanced internal revenue generation.

“This with (necessary adjustments made on some of the programs) led to the increase in the internal revenue receipts. This steady rise has presently generated though not the figures erroneously claimed in the media.

“Aggressive improvement in Federation receipts by securing recovery by the state of oilfields that were also the subject of the successful claim against International Oll Companies (IOCs) on production sharing contracts; the recoveries arising from 13% derivation and the demand by the state for adherence to the fiscal provisions in the constitution in support of states by successfully removing from Federation receipts institutions of Government whether state or federal not so recognized by the constitution such as the Police Trust Fund and others thus widening the available receipts for States and the last but not the least our success on the subject of Value Added Tax.

“The reason behind these painstaking efforts was to make available a basket of receipts sufficient to enable the state to deliver good governance through the provision of goods and services.

“It was this idea that informed the continuity and consolidation mantra that was the theme of your election campaign and government thereafter.

“You will respectfully recall that when the climate of discord became unbearable I and other like-minded members of the Executive Council that were appointed by you resigned.

“You thereafter engaged His Excellency, Asiwaju Bola Ahmed Tinubu, GCFR President and Commander-in-Chief of the Armed Forces of the Federal Republic of Nigeria and as Father of the Nation to intervene in the matter.

“In deference to the directive of Mr. President, I and the others were recalled and we all accepted and joined the cabinet again. I expected Sir that with the opportunity provided by Mr.President, every effort will be made to sustain peace.

“Regrettably Your Excellency the peace in Government and governance that we all – citizens and residents of the state desire has remained out of reach despite our consistent efforts and demand for same.

“This has affected our ability to protect and defend the gains that we made these past years.

“In the course of official engagements, I have reiterated the need for this peace and the fact we all are willing and determined to work for this.

“It is very difficult to deliver good governance where there is acrimony and discord. It is not the point of service that is important but the climate. Our present circumstance makes service delivery extremely challenging. I still hold the belief that it is never too late for peace.

“In view of the above, I find it difficult to accept the redeployment. I do not accept it. I reject it and convey to you my immediate resignation as Commissioner and member of the Rivers State Executive Council with effect from the date of this letter.

“While praying that the Good Lord grants us Peace, I thank you for the opportunity and assure you the assurances of my esteemed regards.”

Related

Featured

Tinubu Approves Credit Scheme Takeoff to Facilitate Purchase of Cars, Houses

Published

7 hours agoon

April 25, 2024By

Eric

President Bola Tinubu has approved the takeoff of the first phase of the Consumer Credit Scheme to facilitate the purchase of houses and cars by working Nigerians.

In a statement on Wednesday, presidential spokesman Ajuri Ngelale said the Consumer Credit Scheme will enhance the quality of life citizens by allowing them to “access goods and services upfront, paying responsibly over time”.

“It facilitates crucial purchases, such as homes, vehicles, education, and healthcare, essential for ongoing stability to pursue their aspirations,” the statement added.

“Through responsible repayment, individuals build credit histories, unlocking more opportunities for a better life. Additionally, the increased demand for goods and services stimulates local industry and job creation.

“The President believes every hardworking Nigerian should have access to social mobility, with consumer credit playing a pivotal role in achieving this vision.”

In line with the President’s directive to expand consumer credit access to Nigerians, the Nigerian Consumer Credit Corporation (CREDICORP) has launched a portal for Nigerians to express interest in receiving consumer credit.

“This initiative, in collaboration with financial institutions and cooperatives nationwide, aims to broaden consumer credit availability,” the statement noted, adding that working Nigerians interested in receiving consumer credit can visit CREDICORP’s website to express interest before the deadline date of May 15, 2024.

“The scheme will be rolled out in phases, starting with members of the civil service and cascading to members of the public.”

The CREDICORP’s objectives include: “(1) Strengthening Nigeria’s credit reporting systems, ensuring every economically active citizen has a dependable credit score. This score becomes personal equity they build, facilitating access to consumer credit.

“(2) Offering credit guarantees and wholesale lending to financial institutions dedicated to broadening consumer credit access today.

“(3) Promoting responsible consumer credit as a pathway to an improved quality of life, fostering a cultural shift towards growth and financial responsibility.”

