The visit was to appreciate the President for participating in First Bank of Nigeria Limited’s 125th anniversary activities held earlier this year as well as update him of recent investment activities of the Group.

In his speech, Dr. Otudeko assured President Akufo-Addo of FBNHoldings’ belief in the Ghanaian economy and indicated that it was evidenced by the recapitalization of FBNBank Ghana by its parent bank, First Bank of Nigeria Limited. He pointed out that the Group’s investment of US$100 million was well above the new minimum capital requirement set by the Bank of Ghana into its Ghana operation.

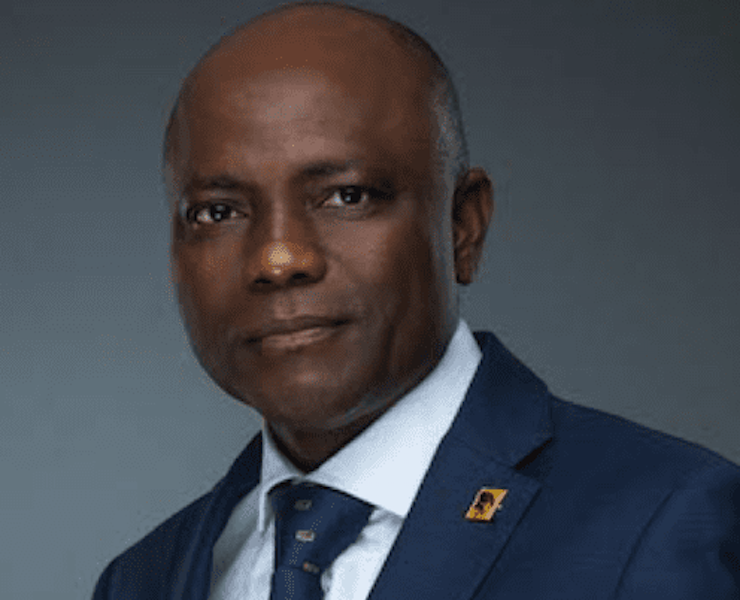

Otudeko added that the bank’s confidence in the Ghanaian economy and the talent of Ghanaians had resulted in the appointment of Victor Yaw Asante as the first Ghanaian Managing Director of FBNBank Ghana Limited.

Dr. Otudeko lauded the President of Ghana for giving the youth opportunities to serve in his government, saying it will prepare them to take over the leadership of Ghana in the near future. He congratulated the President on the choice of Ghana as host of the Africa Continental Free Trade Agreement, saying that it must have taken significant effort to bring this to Ghana.

President Nana Addo Dankwa Akufo-Addo thanked Dr. Otudeko for his kind words and recounted the crucial bilateral and economic ties as well as historic bond, pre and post-independence, that exist between Ghana and Nigeria.

While stating that it is important for the economies of both Ghana and Nigeria to do well for ECOWAS to succeed, the President thanked FBN Holdings Plc for investing in Ghana and gave the assurance that government will provide the necessary support to FBNBank Ghana Limited and the entire business community.

The President also touched on the banking sector reforms and observed that Nigeria also had to embark on a similar exercise in the recent past. He said it was a painful but necessary exercise to strengthen the financial services industry and position it to support business and the economy.

President Akufo-Addo emphasized the importance of providing opportunities to the youth to enable them support the nation’s growth and development agenda and the need for all citizens of the two countries to find avenues to give back to their nations.

Members of the delegation pledged, on behalf of FBN Holdings Plc and FBNBank Ghana, their commitment to helping build a stronger Ghanaian economy, as well as forging stronger economic ties between citizens and businesses of Ghana and Nigeria.

The FBNHoldings Group Board Chairman, Dr. Oba Otudeko, CFR, was accompanied by Mrs. Ibukun Awosika, Chairman, Board of Directors, First Bank of Nigeria Limited; Mr. U. K. Eke, MFR, Group Managing Director, FBN Holdings Plc.; Dr. Adesola Adeduntan, Chief Executive Officer, First Bank of Nigeria Limited; Otunba (Mrs.) Debola Osibogun, Non-Executive Director, FBNHoldings; Dr. Hamza Wuro Bokki, Non-Executive Director, FBNHoldings, and Mr. Victor Yaw Asante, Managing Director, FBNBank Ghana Limited.

FBN Holdings Plc is the most diversified financial services group in Nigeria and includes FirstBank of Nigeria Ltd the mother company of FBNBank Ghana and other subsidiaries around the world.

News6 years ago

News6 years ago

Featured6 years ago

Featured6 years ago

Boss Picks6 years ago

Boss Picks6 years ago

Headline6 years ago

Headline6 years ago

Headline6 years ago

Headline6 years ago

Headline5 years ago

Headline5 years ago

Headline6 years ago

Headline6 years ago

Headline6 years ago

Headline6 years ago