On Saturday, 16 March 2019, Nigeria’s premier financial institution, First Bank of Nigeria Limited and other corporate entities in the FBNHoldings group would collectively have a 1.25km Relay Walk to celebrate the Bank’s 125 years of unbroken business operations in commemoration of its 125 years anniversary.

Following the flag hoisting ceremony, the anniversary activities curtain raiser event that held on 1 March 2019, the 1.25km Relay Walk which is to be carried out at locations across Nigeria and other countries where the Bank operates is among the many activities lined-up to celebrate the Bank’s impact and contribution to the growth and development of Nigeria over the years, predating the independence of the West African country with a view to reinforce the collaborative efforts of all institutions of the group, FBNHoldings, as well as building on the heritage for the next 125 years and beyond.

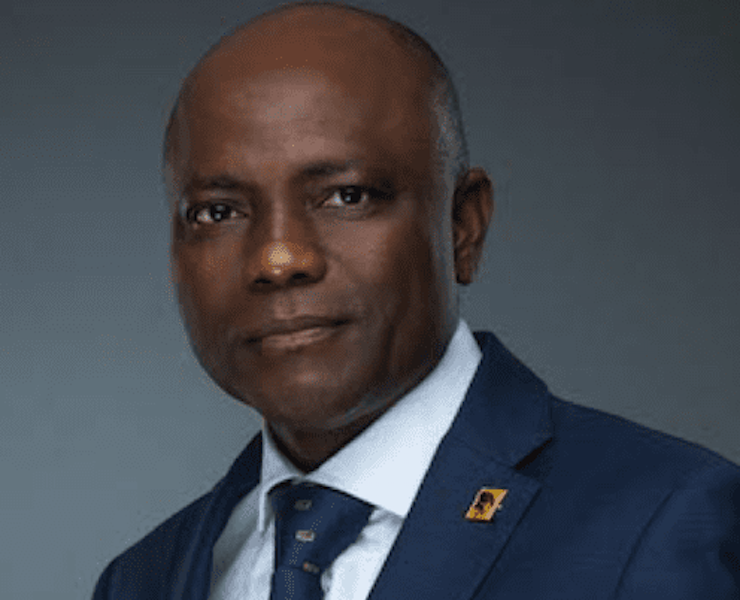

According to Dr. Adesola Adeduntan, the Chief Executive Officer, First Bank of Nigeria Limited, “the 1.25km Relay Walk is a representation of the collaborative effort of not just FirstBank but all entities in our holding company, FBNHoldings, that have in the last 125 years impacted lives and contributed to the growth and development of our host communities and countries where we do businesses. At FirstBank, we are proud of the strides made across these locations where we operate as without the effort of all staff – past and present – as well as our customers and stakeholders, there would be no FirstBank. The 125km is a mark of our incredible journey of delivering impeccable financial services to our customers as we leave no stone unturned to remain an icon of admiration in today’s financial services industry in Africa.”

Speaking on the significance of the ‘Relay Walk”, Adeduntan explains that The Relay Walk is a collaborative effort to achieve a symbolic 1.25km. He added “It is also a representation of the FirstBank brand in the last 125 years; our people, the team work, partnership and the collective spirit which has shown that as a team, together we can do and achieve more. It is neither a marathon, nor sprint, but a surefooted, steady walk we have taken in the last 125 years.”

On how the “Relay Walk” would be carried-out and what it means to the brand, Folake Ani-Mumuney, the Group Head, Marketing and Corporate Communications, FirstBank explains: “As a Group, we have journeyed through the ages, our footprints spreading far and wide with indelible landmarks of several firsts. The Relay Walk, yet another First, combines a relay with a walk. A relay, symbolic with races connotes the agility of sprint, which can only be achieved through a team’s collective effort while the passing of the baton during a relay connotes effective succession, thus all attributes evident in FirstBank’s attainment of 125 years of sustained profitable growth. Ani-Mumuney explained the Relay Walk would see staff, customers and stakeholders walk at least 1.25km in teams and from different locations to make up the minimum 1.25km. At the end of the walk in each location, teams will symbolically pass the baton, committing to a cause that will take the Group to the next 125 years. The baton exchange symbolises the strong culture of succession planning of the Group in the last 125 years, a trait that highlights the dynamic and transformational nature of the brand as well as the essence of future proofing through a deliberate planning of transitions from one generational to another. The baton exchange is a commitment by the current leadership to uphold this spirit of foresight and deliberate planning of taking the brand to greater heights through the next 125 years.

The 1.25km Relay Walk, to be led by Dr. Adeduntan will terminate at the Bank’s corporate Head Office in Marina where staff, customers and other stakeholders will converge to witness the symbolic baton hand over and a commitment to the next 125 years.

News6 years ago

News6 years ago

Featured6 years ago

Featured6 years ago

Boss Picks6 years ago

Boss Picks6 years ago

Headline6 years ago

Headline6 years ago

Headline6 years ago

Headline6 years ago

Headline5 years ago

Headline5 years ago

Headline6 years ago

Headline6 years ago

Headline6 years ago

Headline6 years ago