Related

Featured

Group Celebrates Gov Umo Eno at 60 with Visits to Hospitals, Prisons, Empowerment of 60 Persons

Published

9 hours agoon

April 25, 2024By

Admin

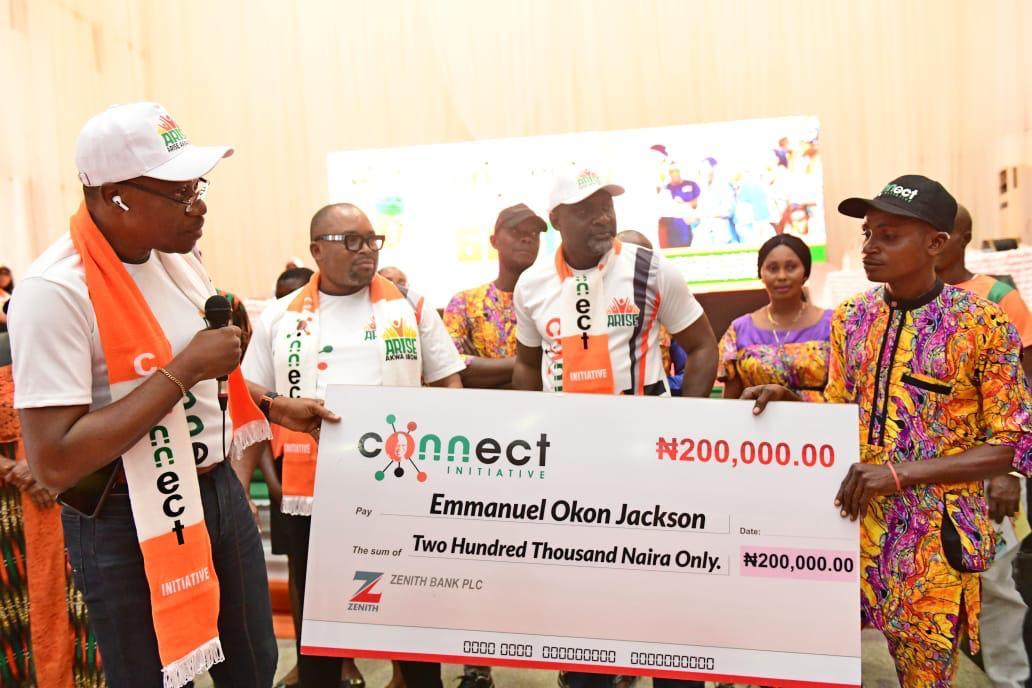

In celebration of the 60th birthday of Akwa Ibom State Governor, Pastor Umo Eno, the socio-political group, Connect Initiative, has embarked on a series of impactful initiatives.

They have empowered 60 vulnerable individuals and extended compassionate visits to hospitals and prisons across the state.

The group made up of professionals and entrepreneurs kicked off its activities with a low-key ceremony where 60 indigent people were given financial support.

The beneficiaries were carefully selected from across the 31 LGAs of the state.

In his opening remarks, the group’s Chief Conector, Dr Frank Ekpenyong, stated that the organisation decided to toe this line because it is the right thing to do putting into consideration the present realities in Nigeria.

He noted that the event which was to commemorate the birthday of Governor whom he described as a humble, compassionate and visionary leader that believes in development from the bottom up.

Dr Frank said that Comnect Initiatives will soon up the ante in terms of standing in the gap for government through impactful programmes and projects

In the course of the ceremony, seven respected Akwa Ibom indigenes were inducted into the Connect Forum: Sir Okon Okon, Captain Iniobong Ekong ( Retd), Aniekan Essienette, Ime Udo, Murphy Esin, Hon. Mbosowo David and Mrs Imobong Akamba.

The group then began the next day with a visit to the St. Luke’s Hospital, Anua, Uyo LGA where they cleared the bills of some indigent patients.

The patients who were in the maternity, female surgical and paedetric wards had concluded their treatments but could not be discharged due to inability to pay their bills.

All the patients: Patricia Victor Brown ( from Itu LGA), Nkoyo Edet Okon ( Oron LGA), Emem Gabriel David ( Nsit Ubium), Enobong Gabriel Emmanuel and Mavelous Bassey were thankful for this womderful intervention of Connect Initiative on behalf of the governor.

The most moving moment of the visit was the case of Mrs Magdalene Okon Edet. After listening to the pathetic story of her surgery and condition afterwards, the group decided on-the-spot to foot her over N400,000 bill.

She and her family broke into uncontrollable tears of joy.

In addition, during the ward rounds, the team was given the cheering news that a mother had earlier that day been delivered of a baby girl.

Not only was the Ebong family’s bill settled, when the good news was relayed to HE Governor Umo Eno that he now had a new birthday mate, he immediately requested to meet with the father of the baby.

The lucky father was acknowledged and presented with special gift by the Governor during the commissioning of Atiku Abubakar Way project in the presence of former President Goodluck Jonathan.

In his remarks, Rev. Father Gabriel Ekong the hospital Administrator thanked Connect Initiative for embarking on this noble cause that has brought relief and joy to many homes.

While praying that God would replenish the pockets of all those who contributed to the kind gesture, he applauded the vision of Governor Umo Eno for urging wellwishers to embrace charitable causes instead of spending the funds on parties or other unproductive endeavours.

He used the opportunity to pray for excellent health and wisdom for Governor Eno, while wishing him a very successful tenure in government.

The next port of call for the Connect Initiative members was the Methodist General Hospital, Ituk Mbang, Uruan LGA.

There, the team visited the wards where Baby Favour Edidiong, Joyce Isaac Mbaba, Imeh Phillip Etukudo, Prince Asuquo Okon and Nko Etim Umoh were all cleared to go home with a commitment that all their outstanding bills would be fully paid. Again the patients erupted in happiness and were full of prayers and praise for the celebrant and Connect Initiative.

The Hospital Superintendent, Dr Aniekan in his remarks thanked the group for this humanitarian gesture, adding that this act was worthy of emulation by other organisations

The day was rounded off at the Minimum Correctional Centre, Uyo where the team pledged to pay the fines of 13 inmates with minor offences

Speaking to journalists after the visits, the President-General of the group, Ms Idy Ekwo stated that its itinerary was carefully planned in accordance with the wishes of the celebrant, Governor Umo Eno.

She noted that based on what was discovered during the visits, Connect Initiative would make charitable interventions a more frequent affair.

More Images Below:

Related

Court Vacates Order for Arrest of Fubara’s CoS, Says It’s Mere Academic Exercise

Rivers: Wike’s Men Reject Reployment, Resign from Fubara’s Govt

Tinubu Approves Credit Scheme Takeoff to Facilitate Purchase of Cars, Houses

Group Celebrates Gov Umo Eno at 60 with Visits to Hospitals, Prisons, Empowerment of 60 Persons

Again, DStv, Gotv Jack Up Subscription Rates

Dr. Ogbonnaya Onu: One Death Too Many

How Yahaya Bello Used Kogi’s $720k to Pay Children’s School Fees in Advance – EFCC Chairman

Nigerian Engineer Wins $500m Contract to Build Monorail Network in Iraq

WORLD EXCLUSIVE: Will Senate President, Bukola Saraki, Join Presidential Race?

World Exclusive: How Cabal, Corruption Stalled Mambilla Hydropower Project …The Abba Kyari, Fashola and Malami Connection Plus FG May Lose $2bn

Rehabilitation Comment: Sanwo-Olu’s Support Group Replies Ambode (Video)

Pendulum: Can Atiku Abubakar Defeat Muhammadu Buhari in 2019?

Fashanu, Dolapo Awosika and Prophet Controversy: The Complete Story

Pendulum: An Evening with Two Presidential Aspirants in Abuja

Who are the early favorites to win the NFL rushing title?

Boxing continues to knock itself out with bewildering, incorrect decisions

Steph Curry finally got the contract he deserves from the Warriors

Phillies’ Aaron Altherr makes mind-boggling barehanded play

The tremendous importance of owning a perfect piece of clothing

Trending

-

News6 years ago

News6 years agoNigerian Engineer Wins $500m Contract to Build Monorail Network in Iraq

-

Featured6 years ago

Featured6 years agoWORLD EXCLUSIVE: Will Senate President, Bukola Saraki, Join Presidential Race?

-

Boss Picks6 years ago

Boss Picks6 years agoWorld Exclusive: How Cabal, Corruption Stalled Mambilla Hydropower Project …The Abba Kyari, Fashola and Malami Connection Plus FG May Lose $2bn

-

Headline6 years ago

Headline6 years agoRehabilitation Comment: Sanwo-Olu’s Support Group Replies Ambode (Video)

-

Headline6 years ago

Headline6 years agoPendulum: Can Atiku Abubakar Defeat Muhammadu Buhari in 2019?

-

Headline5 years ago

Headline5 years agoFashanu, Dolapo Awosika and Prophet Controversy: The Complete Story

-

Headline6 years ago

Headline6 years agoPendulum: An Evening with Two Presidential Aspirants in Abuja

-

Headline6 years ago

Headline6 years ago2019: Parties’ Presidential Candidates Emerge (View Full List)